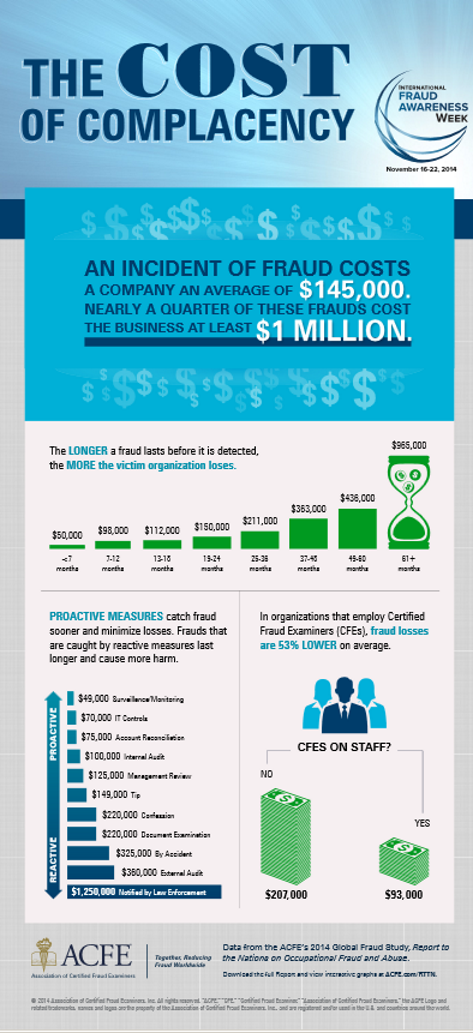

Fraud costs businesses billions directly, but what is the cost of complacency? Research conducted by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization, indicates that the longer a fraud lasts before it is detected, the more the victim organization stands to lose.

A new infographic illustrating the relationship between anti-fraud controls and the duration and cost of fraud has been made available by the ACFE for download online at FraudWeek.com. The data was compiled by the ACFE for its 2014 Report to the Nations on Occupational Fraud and Abuse.

The following are just a few interesting details from the report about fraud and internal controls:

- The median loss caused by frauds in the ACFE study was $145,000. Additionally, 22 percent of the cases involved losses of at least $1 million.

- The median duration – the amount of time from when the fraud commenced until it was detected – was 18 months.

- Frauds discovered by passive detection methods (such as confession, notification by law enforcement, external audit and by accident) lasted longer and resulted in higher losses.

- By contrast, frauds discovered through proactive detection methods (such as hotlines, management review procedures, internal audits and employee monitoring mechanisms) were caught sooner, with fewer financial losses.

The 2014 Report to the Nations includes data compiled from 1,483 cases of fraud submitted by CFEs globally. The full Report is available for download (in PDF format) online at: ACFE.com/RTTN.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes