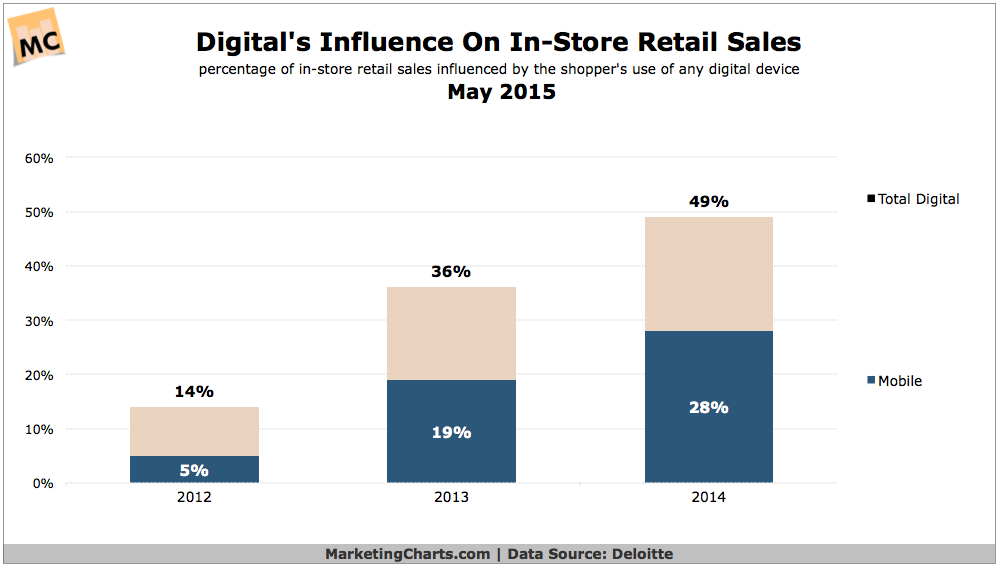

Digital interactions are expected to influence 64 cents of every dollar spent in retail stores by the end of 2015, or $2.2 trillion, according to Deloitte Digital’s latest study, “Navigating the New Digital Divide.” This figure has grown considerably from 14 cents of each dollar spent in brick-and-mortar stores in 2012, the first year Deloitte Digital conducted the annual study.

Deloitte Digital defines “digital influence” as the percentage of traditional brick-and-mortar retail sales impacted by shoppers’ use of digital devicesi. Deloitte Digital has also identified a growing digital divide where consumers’ digital behaviors and retailers’ ability to deliver on those consumer expectations continue to diverge.

“Retailers often use the wrong metric–e-commerce sales–to indicate whether their digital strategy is working,” said Kasey Lobaugh, principal, Deloitte Consulting LLP and Deloitte Digital’s chief retail innovation officer. “Last year, e-commerce sales represented $300 billion, or just seven percent, of total retail sales, while digitally-influenced store sales were over five times higher, topping $1.7 trillion. Retailers that prioritize and design digital functionality with the sole purpose of driving sales in the e-commerce channel marginalize the consumer experience and risk ceding authority to competitors.”

Marketplace volatility in the retail sector further amplifies the significance of capturing and accurately measuring digitally-influenced sales. Deloitte Digital’s research indicates that, in the last five years, the top 25 established retailers have lost 2 percent of their combined market share, which equates to $64 billion, while smaller players that have entered the market with digital at their core have multiplied. Lobaugh added, “We are seeing a real change in the competitive dynamics, with digital as the great equalizer. The findings indicate that the large retailers are collectively losing ground to the much smaller competitors.”

While the upward trend in overall digital usage has accelerated, this year’s study uncovered dramatic new behaviors. Among consumers who use digital devices to shop:

Mobile influence is up, but price checking is down: Consumers surveyed indicated they are 30 percent less likely to use smartphones to perform price comparisons in-store than they were a year ago. This decline occurred while the influence of smartphones alone on in-store sales rose to 28 percent in 2014, up from 19 percent the prior year. Consumers are advancing in their sophistication–using mobile more often for inspiration and idea generation earlier in their shopping process, and not simply as a price comparison vehicle.

Digitally-influenced consumers buy more and spend more: Consumers who use digital while they shop convert at a 20 percent higher rate compared to those who do not use such devices. Consumers that access social media during the shopping process are four times more likely to spend more, and almost one-third (29 percent) of those surveyed are more likely to make a purchase the same day they turn to social media before or during their shopping trip.

Hispanic and Latino consumers are highly digitally-influenced: Nearly half (49 percent) of Hispanic and Latino consumers use social media during their shopping journey, compared to 32 percent across all ethnic groups. Additionally, 41 percent of Hispanic and Latino consumers indicate they spend more in the store due to digital activities, compared to 28 percent of all consumers surveyed.

Not all categories are equal: Digital behavior has evolved across all categories, most notably baby/toddler and home furnishings. The digital influence in the baby/toddler category jumped from 39 percent to 52 percent in one year, and now accounts for more than half of all brick-and-mortar sales in that sector. Additionally, 56 percent of consumers shopping baby/toddler items consult social media for assistance. In the home furnishings category, nearly four in 10 consumers (38 percent) indicate they spend more when using their devices in the shopping process.

Consumers are hunters, not gatherers, once they arrive at the store: Nearly 8 in 10 consumers (76 percent) surveyed interact with brands or products before arriving at the store. Shoppers now make buying decisions at other points in the shopping journey, where they find ideas and inspiration, research product information, validate performance through reviews, and even make purchases online to pick up in store.

“Instead of measuring moments that matter during the shopping journey, retailers continue to focus on measuring the buy button–the point at which they actually have the least influence,” said Jeff Simpson, director, Deloitte Consulting LLP and co-author of the study. “Retailers that simply track channel sales and fail to measure the influence of digital along the entire path to purchase can miss key indicators of performance and customer behavior. Retailers should focus on designing and building customer experiences that play to how their customers are shopping for their products–rather than direct consumers to the point of purchase if what they really seek is inspiration or information.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs