September brings a special treat to payroll practitioners and the payroll profession at large: National Payroll Week, which celebrates both wage earners and payroll practitioners.

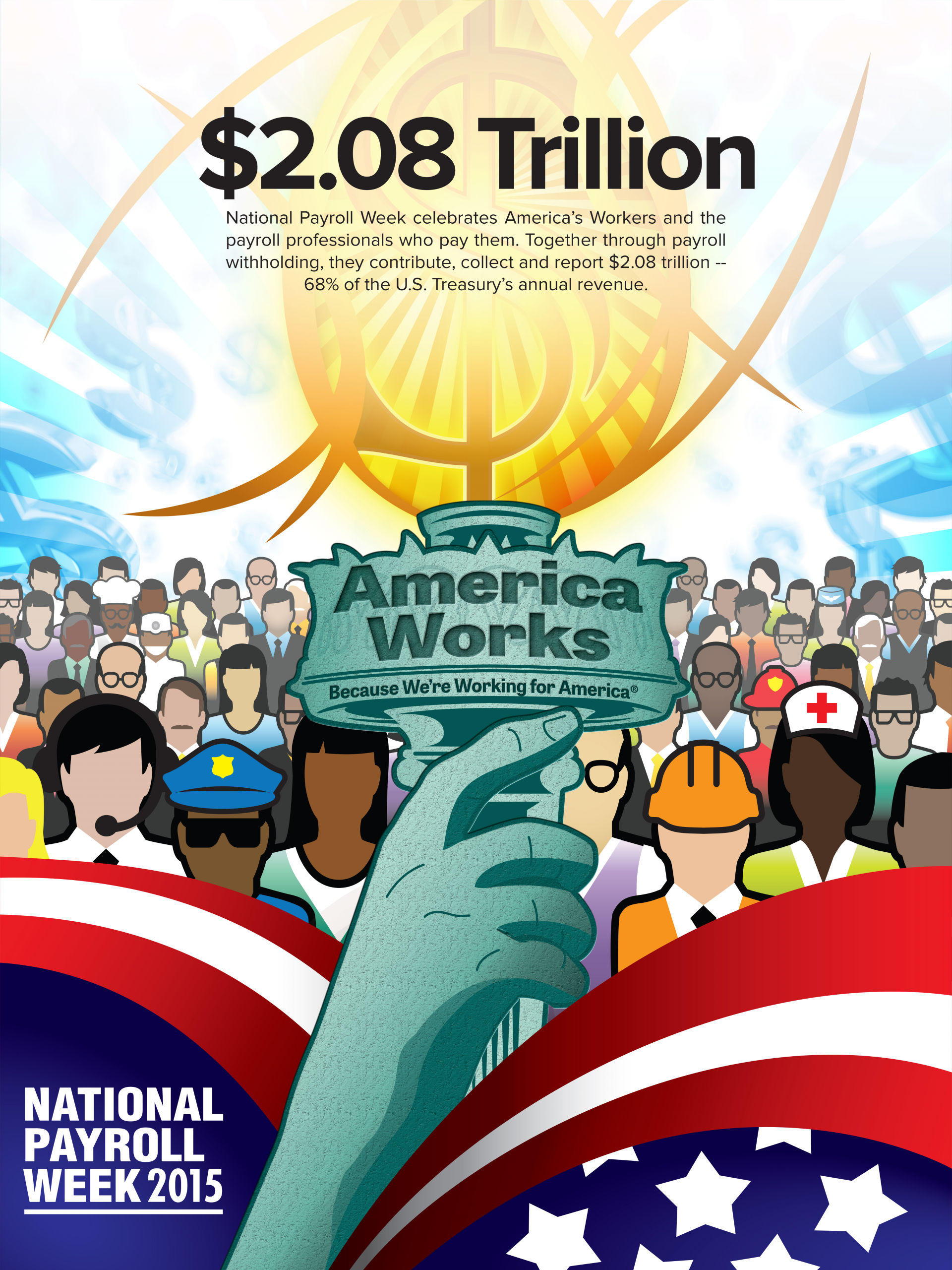

This year, National Payroll Weeks falls September 7-11, 2015. It was first established in 1996 by the American Payroll Association to honor the working Americans whose tax contributions support the American system and the practitioners who process those contributions. It is estimated that approximately 156 million wage earners and payroll practitioners contribute, collect, report and deposit nearly $2.08 trillion. That’s 68 percent of the annual revenue of the U.S. Treasury!

National Payroll Week focuses on the payroll withholding system and seeks to educate wage earners on how the system works and how they can use it to achieve their personal goals, while honoring the men and women behind it.

You work hard year-round to ensure that your clients, and ultimately their employees, receive their paychecks in a timely fashion with little to no inconvenience. Your practice and staff provide tools, tips and resources to make payroll as painless as possible for those you serve. Take a little time during National Payroll Week (and during the entire month of September) to celebrate the value you provide!

Ideas to Commemorate National Payroll Week

Here are a few ideas of how you and those at your practice can celebrate National Payroll Week:

- Host a payroll trivia contest at your practice and gift winners with a free Payday candy bar. Some questions you can ask staff include:

o How many paychecks does your practice produce per year?

o What is the average client monthly contribution to federal revenue?

o How many client employees have direct deposit?

- Hold an open house for clients to learn more about transitioning their payroll services to the Cloud.

- Host an office party and play “Giving You the Best: I am a Payroll Professional” (the payroll song) for all to hear.

- Host a shadow day and invite local high school and college students to learn about the payroll profession.

- Volunteer to teach elementary and middle school students about payroll and deductions.

- How information sessions on compliance for local small businesses.

- Work with a literacy center to host a workshop on job application skills and completing a Form W-4.

- Check with local APA chapters for events.

What is Care.com HomePay doing to celebrate National Payroll Week?

“With National Payroll Week upcoming, we hope to take this time to continue educating families and caregivers on the importance of compliance with household workers,” said Tom Breedlove, Director at Care.com HomePay. “We’ll be leveraging our HomePay blog and social media outlets to reinforce that household employment is different than commercial payroll with different forms, processes, deadlines and labor laws. We’ll also be reminding caregivers and families that the U.S. payroll system is what funds vital worker benefits.”

Is Care.com HomePay offering any resources for NPW for its customers?

“We certainly understand that this is a complicated issue when it comes to understanding the labor laws, tax breaks and other aspects of household employment. As we’ve done in the past, we will continue to offer free phone consultations for families to help explain all the tax & compliance issues associated with employing a domestic worker. We will also offer free access to a budgeting calculator for families, which calculates employer taxes as well as dependent care tax breaks; a paycheck calculator to help caregivers understand what their take-home pay will be; and a sample nanny contract for families to use during the hiring process.”

Approximately what percentage of wage earners are home workers such as nannies?

“It’s difficult to put a hard number on the percentage of wage earners that are home workers because so many are paid under the table. Families paying legally will attach Schedule H to their tax returns, but this metric only gives us a fraction of the actual workforce. According to the IRS, the 2013 tax season saw roughly 202,000 households filing Schedule H. At Care.com HomePay, we continue to focus on all household payroll issues and helping both families and caregivers understand the laws and benefits associated with this sector of employment.”

What are some tips for HomePay customers to recognize their nannies during NPW?

“We always suggest our clients share with their household employees the benefits associated with their legal pay. For one, having paystubs and documented wages help their employees to obtain credit and loans, as well as federal subsidies for healthcare. Employers can also demonstrate their contribution to unemployment and retirement through paying compliantly.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Payroll, Payroll Software, Technology