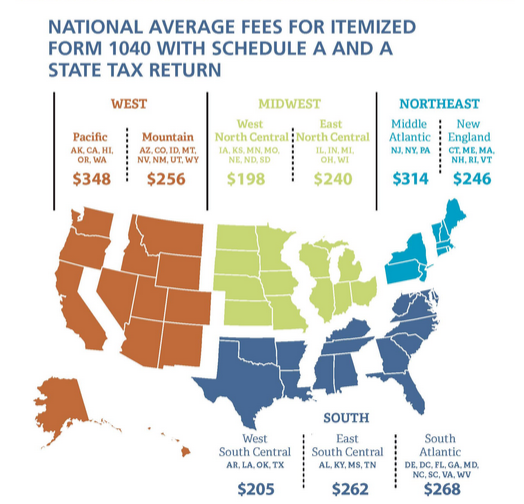

The average cost of a professional income tax preparer to handle a “typical” 2014 tax return (the one filed by April 15, 2015) was $273 this year. This includes an itemized Form 1040 with Schedule A and a state tax return, according to the National Society of Accountants (NSA). Fees vary by region, as well as by the complexity of the return being filed.

This is a 4.6 percent increase over the average fee last year, which was $261. It is an 11 percent increase from two years ago – the last time the survey was conducted. See the infographic of the survey highlights below.

The average cost to prepare a Form 1040 and state return without itemized deductions was $159 this year, also a 4.6 percent increase over the average fee last year, which was $152. This is an 11.2 percent increase from two years ago.

“When you consider the time it takes to complete tax returns, this is a very strong value,” says NSA Executive Vice President John Ams. “The tax code continues to become more complex each year, including some new Affordable Care Act reporting requirements. Professional tax preparers may also be able to find tax deductions and credits that may taxpayers might not notice.”

Fee information was collected in a survey of tax preparers conducted by the NSA. The tax and accounting firms surveyed are owners, principals, and partners of local “Main Street” tax and accounting practices who have an average of more than 27 years of experience. NSA member tax preparers typically hold multiple credentials that demonstrate their expertise, including Enrolled Agent, Certified Public Accountant, Accredited Tax Preparer, Accredited Tax Advisor, and others.

The survey also reported the average fees for preparing additional Internal Revenue Service (IRS) tax forms, including:

-

$174 for a Form 1040 Schedule C (business)

-

$634 for a Form 1065 (partnership)

-

$817 for a Form 1120 (corporation)

-

$778 for a Form 1120S (S corporation)

-

$457 for a Form 1041 (fiduciary)

-

$688 for a Form 990 (tax exempt)

-

$68 for a Form 940 (Federal unemployment)

-

$115 for Schedule D (gains and losses)

-

$126 for Schedule E (rental)

-

$158 for Schedule F (farm)

Fees vary by region, firm size, population, and economic strength of an area. The average tax preparation fee for an itemized Form 1040 with Schedule A and a state tax return in each U.S. census district are:

-

New England (CT, ME, MA, NH, RI, VT) – $246

-

Middle Atlantic (NJ, NY, PA) – $314

-

South Atlantic (DE, DC, FL, GA, MD, NC, SC, VA, WV) – $268

-

East South Central (AL, KY, MS, TN) – $262

-

West South Central (AR, LA, OK, TX) – $205

-

East North Central (IL, IN, MI, OH, WI) – $240

-

West North Central (IA, KS, MN, MO, NE, ND, SD) – $198

-

Mountain (AZ, CO, ID, MT, NV, NM, UT, WY) – $256

-

Pacific (AK, CA, HI, OR, WA) – $348

Most accounting firms offer prospective clients a free consultation, which can be worth well over $100 based on the hourly fees of most tax preparers.

All fees assume a taxpayer has gathered and organized all necessary information. Taxpayers should also make sure they provide information on time to avoid additional fees – most tax preparers will charge an average fee of $114 for dealing with disorganized or incomplete files.

Some professionals charge an average fee of $42 to file an extension, an average fee of $88 to expedite a return, and an average fee of $93 if information is not provided in advance of an agreed-upon deadline. For taxpayers who are audited by the IRS, the average hourly fee to handle the audit is $144.

(Click for larger image.)

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Software, Taxes