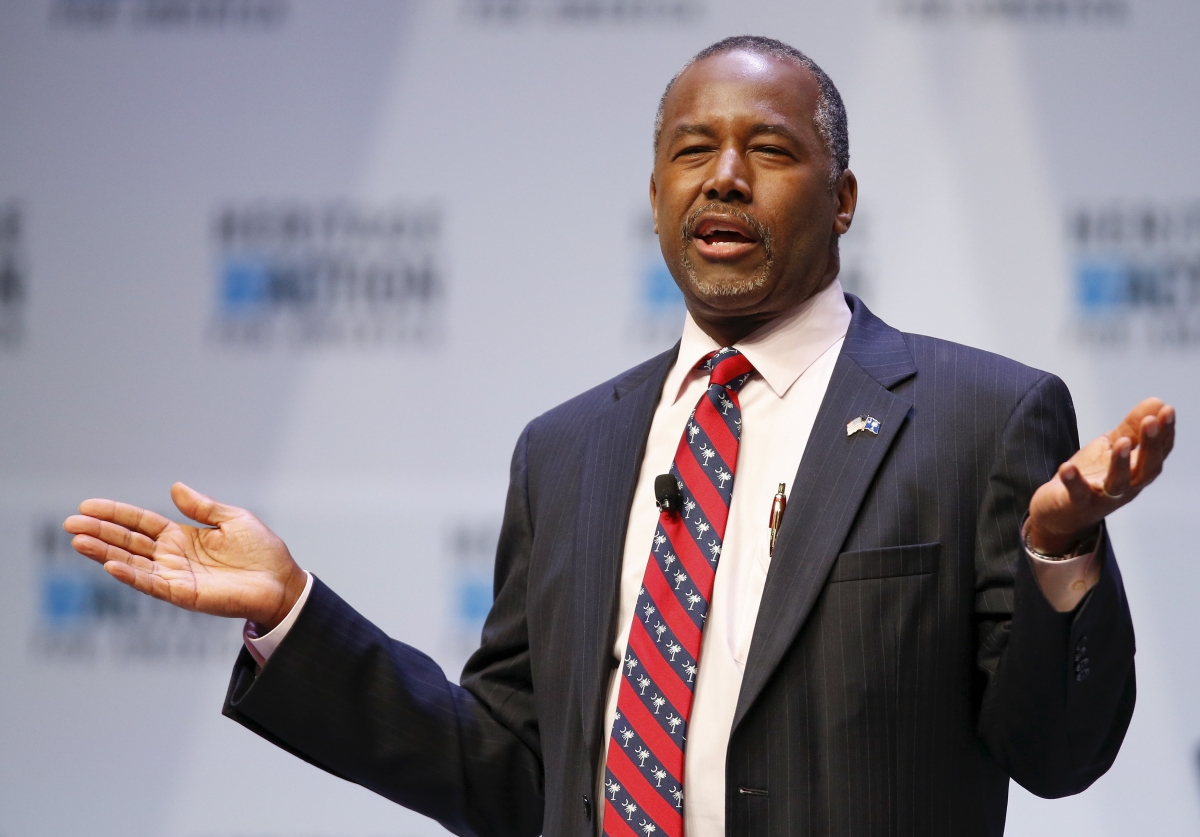

Dr. Ben Carson, the retired neurosurgeon who is running for the Republican presidential nomination, has propose a flat tax rate system to help prop up his crumbling campaign. But the plan is drawing fire from critics who claim that it will “rob from the poor and give to the rich.”

The radical tax plan announced by Carson in early January would replace the current graduated tax rate system – which has seven brackets ranging from 10 percent to 39.6 percent – with a flat rate of 14.9 percent. The candidate would also eliminate taxes on capital gains and dividends and interest income and wipe out estate taxes. Essentially, they represent earnings that have already been taxed and thus should be exempt from “double taxation.”

But Carson doesn’t stop there. He would also eliminate deductions for charitable contributions, mortgage interest and state and local income taxes, while repealing the alternative minimum tax (AMT), the earned income credit and the rules for depreciation. Payroll taxes would be retained. It amounts to a full-scale overhaul of the tax code.

Carson emerged as a serious challenger to GOP frontrunner Donald Trump last year but has recently slipped in the polls. He now trails both Trump and Senator Ted Cruz. Recent figures show Trump registering about 38 percent, Cruz at 15 percent and Carson at 12 percent. The media has also reported that Carson’s campaign manager recently quit and other key staffers are leaving in droves.

The focus on a simplified flat tax system is being widely viewed as a way for Carson to re-energize his campaign. “ Go back to the Constitution. Recognize why taxation exists,” Carson told Fox News in an interview. “It’s because we need money to run the government. It’s not to control people’s behavior and do all of these other things that have been added in with this 80,000 pages of tax regulations.”

Under Carson’s plan, the 14.9 percent flat rate would apply to taxpayers who have incomes above 150 percent of the poverty level, or $36,375 for a family of four. Those who make less would still have to make a small tax payment, although the plan doesn’t indicate a specific amount “Even those who earn little income will pay taxes, no matter how small their contribution might be,” Carson says. Currently, 46 percent of taxpayers don’t pay a dime to the IRS.

As opposed to the bottom rung, the wealthiest taxpayers would likely have to pay less tax than they do now if Carson’s plan is implemented. According to the Tax Foundation, only the richest 10 percent would realize a benefit, not factoring in any other assumptions. The Tax Foundation says that the top 1 percent would see an increase of after-tax income of 33.44 percent, while the bottom 10 percent would face a decrease of just over 13 percent.

Cutting tax rates for the top tier is a common theme among the Republican presidential candidates. But Carson’s plan appears to go further than the others. We will see if this turns into a rallying cry or just a futile attempt to regain momentum in the race.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Tax Planning, Taxes