The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) and U.S. Department of the Treasury about IRS draft Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent, and draft instructions.

In its Jan. 29 letter, the AICPA suggested eight recommendations for consideration by the IRS. Among them are:

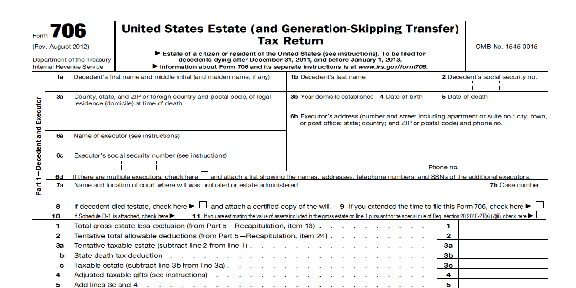

- IRS should clarify that if IRS Form 706, U.S. Estate (and Generation-Skipping Transfer) Tax Return, is filed solely for electing portability, the Form 8971 is not required;

- IRS should allow processing of the form if “unknown” is an appropriate answer, so long as the form is accompanied by an explanation, so that the form is not considered incomplete, which could subject the estate to penalties for failure to file a correct Form 8971 by its due date;

- IRS should ask if the estate tax value is used for income tax purposes;

- The form should include the date of the previous supplemental filing; and

- The instructions should include guidance on post Form 706 filing information needed by beneficiaries for determining basis.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: AICPA, Tax Planning

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)