As a small business owner, you will most likely hire an independent contractor to do some work for you at some point. When you hire an independent contractor, there are tax reporting requirements that you must meet.

If you have employees, then you know that you have to provide them with a W2 form. 1099 reporting is basically the independent contractor’s “W2.” A 1099 form shows the total payments you have made to a contractor from January through December. This is income to the contractor that they will need to report on their tax returns.

In this article, we will cover the following most common questions small businesses have when it comes to 1099 reporting:

- What is a 1099 Form?

- When is a 1099 Form Required?

- What Do You Need to Keep Track of to Report 1099 Info?

- Where Can I Get 1099 Forms?

- How Do I Complete a 1099 Form?

- When and How Do I File 1099 Forms?

- How Do I Create 1099 Forms in QuickBooks?

What is a 1099 Form?

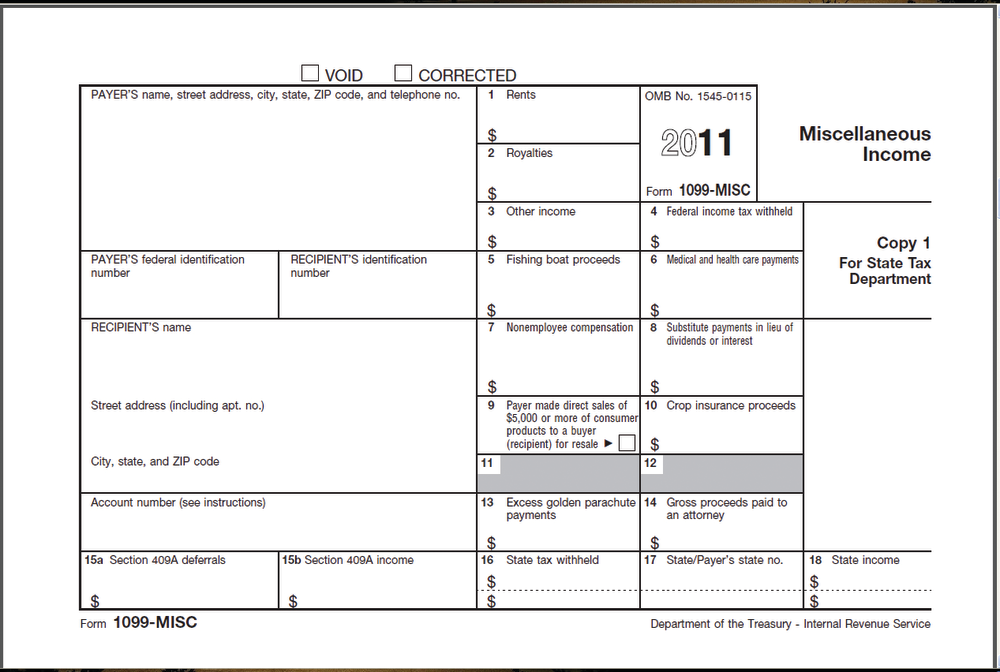

As a small business owner, you will complete Form 1099 Miscellaneous to report any payments of $600 or more made to vendors and contractors during the calendar year. In general, you will report Income, Interest, and Dividend payments made on this form.

It is very important for you to keep track of these payments throughout the year so that you can accurately report this information to both the contractor and the IRS.

The benefit of hiring an independent contractor versus an employee is that you don’t have the added cost of payroll taxes and benefits. However, you want to be sure that your independent contractor does not meet the legal definition of an employee or you could face penalties. To learn more about hiring an independent contractor, check out this article published by the Small Business Administration.

Read the rest of the article at FitSmallBusiness: Enter /form-1099-reporting/ after the .com URL

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs