Employees who live in one state but work in another might benefit from a tax reciprocity agreement between the two states.

If you have an employee who lives in one state but works in another, you typically withhold state and local taxes for the work state. The employee would still owe taxes to their home state. If there is a reciprocal agreement between the home state and the work state, the employee is exempt from state and local taxes in their employment state.

For example, an employee lives in Pennsylvania but works in Virginia. Pennsylvania and Virginia have a reciprocal agreement. The employee only needs to pay state and local taxes for Pennsylvania, and not for Virginia. You withhold the taxes for the employee’s home state.

What does tax reciprocity cover?

Tax reciprocity normally applies to any wages an employee earns through employment: hourly wages, salaries, tips, commissions, and bonuses. Reciprocal tax withholding agreements between states usually do not apply to income earned outside of employment.

Tax reciprocity only applies to state and local taxes. It has no effect on federal payroll taxes. No matter where you live, the federal government still wants its share.

Check the state reciprocity agreements that pertain to your employee to learn what earnings apply to the agreement.

How do employees notify you of tax reciprocity?

Employees must request that you withhold taxes for their home state and not their work state. Employees should ask you to stop withholding their work state taxes by giving you their work state tax exemption form. Employees can get the form from their work state’s government website.

Your role in state tax reciprocity as an employer

If an employee gives you an exemption form, you should stop withholding for the work state. You should then begin withholding for the employee’s home state. At the end of the year, use Form W-2 to tell the employee how much you withheld for each state.

What if you withhold taxes for the work state?

When an employee who lives in one state and works in another starts working for you, you might automatically begin withholding taxes for the employment state. If you withhold taxes for the work state and not the residency state, the employee will have to submit quarterly tax payments to their home state.

When the employee does their individual tax return, they need to submit a tax return for each state where taxes were withheld. The employee will likely receive a tax return for the taxes paid to the work state.

List of states with reciprocal agreements

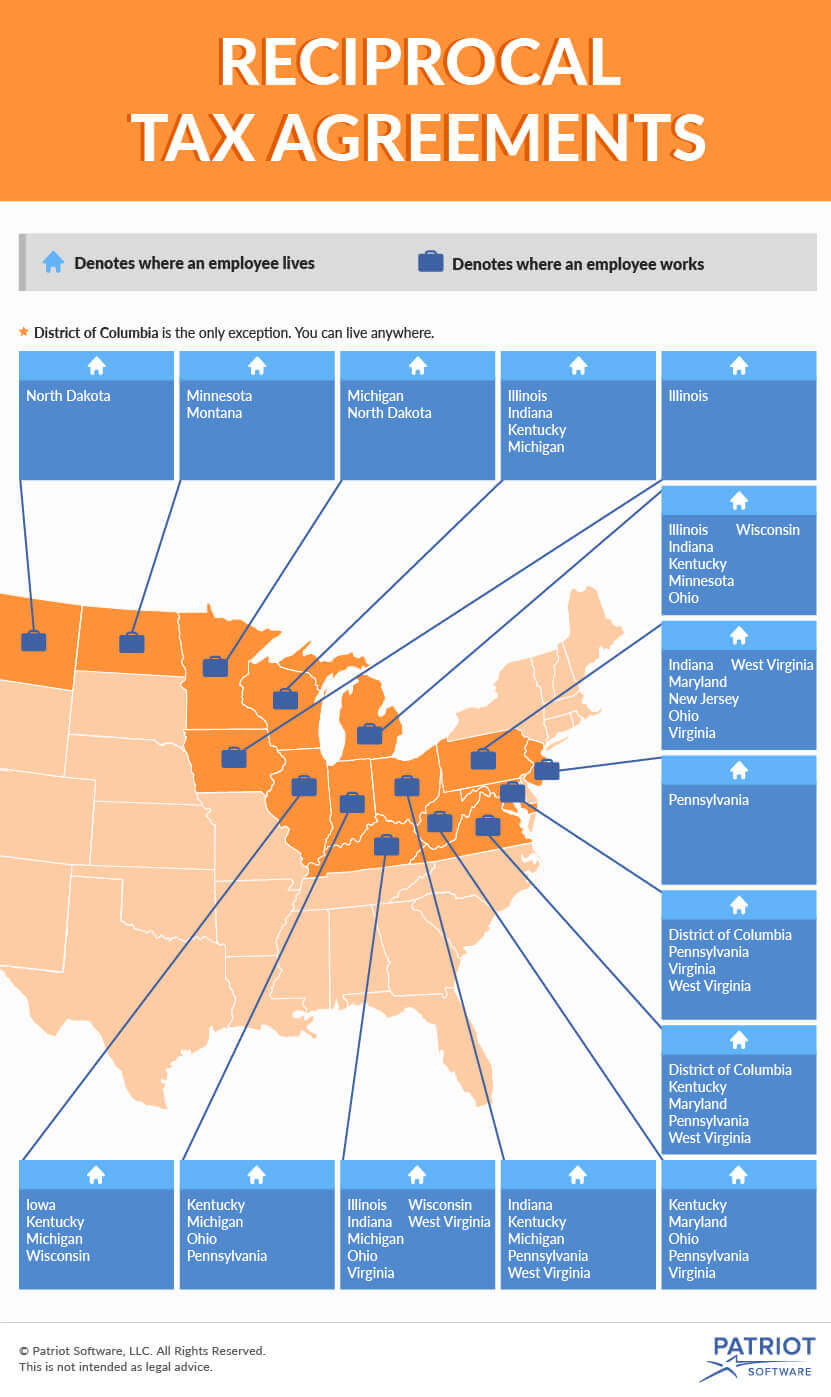

Tax reciprocity between states does not apply to all states. An employee must live in a state and work in a state that have a tax reciprocity agreement together. Below is a list of every state that has a reciprocal agreement.

| The employee works in … | The employee lives in … | Form employee must fill out |

|---|---|---|

| District of Columbia | Anywhere but the District of Columbia | D-4A |

| Illinois | Iowa, Kentucky, Michigan, Wisconsin | IL-W-5-NR |

| Indiana | Kentucky, Michigan, Ohio, Pennsylvania, Wisconsin | WH-47 |

| Iowa | Illinois | 44-016 |

| Kentucky | Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia, Wisconsin | 42A809 |

| Maryland | District of Columbia, Pennsylvania, Virginia, West Virginia | MW507 |

| Michigan | Illinois, Indiana, Kentucky, Minnesota, Ohio, Wisconsin | MI-W4 |

| Minnesota | Michigan, North Dakota | MWR |

| Montana | North Dakota | MT-R |

| New Jersey | Pennsylvania | NJ-165 |

| North Dakota | Minnesota, Montana | NDW-R |

| Ohio | Indiana, Kentucky, Michigan, Pennsylvania, West Virginia | IT-4NR |

| Pennsylvania | Indiana, Maryland, New Jersey, Ohio, Virginia, West Virginia | REV-419 |

| Virginia | District of Columbia, Kentucky, Maryland, Pennsylvania, West Virginia | VA-4 |

| West Virginia | Kentucky, Maryland, Ohio, Pennsylvania, Virginia | WV/IT-104 R |

| Wisconsin | Illinois, Indiana, Kentucky, Michigan | W-220 |

The New York tri-state area (New York, New Jersey, and Connecticut) does not have reciprocal agreements. Because of this, employees in this area will have taxes withheld from their wages for their work state and will have to submit payments for their home state.

———-

Reprinted with permission. Kaylee Riley is a content writer for Patriot Software.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: ESG