At Boston’s Logan International Airport, travelers are greeted by a permanent display of 49 developments representing four centuries of breakthroughs whose origins can be traced to Massachusetts. The array of innovations is staggering—from the microwave oven to infant formula and a newfangled game first known as “Basket Ball.” For finance professionals, one of these displays may mean more than others.

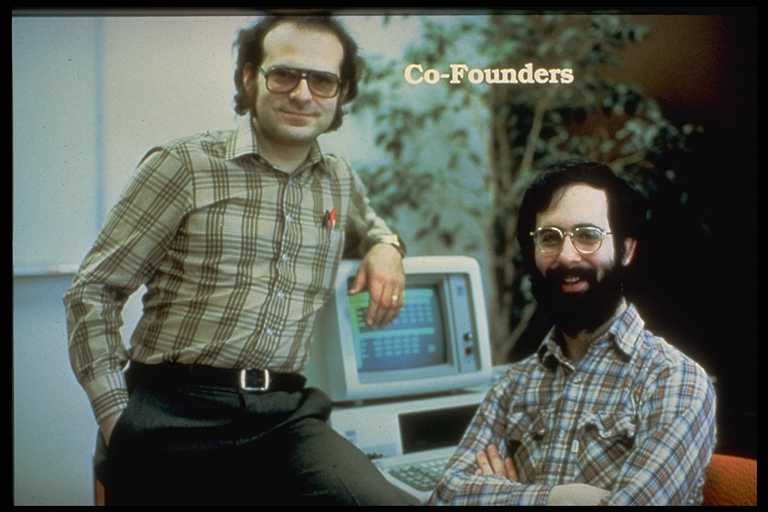

It’s a photo of two very 1970s-looking guys (there’s a lot of plaid, and more than a little hair) smiling next to an early PC. One of them is named Dan Bricklin. While sitting in the front row of a lecture hall at Harvard Business School, Bricklin wrote the first killer app for personal computers. It was an electronic spreadsheet application called VisiCalc, and it changed finance forever.

VisiCalc (short for “visible calculator”) took what previously had been done on paper and automated it to what then was a mind-blowing degree. VisiCalc’s green cells were embedded with formulas so you didn’t have to figure your total expenses or cost of sales by punching every number into the paper tape-spewing adding machine on your desk. Thirty-eight years ago, when most Americans were still dialing on rotary telephones, VisiCalc represented a Jetsons-like future for back-room number crunchers.

Three Cheers to Efficiency

So yes, National Spreadsheet Day is a day to celebrate. And it should be. VisiCalc, followed by Lotus 1-2-3 in 1983 and Microsoft Excel in 1987, transformed how organizations kept their books, developed their plans and budgets, and came up with forecasts. And while spreadsheets held sway in the market for decades, their limitations—propensity for errors, lack of scale, etc.—began to threaten the ability of organizations to adapt in a world that was anything but static.

So here we are 38 years later. And while spreadsheets are still embedded as the finance platform of choice for many businesses, more and more organizations are leaving Excel behind. They’re replacing static spreadsheets, which have forced the compromises that lead to static planning, and replacing them with cloud-based corporate performance management (CPM) solutions that help accelerate their journey toward an active planning environment.

They’re doing so because modern businesses don’t operate the way they did 38 years ago. They make decisions based on information that changes daily, even hourly. Consider a 2016 study by Aberdeen Group, which found that virtually half (49%) of executives are struggling to account for change because business has become chronically unpredictable. Spreadsheets don’t like volatility, and they make updating plans and forecasts laborious and time-consuming.

That inflexibility comes at a price. According to a recent global CFO survey, 77% of CFOs admit major business decisions have been delayed because stakeholders didn’t have timely access to crucial data. CFOs also report that their teams spent more than half of their time on reporting and data gathering—tasks that are largely manual for spreadsheet users but almost entirely automated for CPM users.

CPM: The new game changer

Just as VisiCalc was a game changer for finance organizations accustomed to doing all their work on paper, modern businesses are using CPM solutions to reclaim days and even weeks previously lost to static processes, improve the confidence in their data, make stakeholders across the business accountable for plans and forecasts, and elevate the role of finance as a strategic force in the business. For them, the game is changing again.

At Gentiva, a nationwide home healthcare business based in Atlanta, constantly shifting regulations and market forces made its Excel-based planning unsustainable. The company needed to spend fewer cycles on mundane tasks like data collection and consolidation and more on analytics that would lead to smarter business decisions. After moving to an automated cloud CPM solution, Gentiva eliminated 250 spreadsheets from its planning and budgeting processes. Managers now create budgets specific to their local territories, and nonfinance users have become mainstays in the planning process.

There are thousands of stories out there like Gentiva’s. They are the stories of businesses on their own journey toward active planning, focusing on the transformation that’s most crucial for their business and, one by one, thanking the spreadsheet for its service as they nudge it into retirement.

Applications typically don’t get a cake and a gold watch, but the spreadsheet has earned something better: a national day. So much of what modern finance has become is built on the legacy of VisiCalc. And because of that, we thank Dan Bricklin for writing some code instead of taking notes that day in class!

——–

Kerman Lau is VP of Finance at Adaptive Insights. Kerman is a seasoned finance executive and trusted advisor to business partners and company leaders. He uses his strong systems knowledge to drive innovation, and has implemented planning and reporting systems in companies of all sizes. Kerman is currently vice president of finance at Adaptive Insights, and regularly speaks and writes about FP&A best practices.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs