Are small businesses are falling through the cracks of the banking industry?

According to a recent survey, big banks don’t always offer the service small businesses need, and community banks don’t always provide the technology small business customers are looking for. Seed is providing an alternative to traditional banking by offering a full-service online banking service designed specifically for the 28 million small businesses in the US.

“Traditional banks have struggled to take care of their small business customers because they only have two banking options to offer — consumer or enterprise. Consumer banking products don’t offer all of the features and service small businesses need, while enterprise offerings are unnecessarily complicated and expensive,” said Brian Merritt, co-founder and CEO of Seed. “Seed is solely focused on serving the small business community. We’re responding to the frustrations of small business owners by offering an alternative to the status quo — a complete online banking service designed just for them.”

The challenges small business owners face with their banking services can have a real impact on their business. According to a new survey conducted by Researchscape on behalf of Seed, one-third of small businesses aren’t provided with online and mobile bill-pay; that same percentage pays monthly, often hidden fees to their banks. Perhaps most surprising, 32 percent of survey respondents are not properly separating their personal and business bank accounts, which can lead to serious accounting, tax, and reporting challenges for business owners.

And, despite the rise of mobile, more than half of small businesses said that they don’t have access to an intuitive, simple mobile banking app, while 65 percent have banks that don’t offer phone and in-app messaging support. The lack of mobile banking support makes it impossible for these business owners to manage their business on the go and leads to unnecessary time spent in a branch.

Meanwhile, managing cash flow is the number one financial challenge every small business has, but according to Seed’s survey, banks are not helping. Less than one-third of banks offer financial insights and only 24 percent of banks provide owners with advice on how to manage their business.

Other challenges small-business banking customers reported include:

- 63 percent of respondents default to the bank that holds their personal bank account when selecting a business bank and many are co-mingling their money.

- 59 percent state that the people inside of their bank don’t even know their name.

- 76 percent of survey respondents do not receive valuable business advice from their banks.

- Nearly 40 percent pay monthly fees regularly to their banks.

- 35 percent of banks do not go above and beyond with their customer service.

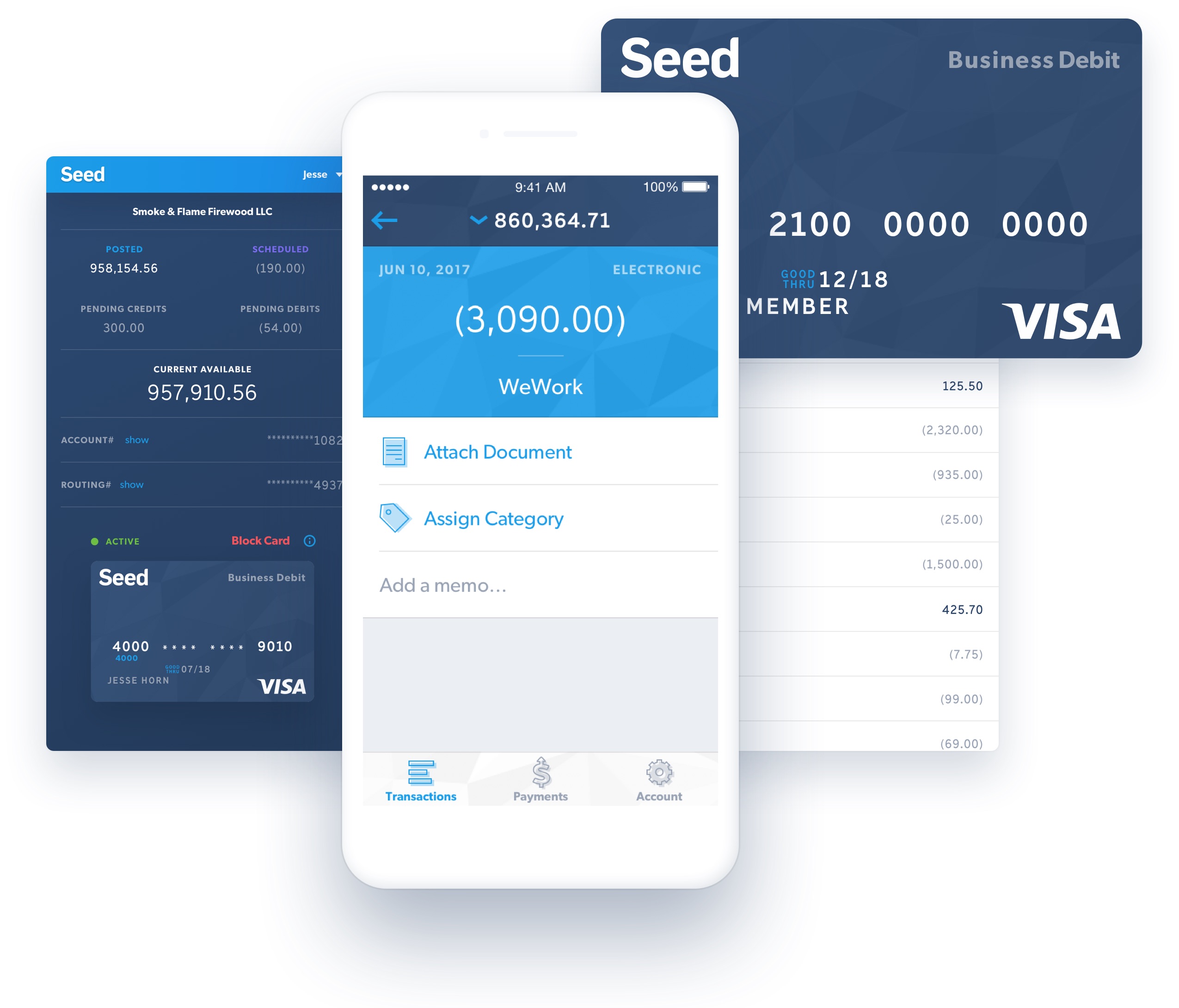

In response to these challenges, Seed provides a full suite of banking features built into easy-to-use, beautifully designed online app, including a Visa® Business Debit card, free bill pay, transfers, mobile deposits, and electronic vendor payments via ACH or paper check.

In addition to standard banking services, Seed offers unique features and benefits designed for the small business owner:

- A complete mobile business banking solution so that you can run your business from wherever you are.

- Personalized attention and support via phone and in-app messaging.

- An online knowledge-base to help answer the many vexing questions small businesses need answered.

- Automated monthly cash flow reports that save time spent on accounting.

- Real-time data can be categorized, searched, and edited with memos, making it effortless to keep tabs on your finances at all times.

- Bills, receipts, and documents can be stored alongside transactions and all data is available on accounting platforms and via download

Seed is live now for iOS and the web. For more information on Seed, visit https://seed.co.

Banking services provided by The Bancorp Bank, Member FDIC. The Seed Visa Business Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa Debit Cards are accepted.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs