Boston has launched an impressive initiative to help people in the city improve their credit situation. Currently, there are around 236,000 Bostonians who have bad credit, or no credit at all.

The program, called Boston Builds Credit, aims to assist a minimum of 25,000 citizens to improve their credit score in the next eight years. With the help of Mayor Martin J. Walsh’s initiative, by 2025 they should be able to raise their credit to at least a FICO of 660.

Below are more details about the program and how it can affect business and individuals alike.

The Boston Builds Credit initiative in a nutshell

Boston residents with problematic finances will get the opportunity to learn how they can boost their credit score. The program will offer workshops and one-on-one counseling, where participants will be able to grasp the methods for improving and keeping a good credit. The budget of the initiative is $4.5 million for the first three years, with the goal of helping 3,000 citizens raise their scores with at least 30 points.

Most importantly, Bostonians will get a chance to understand the factors that can easily affect their credit score: covering ongoing bills on time, keeping an eye on credit balances, and opting for new credit accounts only when necessary. Participants will be able to learn about secure credit cards and credit-building loans too.

The initiative is created and executed together with LISC Boston and the United Way of Massachusetts Bay and Merrimack Valley. It will also offer a pilot program with the Boston Medical Center, which will include credit-building assistance as an option for employee benefits.

Why good credit is so important

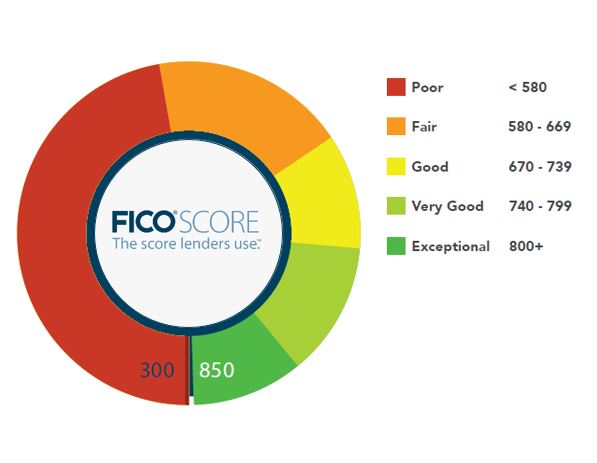

The FICO credit score is based on five crucial factors: length of credit history, credit mix, payment history, amounts owed, and new credit. Each of the five category contributes a different percentage to the formation of the score. The credit score is accepted to represent the financial stability of an individual and can range from 300 to 850. Scores below 579 are considered low, while those up to 669 are fair. Good scores are between 670 and 739. Anything above 740 is typically considered very good or even exceptional.

About 90% of credit decisions are taken on the basis of an applicant’s FICO score. It is used as a benchmark for people’s creditworthiness, as lending institutions divide credit candidates in categories depending on their score range. Higher credit scores mean lower interest rates and better lending options for consumers.

But the credit score’s importance is not limited to loans. People with bad credit are likely to pay higher interest rates when buying a car or getting a mortgage. They may also run into trouble with employers and landlords who may want to check their credit report as a measure of trustworthiness.

How a boosted credit score can help budding businesses

Many businesses in Boston, just like in the rest of the U.S., are required to comply with a legal requirement known as a surety bond to start their legal operations, or to participate in certain business activities. The owner’s credit score is crucial in the formation of the bonding price and in their ability to obtain a bond at all. The bond cost, which is a premium based on the bond amount, is set on the basis of the applicant’s credit score and overall financial situation.

The range of businesses who may have to get bonded is huge: from auto dealers, freight brokers and mortgage brokers to construction specialists, hair salons, health clubs and private investigators. Most often the bond is needed as a licensing requirement before professionals are granted the right to run their activities.

If the Boston Builds Credit program is successful, a number of residents may thus get the chance to open new businesses. With improved credit score, many participants will be able to get bonded for the first time. For others, the higher score will mean a lower bond price, so decreased startup costs.

How do you see the effects of the Boston Builds Credit initiative? We’d love to learn your opinion in the comments below.

————

Vic Lance is the founder and president of Lance Surety Bond Associates. He is a surety bond expert who helps business owners get licensed and bonded. Vic graduated from Villanova University with a degree in Business Administration and holds a Masters in Business Administration (MBA) from the University of Michigan’s Ross School of Business.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs