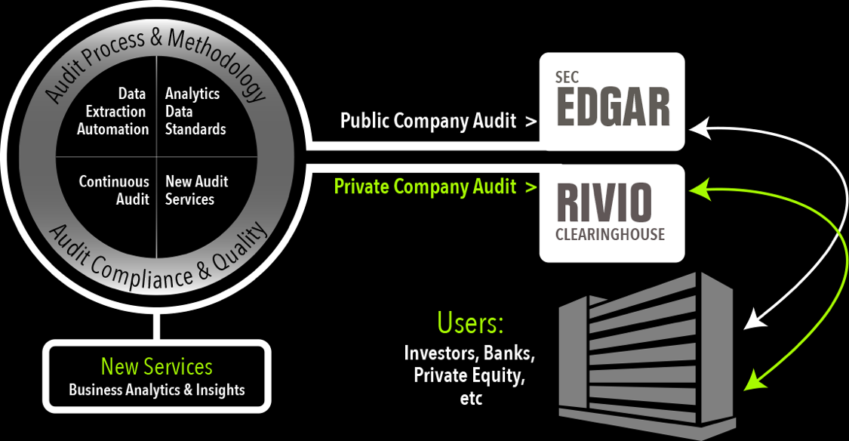

Almost one-in-five of the top 100 accounting firms are now using RIVIO Clearinghouse, a private financial company information exchange developed by CPA.com and Confirmation. And with more uses for the platform being developed beyond the secure delivery of financial statements, RIVIO is increasingly serving as a centralized, streamlined distribution hub for firms of all sizes.

With the number of public companies declining sharply since the 1990s and more than $1.8 trillion in private capital raised in 2017, the marketplace is embracing RIVIO as a means to create transparency and trust in key financial data. The secure platform ensures that lenders, investors and other authorized users can obtain access to financial statements and other key documents from validated CPA firms, all delivered unaltered by management.

“We continue to see the application of RIVIO for multiple uses across the firm and business landscape,” said Erik Asgeirsson, president and CEO of CPA.com. “With the digitization of financial data and the emergence of a new family of assurance services beyond financial reporting, RIVIO has great value as a differentiator for firms and a robust, secure connection point to clients. It’s efficient, easy to use and fills a critical marketplace need.”

RIVIO is driving value for CPA firms in three key areas:

Efficient digital workflow

RIVIO creates a centralized delivery hub that allows accountants to quickly select documents, create projects, and route reports securely to clients. It standardizes the report assembly and issuance process, giving CPA firms more control while improving efficiency. Critical alerts and notifications are automated – if a firm updates or withdraws a financial report, for example, the platform automatically notifies each recipient of the document.

Fraud prevention

An alleged $10 million financing fraud this past fall involving the parent company of Newsweek and several related entities offers another proof of concept for the solution. The alleged scheme revolved around the creation of a fictitious auditor – if the lenders had required receipt of the financial statements through RIVIO, the fraud could not have occurred. “This was a high-profile case but there are many similar frauds out there that don’t get the same media coverage, so it’s more common than you think,” said Brian Fox, president and founder of Confirmation

Enhancing advisory services

RIVIO is providing value for other uses beyond the distribution of audited financial statements. In the assurance category, for example, Systems and Organization Controls (SOC) examinations are in high demand for CPA firms and their clients. SOC reports are sophisticated reviews of a company’s internal controls over financial reporting, processes and cyber-readiness, among other areas, and help demonstrate that a potential vendor or business partner is taking the necessary steps to protect data privacy and availability and the integrity of their systems. Most variations of the reports are not public, however, and in fact require non-disclosure agreements (NDAs) from parties who wish to view them. New one-click functionality permits authorized users to sign the confidentiality agreements and gain immediate access to a SOC report, a streamlined process that gives clients maximum control and still creates documentation at each step.

To learn more about the clearinghouse and its applications, please visit RIVIO.com.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs