Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Subscribe Already registered? Log In

Need more information? Read the FAQs

June 1, 2022 Sponsored

Your firm probably relies too much on tax season for revenues. That’s means you’re taking on too many clients and piling too much work on your employees.

May 18, 2022 Sponsored

Employee management is more than just payroll. It also requires attracting and retaining workers, HR, benefits management, insurance, PTO, tax filings, workers' comp and more. Learn how a PEO can give your clients confidence beyond payroll.

April 8, 2022 Sponsored

In 2019, Aronson, a leading firm based in Maryland, was looking to streamline its assurance document exchange process. In this case study, you’ll learn more about the challenges the teams at Aronson faced, how they evaluated technology solutions, an ultimately how they were able to streamline the document exchange process while leveraging innovative technology to...…

March 28, 2022

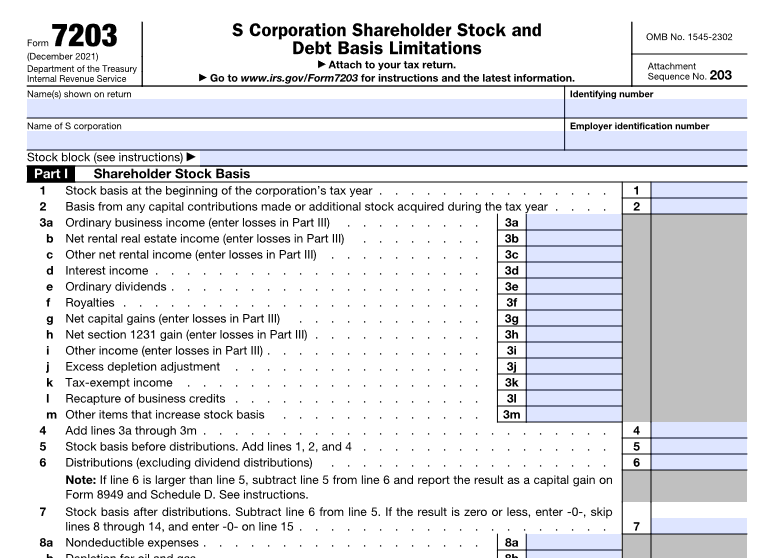

S corporation shareholders use Form 7203 to figure the potential limitations of their share of the S corporation’s deductions, credits, and other items that can be deducted on their individual returns.