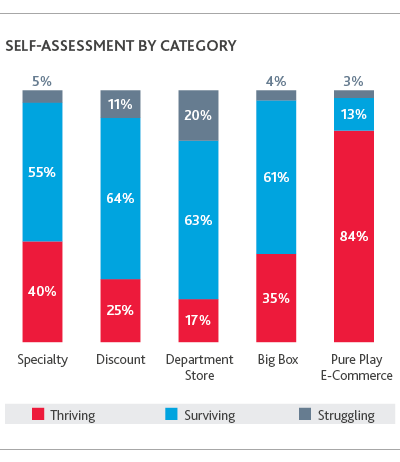

More than half (54 percent) of traditional retailers—including big box, department store, discount and specialty retailers— say they are just surviving headed into 2019, according to the 2019 BDO Retail Rationalized Survey of 300 c-suite executives.

The survey’s findings laid bare a clear distinction between the Survivors, retailers who report being stable and breaking even, and the Thrivers, who identify as profitable and experiencing robust growth. Survivors tend to avoid risk and are focused on keeping pace with traditional competitors, while Thrivers are making smart bets and focused on standing out from competition with exclusive offerings. An overwhelming majority of pure play e-commerce businesses (84 percent) say they are thriving, likely thanks to their lighter overhead and lack of dead store weight, while one-in-five department stores (9 percent) report struggling as they seek to optimize their physical assets and best compete with online offerings and attractive prices.

“The majority of retailers are stuck in survival mode, says Natalie Kotlyar, national leader of BDO’s Retail and Consumer Products practice. “Playing catch-up in perpetuity is preventing retailers from seizing new opportunities and leapfrogging the competition. It’s time for retailers to get rational: Scale with stability. Focus with foresight. Invest with intention.”

Competitive Retailers Foresee Turbulent Times

To gauge retailers’ perceptions of their standing, the survey queried respondents to evaluate their strengths, weaknesses and true competitive differentiators. Most importantly, Thrivers are planning ahead: the survey revealed 51 percent are actively preparing for an economic downturn and 52 percent anticipate increased levels of retail bankruptcy in 2019. Conversely, the majority of Survivors are taking a wait-and-see approach to what could be a legitimate retail apocalypse.

Capital Investments Needed

Two-in-three c-suite executives surveyed say they have recently secured—or will soon secure—outside capital, but their needs for capital infusion vary by type of retailer. Across the board, retailers are making significant investments in their e-commerce operations, however over one-in-three Thrivers are planning to grow their store count, with some e-tailers making their foray into the physical space. A sign of industry health overall, fewer than one-in-five retailers need a capital infusion to drive a turnaround strategy.

To Amazon or Not to Amazon? Retailers Weigh Partnerships

Notably, 70 percent of those surveyed believe the cons of partnering with Amazon outweigh the pros. Only 9 percent of retailers see exclusive products as Amazon’s biggest advantage over their business. While this may change as Amazon continues to roll out its private label brands, Thrivers are wise to be capitalizing on this perceived gap today.

Technology & Transformation

The majority (38 percent) of retailers say consumer demand is the greatest driver of digital transformation, yet only 41 percent are planning to significantly invest in improving their understanding of customer behavior over the next 12-18 months. To leapfrog competitors, retailers should prioritize revenue-generating digital initiatives that address consumer pain points unmet by competitors or automate routine processes that detract from that focus.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs