Taxpayers with expiring Individual Taxpayer Identification Numbers (ITINs) can get their ITINs renewed more quickly and avoid refund delays next year by submitting their renewal application soon, the Internal Revenue Service said today.

An ITIN is a tax ID number used by taxpayers who don’t qualify to get a Social Security number. Any ITIN with middle digits 83, 84, 85, 86 or 87 will expire at the end of this year. In addition, any ITIN not used on a tax return in the past three years will expire. As a reminder, ITINs with middle digits 70 through 82 that expired in 2016, 2017 or 2018 can also be renewed.

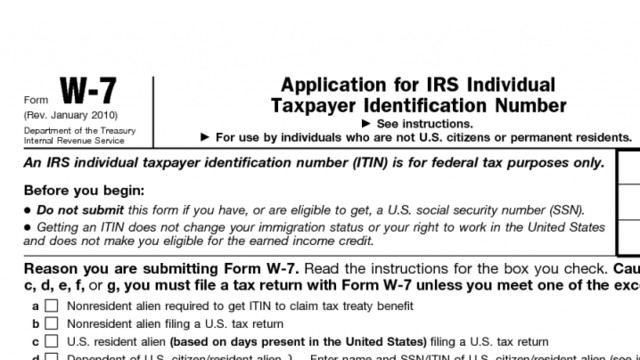

The IRS urges anyone affected to file a complete renewal application, Form W-7, Application for IRS Individual Taxpayer Identification Number, as soon as possible. Be sure to include all required ID and residency documents. Failure to do so will delay processing until the IRS receives these documents. With nearly 2 million taxpayer households impacted, applying now will help avoid the rush as well as refund and processing delays in 2020.

Avoid common errors now and prevent delays next year Many common errors can delay an ITIN renewal application. These mistakes generally center on missing information or insufficient supporting documentation. Common mistakes to avoid include:

- Missing W-7 Applications. Taxpayers renewing their ITINs must submit to IRS a completed new W-7 application along with either original documents or copies of documents certified by the issuing agency.

- Did not indicate reason for applying. A reason for needing the ITIN must be selected on the Form W-7.

- Missing a complete foreign address. When renewing an ITIN, if Reason B (non-resident alien) is marked, the taxpayer must include a complete foreign address on their Form W-7.

- Mailing incorrect identification documents. Taxpayers mailing their ITIN renewal applications must include original identification documents or copies certified by the issuing agency and any other required attachments. They must also include the ITIN assigned to them and the name under which it was issued on line 6e-f.

- Insufficient supporting documentation, such as U.S. residency documentation or official documentation to support name changes. Dependents are required to supply residency documentation in most cases.

- Did not include a tax return to validate a tax benefit. Spouses and dependents residing outside the U.S. who would’ve been claimed for a personal exemption should not renew their ITINs this year, unless they are filing their own tax return, or they qualify for an allowable tax benefit. For example: a dependent parent who qualifies the primary taxpayer to claim Head of Household filing status, American Opportunity Tax Credit (AOTC), or Premium Tax Credit. In these cases, the individual must be listed on an attached U.S. federal tax return with the appropriate schedule or form that qualifies for the allowable tax benefit and the federal tax return must be attached to the renewing Form W-7 application.

The IRS urges applicants to check over their forms carefully before sending them to the IRS. For more information, visit the ITIN information page on IRS.gov.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs