Helping clients understand their numbers is a continuous focus for accounting professionals, and while there are several dashboard tools readily available, most of these require additional downloads, setup, and a learning curve.

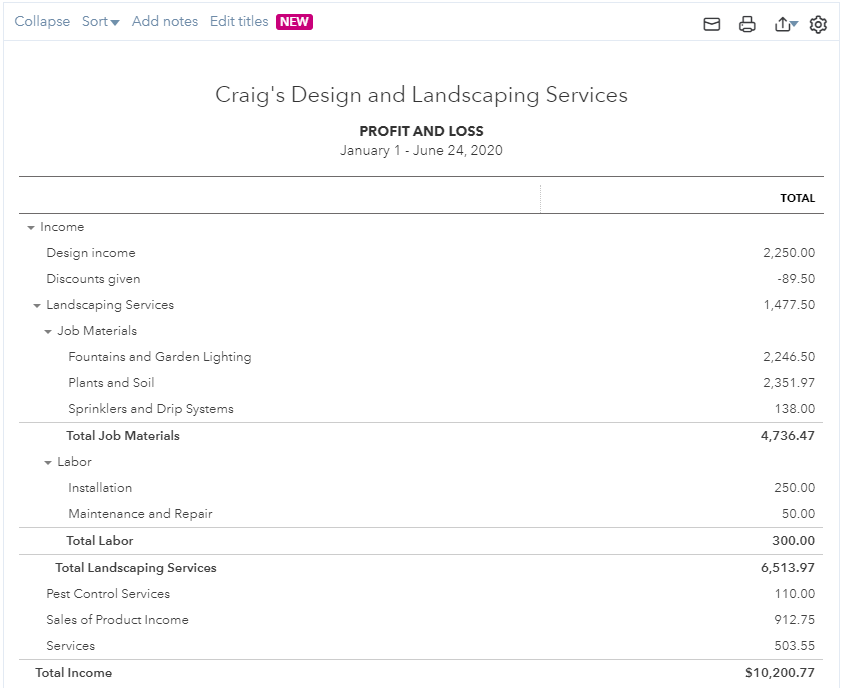

That’s not the case with Reports in QuickBooks Online. In addition to tried-and-true, fully customizable P&L and balance sheet reports, there are several new reporting features to help make it easier for you to create reports that are easy for your clients to understand and digest.

“No more data exports and making repetitive edits in Excel every month!” says Nitin Garg, a product manager with QuickBooks Online Accountant. “The new capabilities and enhanced functionality will help accountants produce necessary reports for their clients directly from QuickBooks.”

Here’s a quick list of the new reporting features:

More data at your fingertips: QuickBooks Online is now optimized to load twice as much general ledger data, so you’ll see larger reports at once – no longer will you have to click “load more” to view all data for a given period of time. Plus, scrolling through large reports is a breeze thanks to the performance improvements.

Take CTRL-F to a new level: Now, the entire browser cache will be searched for data, even if the information isn’t displayed on screen.

Enhanced navigation: In detail reports such as the general ledger, when you drill into a particular transaction and return back to the report, QuickBooks now preserves your location so you no longer have to scroll from the beginning.

Enhanced report appearance and readability with Smart Page Breaks: The appearance and readability of printed reports is now greatly improved thanks to intuitive formatting and page breaks, as well as the option to repeat headers on each report page. For example, when viewing subtotals or groups of accounts, the new “Smart Page Breaks” feature puts a break in the appropriate spot, helping you make better sense of reports.

Comparing reports now taken to the next level: Previously, comparing reports meant using Excel to export multiple reports and putting them together manually. That’s now a thing of the past with the new “Reorder Comparison Columns” functionality. Now, you can create multiple comparisons in a single report and reorder any columns you’d like, looking at period year-to-date, previous period, previous year, and previous year-to-date. In addition, you can now compare previous year-to-date when running a P&L summary report. This was an enhancement based on user feedback.

Preserve collapse and expanded sections: You’re now able to save collapsed and expanded sections in customized reports. This means reports are always presented at just the right level of depth.

Customize section titles to match your client’s business: The days of using Excel to edit section titles in reports are gone. Now, all QuickBooks Online users can edit and change section titles on reports to match their company’s terminologies. Specifically, this can be done for the P&L and balance sheet reports, where all section title changes will automatically be reflected on both.

Ready to get the ball rolling? Tap into these new features now.

https://quickbooks.intuit.com/online/

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs