The Treasury Department and the IRS have released a proposed redesigned partnership form for tax year 2021 (filing season 2022). The proposed form is designed to provide greater clarity for partners on how to compute their U.S. income tax liability with respect to items of international tax relevance, including claiming deductions and credits.

The redesigned form and instructions provide guidance to partnerships on how to report international tax information to their partners in a standardized format. This proposed form would apply to a partnership required to file Form 1065 only if the partnership has items of international tax relevance (generally foreign activities or foreign partners). The proposed changes would not affect domestic partnerships with no international tax items to report.

This early release is intended to afford time for stakeholder input and engagement. Treasury and IRS invite comments from affected stakeholders through Sept. 14, 2020. Written comments should be sent to the following email address: lbi.passthrough.international.form.changes@irs.gov with the subject line: “International Form Changes.”

The Treasury Department and the IRS will be actively engaged with stakeholders to solicit input on these proposed changes before the forms are finalized later in 2020.

Currently, partners are required to report international tax information on their tax returns on several tax forms and schedules. Partners generally obtain the information required to be reported from their partnerships, usually through narrative statements attached to K-1s. Those statements are compiled in a variety of formats and may be difficult for partners to translate onto their own returns. The proposed changes intend to ease this burden through a standard format that offers greater clarity to both partnerships and their partners.

The standard format of the new partnership schedules is designed to better align the information that partnerships provide on the schedules with the tax forms used by partners, allowing partners to more easily prepare their tax returns and the IRS to more efficiently verify taxpayer compliance. It is intended that all of the information to be reported on the new schedules is already necessary for the partnership to provide to partners or is available to the partnership.

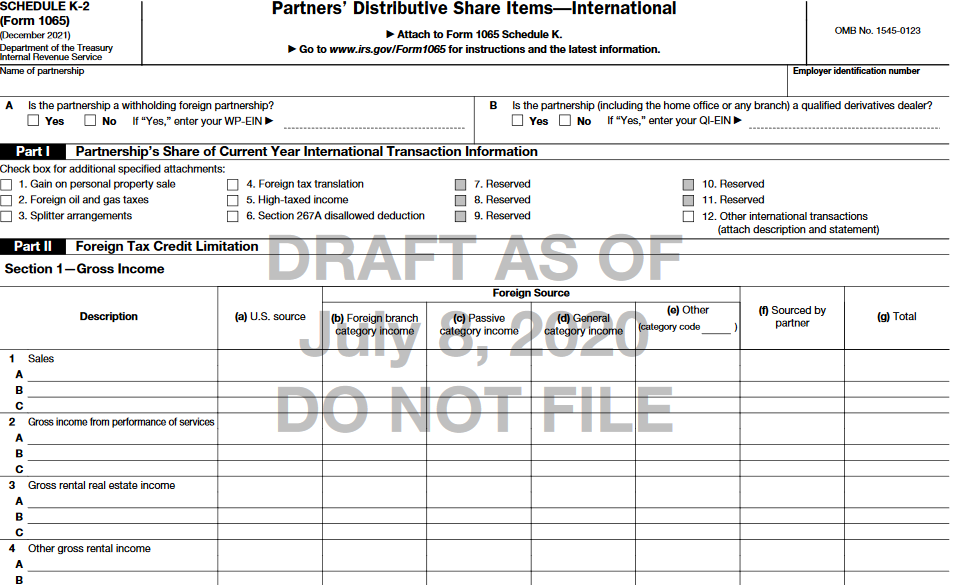

The Treasury Department and the IRS are releasing the draft new Schedule K-2 (Form 1065), Partners’ Distributive Share Items – International and Schedule K-3 (Form 1065), Partner’s – Share of Income, Deductions, Credits, etc. – International, both for tax year 2021 (filing season 2022), and the draft instructions, to allow partnerships and other stakeholders time to consider the proposed changes and to provide comments that can be taken into account in finalizing the schedules and instructions.

The proposed parts included in new Schedule K-2 (Form 1065) replace portions of existing Form 1065, Schedule K, lines 16(a) through 16(r). The proposed schedule provides for international tax information to be reported in a standardized manner generally corresponding to the tax forms listed above.

The proposed parts included in new Schedule K-3 (Form 1065) replaces portions of Schedule K-1, Part III, Boxes 16 and 20, and provides information to the partner generally in the format of the following forms that might be completed by the partner:

- Form 1040 (U.S. Individual Income Tax Return)

- Form 1040-NR (U.S. Nonresident Alien Income Tax Return),

- Form 1116 (Foreign Tax Credit (Individual, Estate, or Trust)),

- Form 1118 (Foreign Tax Credit – Corporations),

- Form 1120 (U.S. Corporation Income Tax Return)

- Form 1120-F (U.S. Income Tax Return of a Foreign Corporation),

- Form 4797 (Sales of Business Property)

- Form 8949 (Sales and Other Dispositions of Capital Assets)

- Form 8991 (Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts),

- Form 8992 (U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI)), and

- Form 8993 (Section 250 Deduction for Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI)).

The Treasury Department and the IRS plan similar revisions, as applicable, to Form 1120-S (U.S. Income Tax Return for an S Corporation) and Form 8865 (Return of U.S. Persons With Respect to Certain Foreign Partnerships). The Treasury Department and the IRS welcome comments on similar changes to be made to Forms 1120-S and 8865 for the 2021 tax year.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs