Workflow automation allows mid-market businesses, which Intuit defines as businesses that have 10 to 99 employees and $500,000 to $20M in annual revenue, to streamline time-consuming, repetitive tasks, while maintaining accuracy and increasing productivity. Intuit recently launched several features in QuickBooks® Online Advanced that accounting professionals will want to know about – and share with their clients to simplify their business processes.

Invoice Approval Template

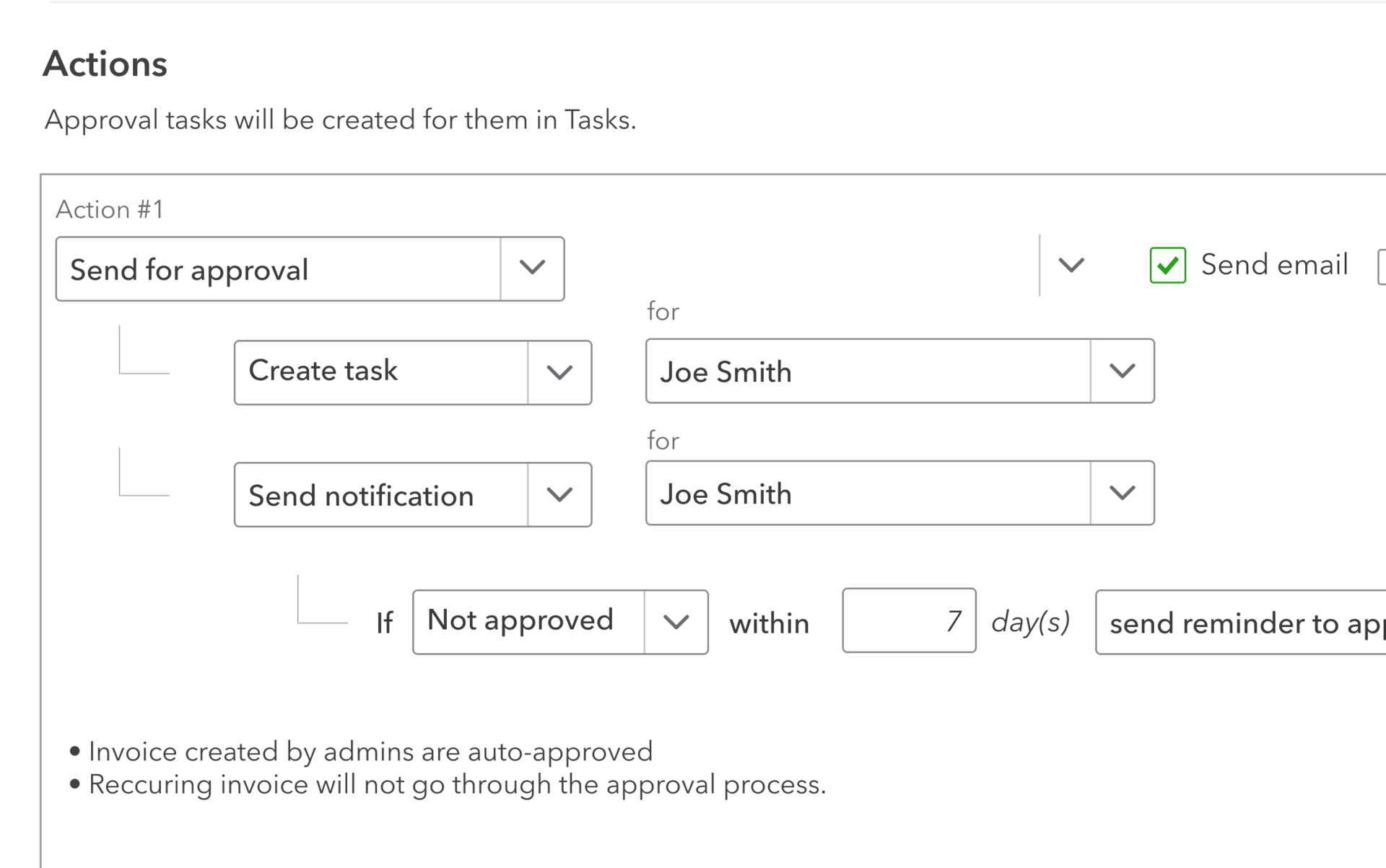

With the introduction of the Invoice Approval template, your clients can now assign approval tasks to their colleagues, increasing the accuracy and efficiency of collaboration for the invoicing process. Leveraging “if-this-then-that”-style technology, the new Invoice Approval template removes the repetitive work of selecting users and emailing each to request review or approval of invoices.

Overview: Invoice Approvals can be accessed via Workflows. This new business process automation template allows users to create invoice approval rules and designate invoice approval personnel via custom roles with just a few clicks. Once these rules are set up, the client can process large volumes of invoices, while maintaining the confidence that the invoices meet the company’s invoicing approval rules, improving the efficiency and accuracy of the entire process.

Sales managers or finance leaders can also be added to QuickBooks Online Advanced to participate in the invoice approval process through the “Manage Users” option. With granular user permissions, each user can be granted appropriate access to the financial information they need to perform their duties, such as invoice approval. Users with approval duties will see a list of invoices to approve in their Tasks tab, where they can quickly glance at what key tasks they need to do, ensuring faster invoice delivery and payment collections. Mobile alerts of pending invoices for approval can be enabled and will show up in users’ QuickBooks Online Advanced mobile app.

How it works: Admin users will click on “Workflows” to enter the workflows hub. Select “Templates” and choose the “Invoice Approvals” template to begin creating an automated invoice approval for your firm. You can select different conditions related to the invoices that require approvals, such as dollar amount, etc. Click “Save and Enable” to complete the creation of the new invoice approval automation. This feature ensures that invoices are correct and accurate before they’re sent to customers – for example, by making sure the “Bill to” contact is accurate. The feature also helps ensure invoices meet requirements on purchase order details, such as when “product quantity” must be included.

Tasks

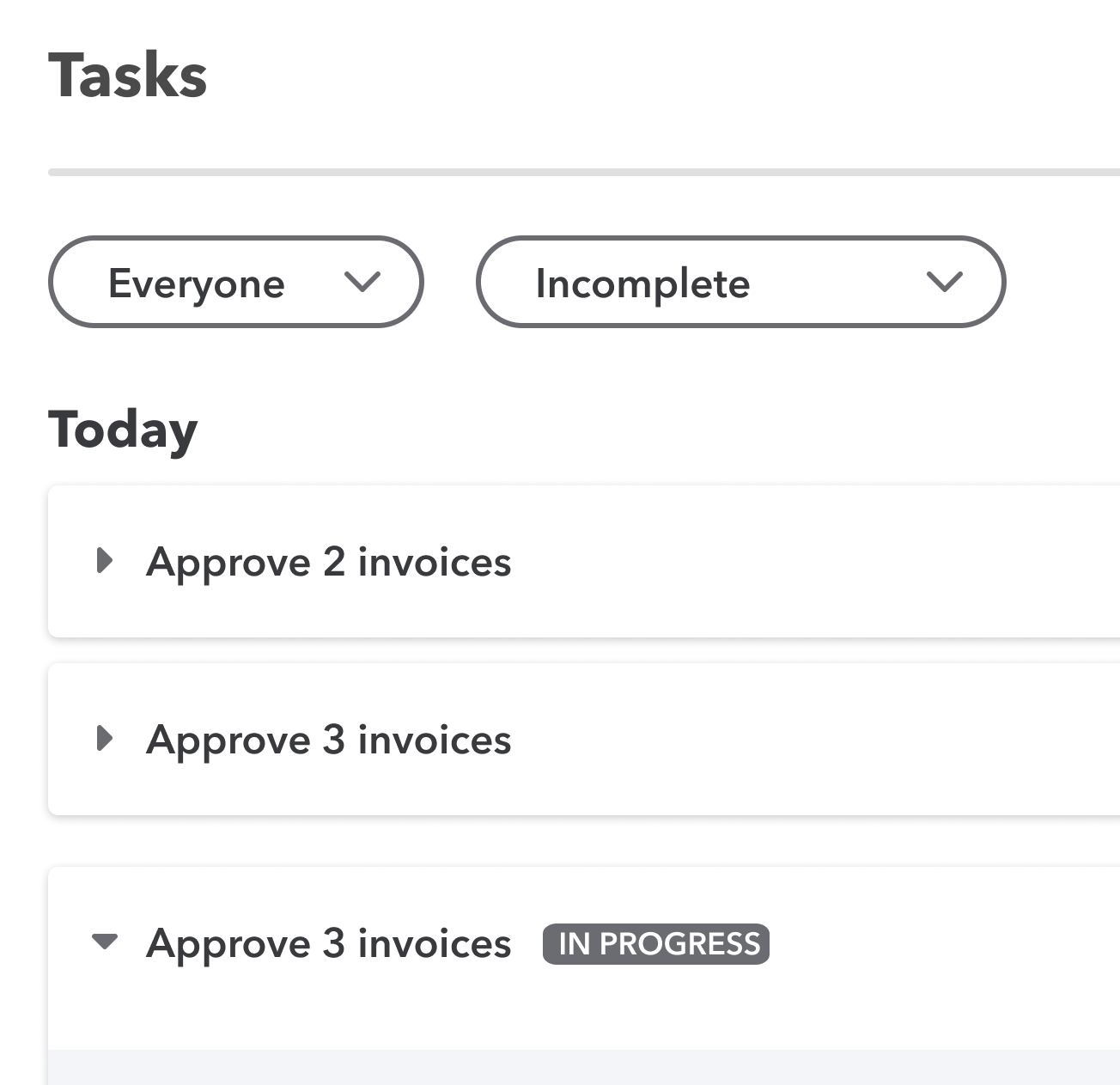

To fully support an automated approval process, another new feature called Tasks has recently launched. Tasks is where admin users can see all invoices that are pending approval, denied approval or need approval.

Overview: Since the launch of Task Manager in late June, more than 1,000 companies have adopted the custom task capability. The feature organizes and tackles a QuickBooks to-do list, automates tasks assignment flow to increase team productivity, and increases collaboration within QuickBooks Online Advanced users. With more employees working remotely for longer term, the Tasks center makes it easier to assign essential financial tasks to remote employees directly from within QuickBooks.

How it works: With this feature, clients can create or review invoice approval related tasks that are auto-generated by the system based on the Invoice Approval template. It also helps you with creating customized tasks, delegating to-do lists, and coordinating team projects.

Other recent feature improvements in Advanced include the following:

More custom fields. Many QuickBooks Online Advanced users enjoy the efficiency and flexibility of custom fields, so Intuit now supports 48 custom fields (up from 36), meaning your clients have up to 12 fields each for Customer, Vendor, Sales forms, purchase order, and other expenses. Additionally, users can sort, filter, group by, and display information in columns of custom fields in three reports: custom contact list, vendor contact list, and unpaid bills.

Custom chart builder. In response to requests from accountants, you can now up-level your advisory services by creating custom KPI dashboards for your clients. The new custom chart builder feature empowers your clients to make better-informed and faster business-critical decisions. Enhancements to the custom chart builder in the Business Performance Dashboard now allow users to set a comparison while creating a custom chart, letting you compare key data against the same period in the last year. Preset charts are also available, including viewing business performance over the fiscal year nested under a “time period” option.

Custom roles expansion. You can now customize user access and ensure the right people see the right information inside your client’s company. Through custom roles expansion in Advanced, clients can get even more granular with more pre-set roles to use and expand. The custom roles feature also offers new roles for payroll permission, banking, expense management, and inventory management.

To learn more, visit the QuickBooks Online Advanced website just for accountants. https://quickbooks.intuit.com/accountants

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs