Paychex Flex

From the 2020 reviews of professional payroll systems.

Paychex Flex is an online payroll service application from Paychex. Designed for small businesses with up to 50 employees, Paycheck Flex offers three plans: Paychex Go, Paychex Flex Select, and Paychex Flex Enterprise. All three plans offer full-service payroll, including processing and remitting of all required tax forms and payments. Along with complete payroll services, Paychex Flex also includes HR resources designed for small businesses.

Paychex Flex (Select and Enterprise plans) also includes a free mobile app for both iOS and Android devices, with payroll able to be processed from any device. For accounting professionals interested in using Paychex Flex, the application also includes AccountantHQ, a centralized dashboard that lets accounting professionals access all of their clients from a single platform.

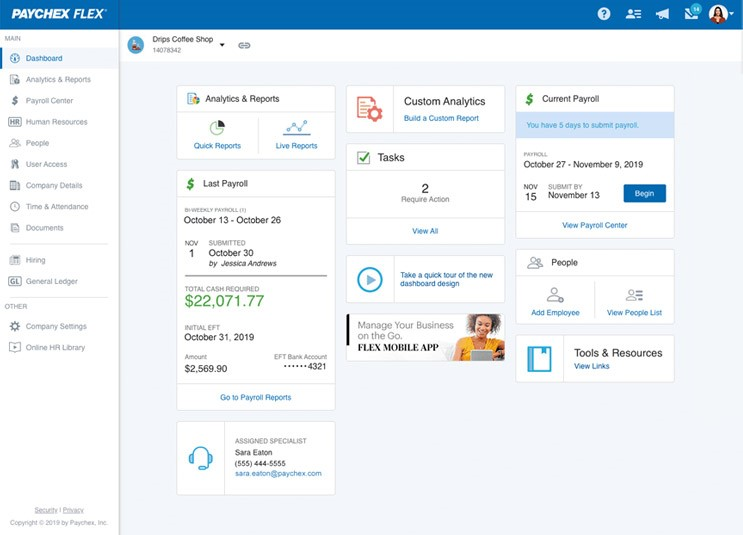

Click for larger image: Paychex Flex includes a user dashboard that offers detailed information and easy access to payroll tasks.

All three versions of the Paychex Flex include complete online payroll processing along with time tracking and attendance, complete tax administration, and new hire reporting. The Select and Enterprise plans also include HR resources, a general report, state unemployment insurance services, and accounting software integration.

Paychex Flex offers direct deposit capability, along with benefit management and multi-state payroll capability, with users able to process payroll from the main dashboard in the application. Accountants using Paychex Flex will appreciate the dashboard feature where payroll can be processed for any client, with firms able to choose a client from the dashboard and have ready access to all payroll-related applications. Users have the option to automatically create checks each pay period, which is convenient for businesses with a large number of salaried employees, while the pay entry grid offers quick entry of payroll related data for hourly employees. The application offers multiple payroll entry methods, and allows users to easily pay a select group of employees quickly.

Paychex Flex includes tax tables for all 50 states, and will calculate, file, and pay all federal, state, and local payroll taxes. All plans offer good reporting options, with the Enterprise plan offering custom analytics and advanced reporting options, including the ability to create custom reports from scratch. Accounting firms using Paychex Flex can create custom reporting options for each client, including a reporting set that can be set to process automatically after each pay period. Paychex Flex also offers a Quick Reports option as well as the choice to run live reports. All Paychex Flex reports can be exported to Microsoft Excel if additional customization is required, or saved as a PDF.

Time and attendance applications are available in Paychex Flex for easy online time tracking, with employees able to punch in and out online or by using a mobile device. For those that desire a more traditional way of tracking employee time, a time clock option is offered in the application, with an iris recognition time clock option available as well.

Along with full-service payroll, Paychex offers a number of add-on resources for small businesses to choose from including complete HR Services, Hiring Services, Employee Benefits Management, Business Insurance, Finances and Payment, and Startup Services. Paychex Flex also integrates with numerous third-party accounting applications including QuickBooks Desktop, QuickBooks Online, Kashoo, AccountEdge, and others. The application includes an employee self-service option, which allows employees to enter all onboarding information themselves. In addition, the self-service option provides employees with convenient access to all related time-entry features as well as access to paystubs, W-2s, and any benefit information as well as personal information.

Both Paychex Flex Select and Paychex Flex Enterprise offer access to HR and Business Forms, employment and income verification services, and the Paychex Learning Management System. The Enterprise plan also offers complete HR administration, including employee training management, performance reviews, and all HR related compliance, with easy access to HR professionals when necessary.

All Paychex Flex subscribers are assigned their own client service advisor, who is the go-to for the entire setup process. Payroll support is available around the clock, with support accessible via telephone or email. Subscribers will also have access to the password-protected help option available from the Paychex Flex website, with support options targeted to both employers and employees.

Paychex Flex also offers an option for accounting professionals that are interested in offering payroll services to clients. Paychex Flex offers three plans, with additional payroll options available for larger businesses as well. Pricing varies, depending on the plan subscription as well as any add-on options, with pricing information available directly from the vendor.

2020 Overall Rating – 5 Stars

Strengths:

- Three plans available that are suitable for up to 50 employees

- Excellent integration options

- Good selection of add-on modules

Potential Limitations:

- Add-on modules can increase pricing significantly

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits