Rippling Payroll

From the 2020 reviews of professional payroll systems.

Rippling Payroll is part of Rippling’s all-in-one platform that combines payroll with complete HR and benefits management. Completely online, Rippling is suitable for businesses with 2-500 employees. Rippling Payroll can also partner with accountants who wish to provide payroll services to the clients, with free payroll included for the firm.

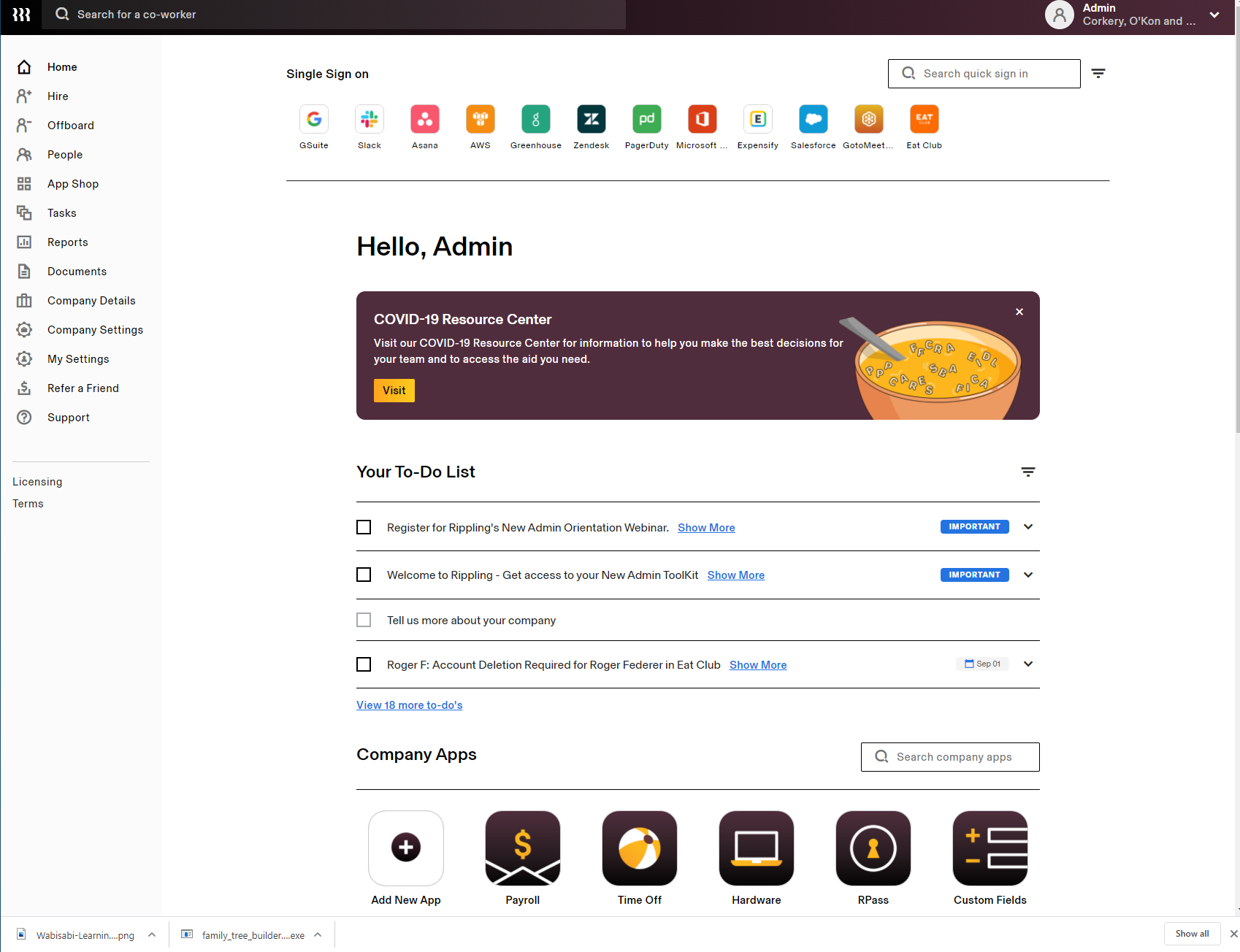

Click for larger image: The home screen offers easy access to all payroll related tasks.

Those interested in Rippling Payroll will have to also purchase the Employee Platform Management plan. The management plan is also required in order to use any of the other modules offered which include Full-Service Payroll, Benefits Administration, ACA & Cobra, HR Help Desk, Applicant Tracking, App Management, and Device Management. All modules can be purchased separately, so you only pay for what you need.

Rippling Payroll is completely online and includes a mobile app for both the payroll and the HR modules, with the app supporting both iOS and Android devices. All information entered through the app will automatically sync with the full application.

Rippling Payroll supports payroll for all 50 states, as well as international payroll, and new hire filing as well. The application includes an unlimited number of pay runs as well as complete tax filing and remittance for federal, state, and local taxes and also manages completed I-9 documents, as well as year-end forms such as W-2s and 1099s. Users can pay employees using a standard check, with direct deposit supported in the application as well, and the employee self-service portal allows new employees to enter their personal data directly into Rippling Payroll. Employees can also use the portal to access paystubs and add, edit, or delete tax, benefit, or other personal information. Rippling Payroll also supports wage garnishments, and tracks PTO, with user-defined fields available for tracking additional information.

Rippling Payroll is designed to automate the entire payroll process, with users able to customize the system to suit their needs. With HR data synced automatically with payroll, users can run payroll with limited data entry needed. The main screen features a vertical menu bar to the left of the screen that offers access to all payroll related functions, with a to-do list as well as access to all linked apps available from the main screen as well. In addition, the application offers features such as the Instant Pay Run Comparison, which allows users to quickly compare the upcoming pay run with the prior run, making it easy to spot discrepancies, and correct them if necessary. Users can run salaried and hourly employees separately and can import time data directly into the application if desired. Also available in Rippling Payroll is a Job Codes feature that allows users to track employee time by multiple dimensions including location, client, or task , with the ability to change employee pay rates for employees that perform multiple jobs.

Rippling Payroll also includes a paperless component, allowing users to manage employee files such as offer letters, agreements, I-9s and W-4s online in the documents feature. Manual paychecks can be recorded in Rippling Payroll, but the application does not include after-the-fact payroll capability.

Rippling Payroll offers a good selection of built-in reports including a Journal Report and a Transactions Report which can be processed after each payroll. The application also includes trend reports, a headcount report, and a cash requirement report for funding payroll. Rippling Payroll users can also create custom reports in the application, with all reports able to be exported to Microsoft Excel, or saved as a PDF.

Rippling Payroll offers data synching with more than 500 apps including popular accounting software applications such as QuickBooks and NetSuite, as well as time tracking applications such as TSheets and Deputy. The application also offers a separate App Management module which can be purchased separately for complete management of all installed apps.

Rippling Payroll offers an optional HR/Help Desk module that provides users with telephone or email access to HR professionals. In addition, the HR module provides automatic compliance updates as well as complete integration with other platforms, for an all-in-one system.

Users can access Rippling Payroll support directly from within the application, with an option to visit the Help Center for how-to-guides, FAQs, and video tutorials. There is also an option to access the support team via email.

Rippling Payroll is a scalable employee management platform well suited for businesses with 2-500 employees. The base price for Rippling Payroll is $35 per month, with a $8-$10 per employee charge for the employee management platform and an $8-$10 per employee charge for the payroll module. Various add-on options such as the HR Help Desk and App Management modules are also available at an additional cost.

2020 Overall Rating – 4.75 Stars

Strengths:

- Includes a complete employee platform

- The application is scalable supporting between 2-500 employees

- Offers excellent integration options

- Supports international payroll

Potential Limitations:

- Can be expensive for small employers

- Support is available by live chat and email, not by phone

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits

![RipplingPayroll-Logo-Card[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/10/RipplingPayroll_Logo_Card_1_.5f738ab224a86.png)