RUN Powered by ADP for Partners

ADP

From the 2020 reviews of professional payroll systems.

RUN Powered by ADP Payroll for Partners (RUN for Partners) is ADP’s white-labeled payroll processing and HR management solution designed for businesses with 1-49 employees. Interfacing with all the major accounting applications, it processes payroll and calculate, deduct and pays taxes on a secure cloud-based platform. Included is ADP Accountant Marketing Toolkit, powered by CountingWorks, for creating custom video and collateral to help accountants market the service and their firm. ADP offers a Certified Partner program for RUN Powered by ADP Payroll for Partners.

RUN for Partners is available on ADP Accountant Connect, a free, mobile-friendly portal providing quick and secure access to client data and valuable practice management tools including Wolters Kluwer CCH Resource Library, CPE courses, IBISWorld Industry reports, PPP tools and ADP’s exclusive Compensation Benchmarking, powered by ADP DataCloud.

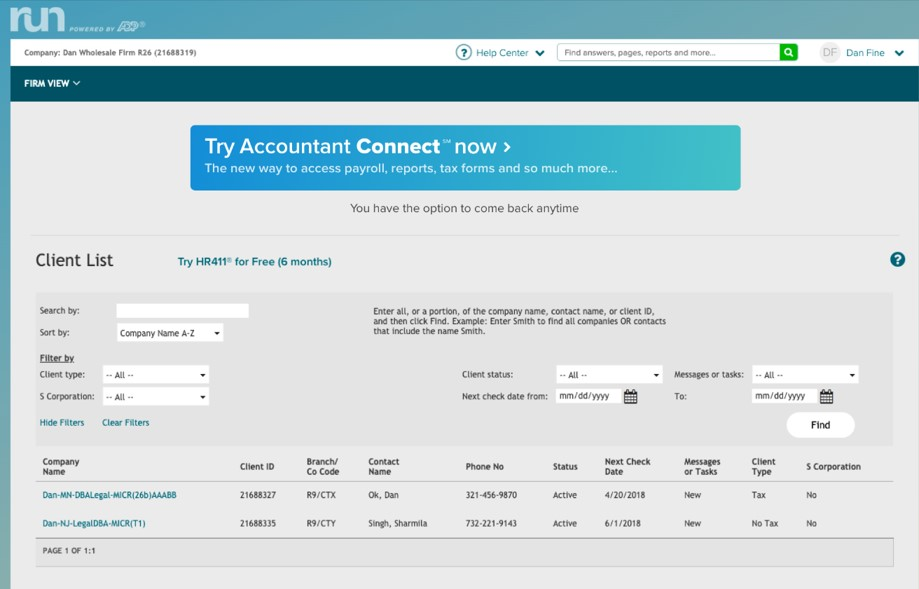

[Click for larger image: Run Powered by ADP offers easy access to all payroll features from the user dashboard.]

RUN for Partners includes an easily navigated user dashboard that provides access to the Run Payroll feature as well as all other payroll related options. If subscribed to the optional HR features, they can also be accessed directly from the dashboard. In addition, users can check upcoming payroll dates, enter manual checks and view any messages directly from the dashboard.

Once payroll is set up, it requires little data entry, with businesses only needing to enter data when regular hours change, such as when tracking vacation, holiday, or sick hours. The option to add additional pay for bonuses and commissions is offered in the application, with contractor payroll supported in the application as well.

For those using the optional Time and Attendance add-on module, all hours entered in the module will be automatically added to the payroll application. Once payroll has been reviewed and approved, the application will display the amount of the payroll run for funding purposes. At that point, users can just click on the Approve tab to run payroll.

In addition to regular payroll, RUN for Partners also supports after-the-fact payroll. For accounting firms using Accountant Connect, all client dashboard provides easy access to all clients from one central location.

ADP’s RUN for Partners includes tax tables for all 50 states, with all federal, state, and local taxes filed by ADP, including complete compliance reporting, electronic filing, and tax remittance. In addition, both W-2s and 1099s are processed by the application as well.

RUN for Partners includes excellent reporting options in a variety of categories including Payroll, Taxes, Benefits, HR, and Miscellaneous. Standard reports available include a Payroll Summary, Payroll Details, Earnings Record, Wage and Tax Register, Deduction Summary, Payroll Liability, Earnings by Department, New Hire, and Performance Review. All reports in RUN can be exported to Microsoft Excel for further customization, and those subscribing to one of the more robust RUN plans will also have access to various HR forms and documents, as well as an employee handbook wizard.

RUN for Partners offers easy integration with numerous ADP add-on modules including ADP Time and Attendance, which includes complete clock-in and clock-out capability. RUN also integrates with third-party time and attendance applications including TSheets, Homebase, Deputy, and ClockShark. The application also includes a general ledger interface option that allows users to easily export journal entries from RUN directly into numerous third-party accounting applications including QuickBooks, Xero, and Wave. In addition, those using other applications can create a generic output file for export to any application. RUN also integrates with employee benefits options, benefits administration, point of sale, and recruiting and onboarding applications. The application also includes an employee self-service option, where employees can access payroll and benefits information including up to three years of paystubs, W-2s, and insurance and benefit data.

RUN for Partners include a variety of HR resources including ADP Employee Access, New Hire Onboarding, and Employment Verification, also offering Enhanced HR Help Desk Support, Background checks, and HR training and toolkits.

RUN for Partners users can easily access help options from any data entry screen. Toll-free supported is offered to all product users, with support available during extended business hours with email support offered as well. All user resources are password protected, with access available only to authorized users. Those using Accountant Connect will have access to a separate help desk.

2020 Rating – 5 Stars

Strengths:

- Offers four different plans

- Offers a plan specifically for accountants

- Includes ADP Marketing Toolkit and Accountant Connect

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits

![run-powered-by-adp[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/10/run_powered_by_adp_1_.5f738d9873a93.png)