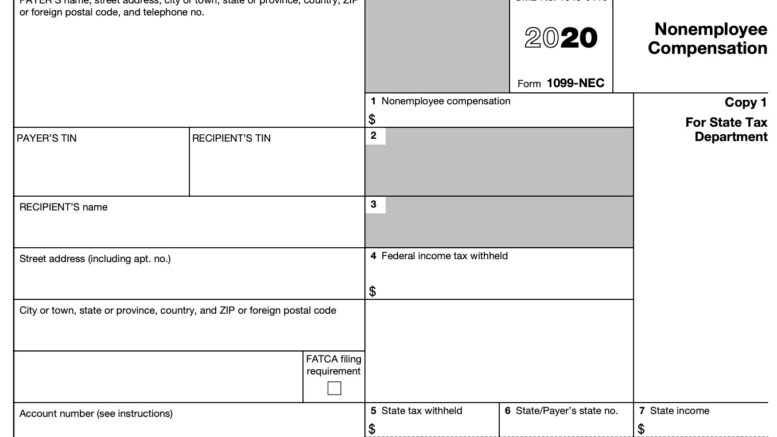

WageFiling, LLC has alerted its clients to an important change in the way nonemployee compensation is reported for 2020. The new Form 1099-NEC will be used to report all payments made to nonemployee service providers, while Form 1099-MISC will narrow in scope, retaining its focus on royalties, health care payments, and other business-related payments not made directly to an individual.

For years, businesses used Form 1099-MISC to report calendar-year payments exceeding $600 to individuals who performed business services. These include vendors, independent contractors, freelancers, and consultants. Payments to those service providers are now reported on Form 1099-NEC. The other traditional uses of the 1099-MISC are still in effect. When filing electronically, the deadline is January 31 for Form 1099-NEC and March 31 for Form 1099-MISC.

“The new form presents a few new wrinkles for businesses, but a little planning can go a long way at filing time,” says WageFiling co-founder Scott Zubrickas. “Form 1099-NEC effectively pulls out some of the information we used to report in Box 7 of the 1099-MISC, and bumps up the deadline for that information. Companies can make things easier by requesting new W-9s from their service providers. Fresh W-9s are a good way to avoid incorrect filings, and the process of requesting them gives companies a chance to identify who needs a 1099-NEC.”

The new form resolves some administrative issues that arose from the PATH Act signed into law in 2015. It is based on an existing form that hadn’t been used since 1982—right around the time WageFiling co-founder Bob Miner began writing software to help his clients file 1099-MISCs quickly and easily. Nearly 40 years later, WageFiling is one of few Authorized e-file Providers to be rated a Quality Supplier by the IRS, and the only one to have earned that rating for 25 straight years.

“When filing requirements change, businesses can spend a lot of time and energy making sure that they remain compliant,” notes Zubrickas. “We speed things up by automating the filing process—even converting old MISC data into the NEC format—but also by talking with our clients and confirming that their filings are in order. It’s great to be able to prepare and file a 1099 for less than a cup of coffee. But the peace of mind that comes from working with a long-time partner of the IRS can be even more valuable.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs