Taxify by Sovos

Sovos

From the 2020 reviews of sales tax compliance systems.

Taxify by Sovos is an online sales tax management platform designed for eCommerce businesses and other online sellers though the product can also be used by brick and mortar retailers as well. A good fit for small to mid-sized retailers, Taxify offers four plans, with users able to scale up to the next plan if they outgrow their current plan.

Designed to work behind the scenes, Taxify offers real time tax rates for more than 14,000 state and local tax jurisdictions as transactions are processed, eliminating the need for time-consuming data entry. The application also includes niche features such as guides for Amazon sellers, as well as detailed information on how Amazon sellers can easily comply with sales tax requirements for each state.

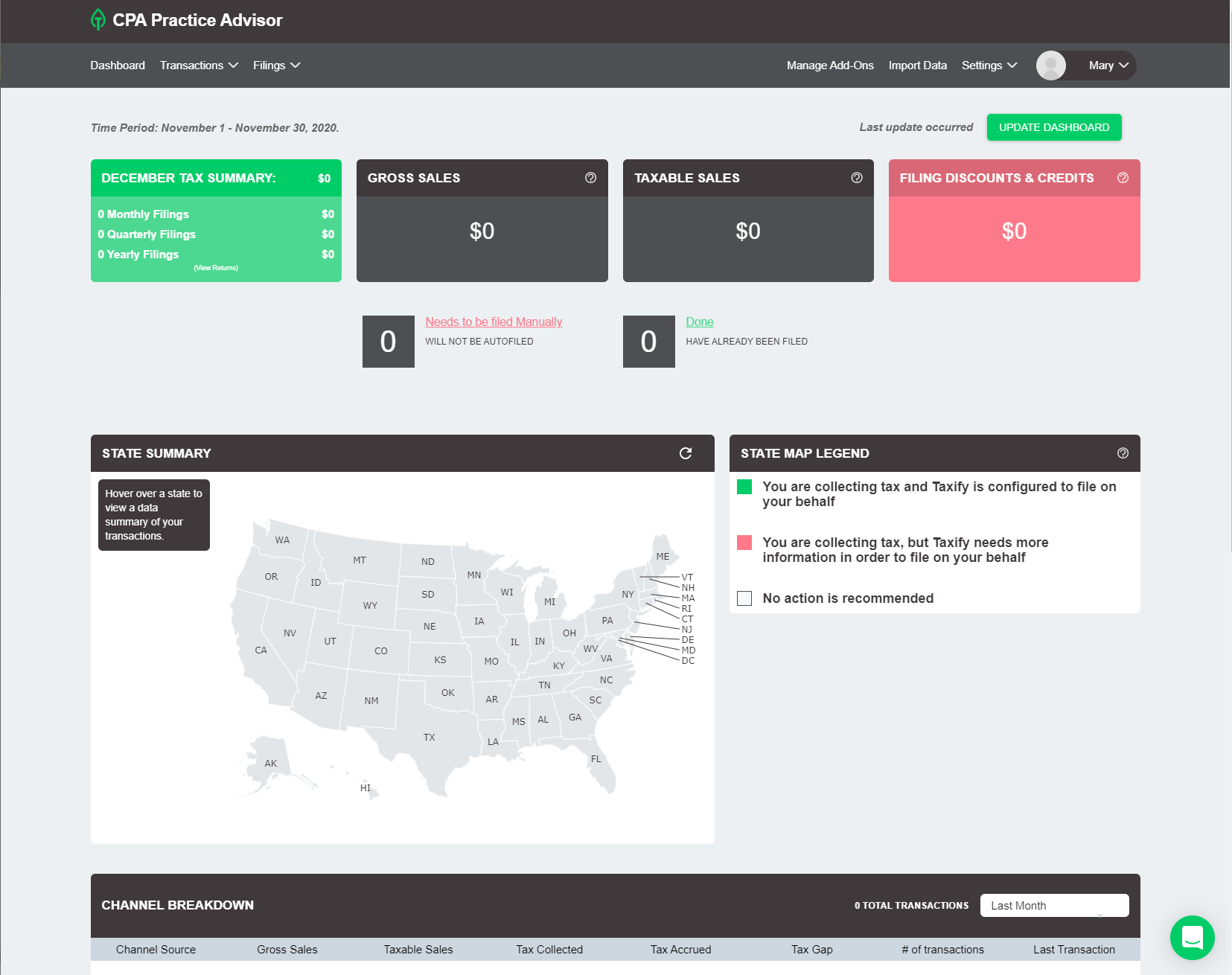

The Taxify dashboard offers an easily navigated user interface where users can enter and access all transactions. In addition, the dashboard offers a complete tax summary for each tax period, gross sales for the same time frame as well as taxable sales for the period. In addition, all filing discounts and credits are displayed on the dashboard, and an interactive map allows users to hover over a particular state to view a summary of all sales transactions.

Taxify’s dashboard also includes a channel breakdown, which lists all channel sources, along with information such as gross sales, taxable sales, tax collected, tax accrued, any tax gap, the total number of transactions, along with the last transaction completed. There is also a monthly tax summary available that lists all filings due and the estimated amount of tax due for each filing.

Click for larger image: The dashboard in Taxify provides users with a summary of all transactions and monthly sales calculations.

Designed to work behind the scenes, Taxify integrates with numerous third-party applications including QuickBooks, Xero, SAP, Oracle, and NetSuite as well as retail and online platforms such as eBay, Amazon, Magento, PayPal and Square. Users can also import transactions directly from these or other applications directly into Taxify if necessary.

In addition, Taxify includes AutoFile, which is designed to file sales tax returns for retailers in every state and local jurisdiction. Taxify does this by pulling in all sales transactions from multiple sources in order to calculate sales tax properly. Once the transactions have been processed, and jurisdictions identified, Taxify will complete all the necessary tax forms and file them electronically with the appropriate tax jurisdiction, with payment remitted as well.

In order to have payment remitted automatically, users will need to complete bank and check information in order to use AutoFile, which will automatically pay any amount due directly from the bank account that is specified.

Because AutoFile accesses the unique requirements of all states that require sales tax returns, the processed returns are accurately calculated, filed, and payment remitted on time. Though AutoFile is an automated process, users do have the option to modify any return prior to the filing process being completed.

Taxify is designed to collect the appropriate sales tax in all 50 states with access to all sales tax rates in real time. The rate calculation also takes product categories and exemptions into consideration when calculating rates, so users will never pay tax on an item that falls under a tax exemption. Taxify can also handle differing tax rates in a single jurisdiction, along with shipping and handling rules for each state. And because rates are determined in real time, the application also helps to ensure that sales tax is not charged during specified periods such as a tax holiday.

Taxify includes good reporting options, with users able to access all historical data, including transaction processing and sales tax remitted. In addition, the application also includes complete audit trail capability, with users able to view system access, as well as any changes or updates made.

Taxify support is available via phone, email, and by online request, with access to support available directly from the application. The product also offers a variety of resources for retailers, including state-by-state regulations, state Nexus updates, an Amazon sales guide, and access to a variety of events and webinars.

Taxify by Sovos is a solid sales tax application that is ideal for those selling online, though it also works for brick and mortar retailers as well. Taxify offers four plans, the Starter, which handles up to 1,000 transactions monthly, and runs $47/month; the Standard plan, which handles up to 5,000 monthly transactions and runs $97/month; the Premium, which can handle up to 20,000 transactions monthly, and runs $247/month, and an Enterprise version designed to handle more than 20,000, with pricing available from Taxify. There is also a $27 per state or local return charge assessed in each plan.

Strengths:

- Good integration options

- Real time tax rates

- Product offers scalability with 4 plans available

Potential Limitations:

- Per-return filing cost can elevate pricing

2020 Overall Rating: 4.75 Stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Michael Blackburn August 1 2025 at 5:33 pm

In the last few weeks support from Taxify has been almost non-existent. When I called support to ask why a filing had not been completed and to let them know that the due date had just passed, I was placed on hold and I waited for 24 minutes as I listened to a repeated message: "It seems to be very busy at the moment, if you would like to open a ticket....". There was never any indication of where I was in the queue. I finally hung up in exasperation. I had already sent in several emails asking for some kind of response, other than the very first one that said that "... the case was in current review....." We have used the service for more than 10 years and support has been very responsive until late. We are actively seeking alternative services.