For years, it’s been the same process. You or your client hires someone to perform contract work, for which they’re paid. At the end of the year, these contractors receive a 1099-MISC to report the money that they earned.

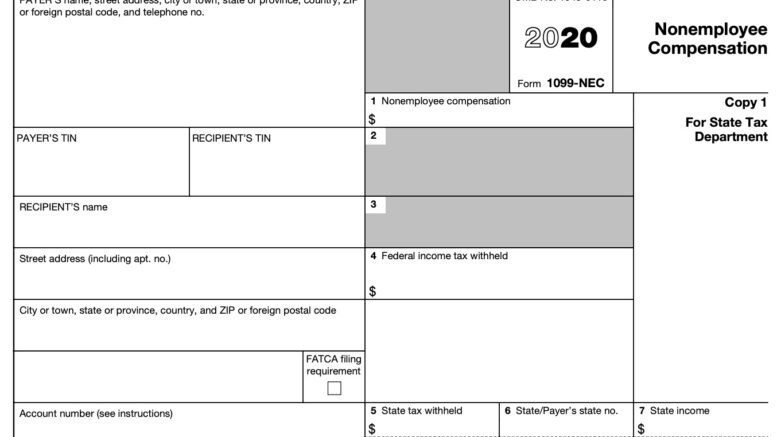

But 2020 will be different. While you’ll still be sending 1099s, it won’t be 1099-MISC, but 1099-NEC, which stands for Non-Employee Compensation. While 1099-MISC will still be used, it will no longer be used to report the earnings of contract employees.

With the effects of COVID-19 wreaking havoc with businesses worldwide, more employees, laid off due to the pandemic are working as independent contractors in order to earn money, which means even more 1099s to be processed.

Of course, compliance isn’t only about the new form, or mailing it out in time. Good 1099 compliance should always begin when a contractor is hired, not at year end, when forms are due to be mailed out. In fact, a contractor should not be paid until an EIN or social security number is on file, along with a valid mailing address.

Non-compliance can have costly repercussions, including penalties and late fees assessed due to filing forms late or not filing forms at all, which is why so many clients have turned to their accountants to file their 1099 forms for them.

Of course, 1099s aren’t the only year-end form that is required. Whether you or your clients employ a single employee or thousands, if you have an employee, you need to process W-2s. In most cases, W-2s are processed by a payroll service, but if you handle payroll in-house, you’re responsible for getting these forms out to your employees as well as filing them at year end. And like, 1099s, there are fees that grow to be astronomical depending on how late you are in filing those reports.

Luckily, there’s W-2/1099 software available. While most of these programs do the same thing; process and file W-2s and 1099s, some of the features and functions can vary. If you’re not sure if W-2/1099 software is a good choice for you, or if you’re interested, but not sure where to start, this issue of CPA Practice Advisor can help.

We reviewed 11 W-2/1099 software applications, most of which are stand-alone applications designed to work with numerous software applications and operating platforms.

Most companies that offer W-2/1099 software applications are updated in the fall for use at the beginning of the following year. With the new 1099-NEC form, that update may occur even sooner. In all likelihood, these applications are available for the 2020 tax year right now.

A combination of on-premise and online products is included in the reviews. Products reviewed include:

- AccountantsWorld – After-the-Fact Payroll

- American Riviera Software – Magtax

- AMS – W-2 and 1099 Forms Filer

- CCH – Payroll Compliance Reporting

- EG Systems Inc. – W-2/1099 Filer

- Greatland-Yearli

- Real Business Solutions – W2 Mate

- Spokane Computer – MAG-Filer

- Tenenz – Eagle View Filing

- Tenenz – Laser Link

- Track 1099

Whether it’s COVID-19 or another unexpected circumstance, contract and freelance employees are only likely to increase in the coming years. Make sure you’re prepared.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs