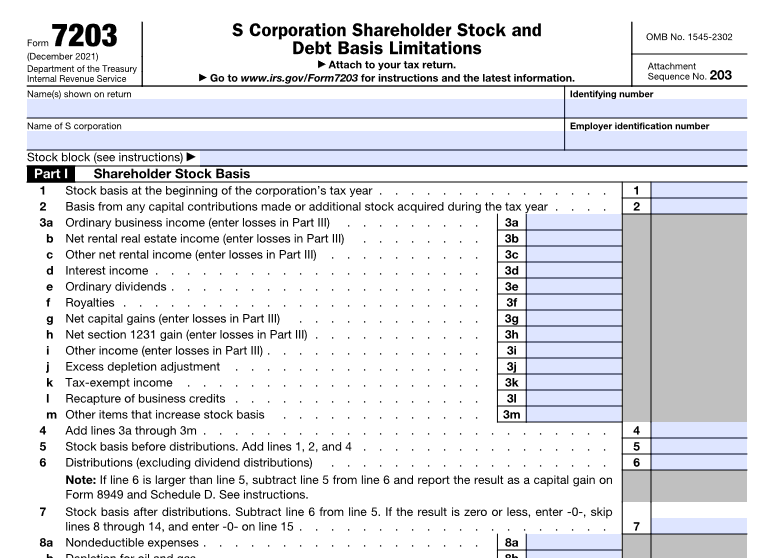

Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. Download form.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs