Interest rates are once again near zero, leaving companies that hedged their variable rate exposures in higher interest rate environments with significant derivative liabilities and large, near-term cash payments needed to settle these derivative liabilities. All this comes while many companies are looking to minimize near-term cash spend in the current environment. This has left some to consider a “blend and extend” strategy, which results in reducing near-term cash spend to settle derivatives while simultaneously extending the duration of their hedge coverage.

Blend & Extend Strategy Explained

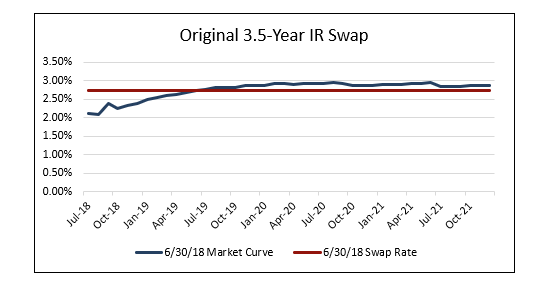

When companies are exposed to variability in forecasted cash flows related to changes in interest rates, they often turn to financial markets to hedge this exposure and “lock in”, or eliminate, variability in their forecasted cash flows. For example, let’s assume a company has $500 million of variable rate debt with monthly interest payments tied to the one-month London Inter-Bank Offered Rate (LIBOR) interest rate. The company desires to hedge its variable rate exposure for the next three and one-half years. On June 30, 2018, the company executes an interest rate swap with its bank where at each monthly reset calculation period it pays a fixed rate of 2.75

(Click for larger image.)

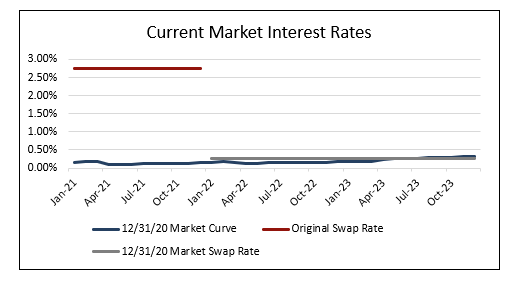

Fast forward to 2020 where LIBOR interest rates have experienced a steep drop, resulting largely from the COVID-19 pandemic. Due to the lower market interest rates, the original swap described above is now in a significant liability position. Further, the company is required to make significant monthly cash payments to the bank based on the difference between the fixed rate of 2.75

(Click for larger image.)

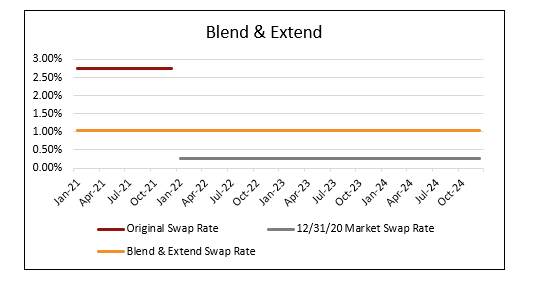

If the company desires to hedge its variable interest rate exposure for a longer duration, it could layer on a forward starting two-year interest rate swap with a fixed rate of about 0.25

(Click for larger image.)

It’s important to note that the fair value of the original swap and the new “blend and extend” swap will be the same, or similar (after transaction costs), both before and after. The fixed rate of the new blend and extend swap is set to a rate that results in the fair value of the new blend and extend swap being equal to the fair value of the original swap, with additional adjustments for transaction costs.

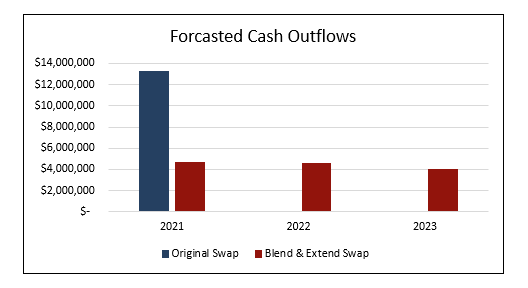

Additionally, the expected cash payments over the extended term are expected to be like the original swap, based on current market rates. The difference is the expected timing of these cash flows. At the date of the blend and extend transaction, the following are the forecasted cash outflows of the original and new blend and extend swap.

(Click for larger image.)

As indicated above, the blend and extend transaction is expected to reduce cash outflows for the current year and spread these amounts over the extended period, all while extending the duration of the hedge coverage.

Hedge Accounting Considerations

The obvious benefit of the blend and extend strategy is delaying large cash settlement payments at a time when cash may be needed the most; however, there are other considerations. From a commercial standpoint, companies need to be aware of the transaction costs embedded in the blend and extend strategy and assess whether this strategy is the best alternative. Additionally, a company should also be aware of hedge accounting implications. Below are some key hedge accounting considerations as it relates to the blend and extend strategy.

New Hedge Relationship

If the company was applying hedge accounting on the original swap, the hedge relationship will not survive the blend and extend transaction. This is viewed as a termination of the original swap and an execution of a new swap. Hedge accounting on the original swap would be discontinued prospectively. To continue the benefits of hedge accounting, the company would then designate the new blend and extend swap in a new hedge relationship.

Designation Of Original Hedge Relationship

As noted above, ASC 815 requires hedge accounting to be discontinued prospectively when the hedging instrument is terminated. This will result in the company going through a valuation exercise to determine the fair value as of the termination date to determine the cumulative loss that has been deferred in accumulated other comprehensive income (AOCI). If the forecasted transaction is still expected to occur, these amounts will remain “frozen” in AOCI and reclassified into earnings over the original swap term.

Designation Of New Hedge Relationship

The new hedge relationship is further complicated due to the blend and extend swap being “off-market”. This is commonly referred to as a “non-zero fair value designation”. If the company wanted to terminate its original swap and enter a new at-market swap paying any cash, it could’ve borrowed funds equal to the value of the original swap, terminated the original swap using these funds, and entered a new at-market swap. Rather, the value of the original swap was rolled into the blend and extend swap and is viewed as an embedded financing component. This embedded financing component is a source of ineffectiveness and needs to be considered when assessing whether the hedge relationship is highly effective, thus meeting the requirements to apply hedge accounting.

The hedge accounting nuances described above may seem complicated; however, they’re standard operating procedures for experienced hedge accounting advisors. As such, it’s important to discuss these transactions sooner rather than later with the company’s hedge accounting advisors and auditors.

===============

Matt Smith is a Director in Opportune LLP’s Financial Instruments Group. Matt assists companies with their accounting for complex financial instruments under both U.S. GAAP and IFRS. With 15 years of client service experience at Opportune and EY, Matt has gained extensive knowledge and expertise in derivative valuation and hedge accounting, stock-based compensation, debt and equity financing activities, embedded derivative assessments, Dodd-Frank compliance, and SEC reporting. Matt has an undergraduate degree in accounting from Oral Roberts University. He’s also a member of the American Institute of Certified Public Accountants.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Benefits