Now that the American Rescue Plan Act (ARPA) has provided a wide range of tax breaks to individual taxpayers, some of them retroactively, tax practitioners are being inundated by questions from clients. Case in point: Should a taxpayer file an amended return if they have already filed a 2020 return with the IRS?

Of course, there may be extenuating circumstances, but the short answer, in a word. Is “no.” The IRS is strongly urging taxpayers to not file amended returns related to the new provisions in ARPA or take other unnecessary steps at this time.

ARPA is designed to provide relief to beleaguered taxpayers coping with the effects of the COVID-19 pandemic. Some of the key tax-related provisions included in the new law are as follows:

- A third round of economic stimulus payments. This one is $1,400 per qualified taxpayer, including dependents, subject to a phase-out based on adjusted gross income (AGI).

- An extension of weekly unemployment benefits of $300 through September 6, 2021. Plus, the first $10,200 of unemployment benefits received in 2020 is exempted from tax for a family with an AGI under $150,000.

- Enhancements to the Child Tax Credit (CTC) for 2021, including an increase in the maximum CTC to $3,000 ($3,600 for a child under age six), making the credit fully refundable and authorizing advance payments beginning in July.

- A 100% subsidy allowing ex-employees to continue health insurance coverage through September 30, 2021, without any resulting tax liability. Employers may recover the costs through a tax credit.

- An expansion of the premium tax credit for health insurance premiums as allowed under the Affordable Care Act (ACA). The new law includes various provisions taking effect in 2020 through 2022.

The IRS has promised that it soon will provide additional guidance on ARPA changes that could affect 2020 returns of taxpayers. For the time being, it has already offered insights into the tax exemption for the first $10,200 of unemployment benefits received in 2020. Notably, for taxpayers that haven’t filed their 2020 returns yet, the IRS says it will provide a worksheet for paper filers and will work with software industry to update current tax software to determine how to report unemployment income on 2020 tax returns.

For those who received unemployment benefits last year and have already filed their 2020 tax returns, the IRS has emphasized that they should not file an amended return at this time, until it issues additional guidance.

Other issues, such as the methodology for handling the advance payments of the CTC, will also be addressed.

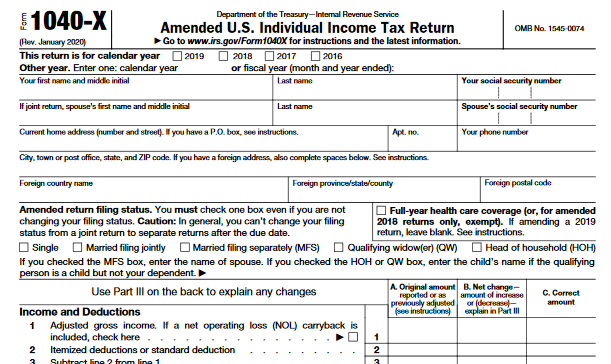

Final thoughts: Filing an amended 2020 return may result in unwanted complications. This is clearly a time when it pays to “wait and see” what happens next. We will keep you posted.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Benefits, Income Taxes, Taxes