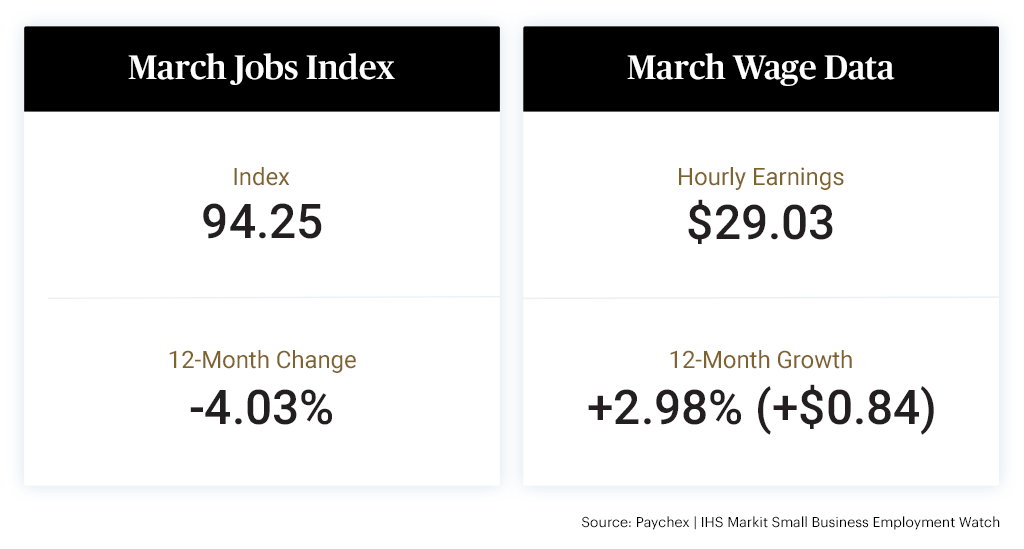

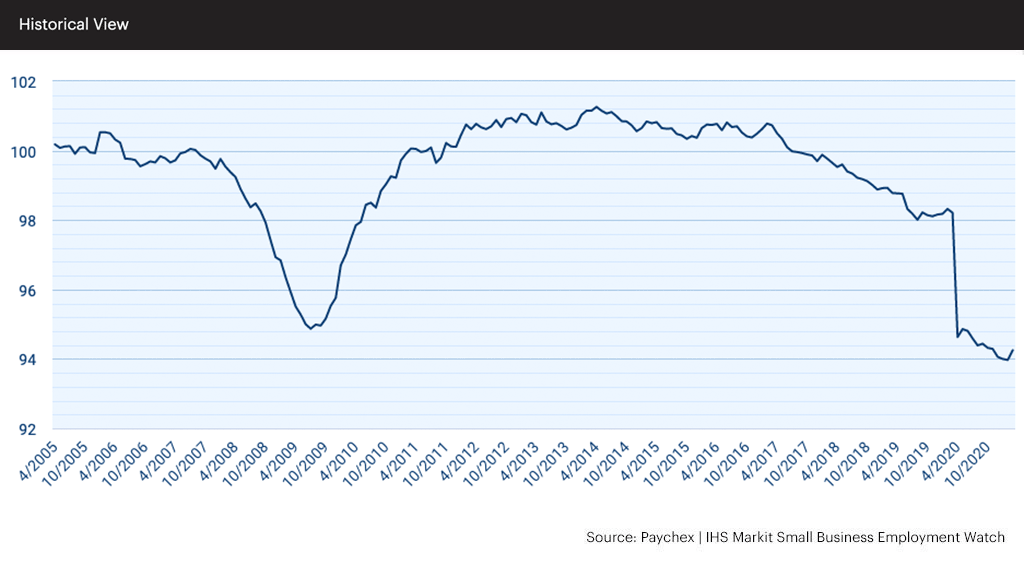

The latest Paychex | IHS Markit Small Business Employment Watch shows notable increases in jobs growth in March across all four U.S. regions and nearly all states and metros analyzed in the report. The Small Business Jobs Index increased to 94.25 in March. While the index remains 4.03 percent below its March 2020 level, last month’s 0.30 percent increase has been the most significant one-month gain since 2013.

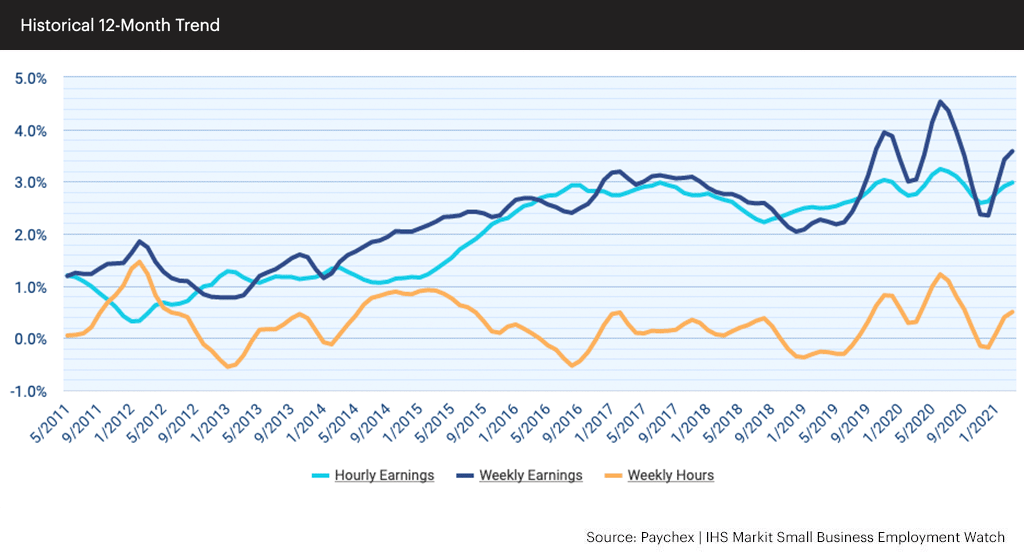

Another leading indicator of economic strength, hourly earnings, reached 2.98 percent, its fourth month of growth. Weekly earnings also increased, rising to 3.58 percent, a result of growth in weekly hours worked.

“The Small Business Jobs Index revealed a meaningful increase in March. But there remains much ground to make up,” said James Diffley, chief regional economist at IHS Markit.

“With vaccinations ramping up across the country and business restrictions easing as a result, small business employment growth is starting to move in a positive direction. Increased hiring and wage growth in the leisure and hospitality industry, which was particularly impacted over the past year, are promising signs,” said Martin Mucci, Paychex president and CEO. “The extension of the Paycheck Protection Program for two more months provides additional support as the loans should help qualifying businesses weather remaining challenges resulting from the COVID-19 pandemic.”

The monthly report is compiled from aggregated payroll data of approximately 350,000 clients on the Paychex human capital management (HCM) suite. Paychex software and solutions reach 1 in 12 American private-sector employees, making the Small Business Jobs Index report an industry benchmark. The national jobs index uses a 12-month same-store methodology to gauge small business employment trends on a national, regional, state, metro, and industry basis.

In further detail, the March report showed:

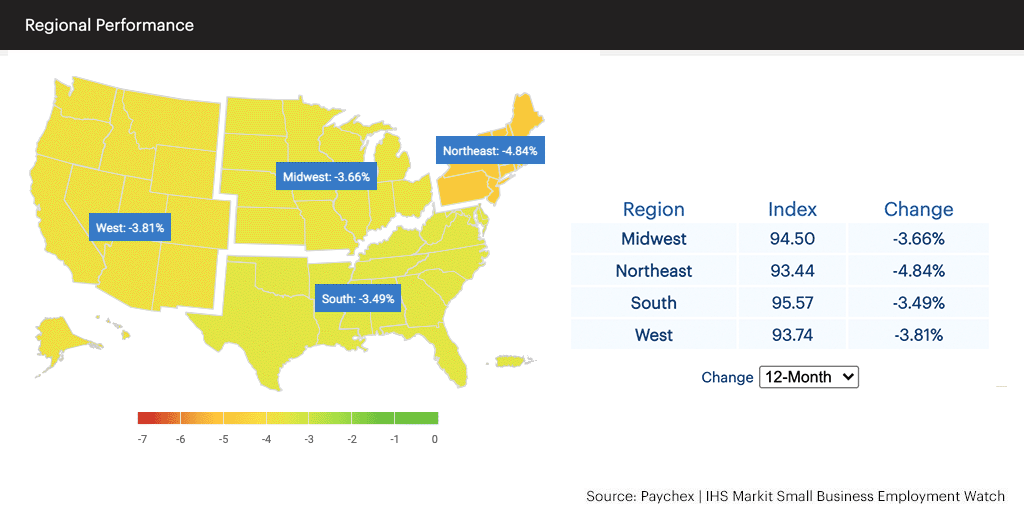

- Jobs growth improved in all four U.S. regions in March, as well as in 18 of the 20 states, and 16 of the 20 metros analyzed.

- The South continues to lead all regions in small business job growth.

- Florida remains the top state for job growth.

- Leisure and hospitality saw the greatest improvement among industry sectors, up 1.00 percent.

- Leisure and hospitality also saw a significant gain in hourly earnings growth.

The complete results for March, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at www.paychex.com/watch. Highlights are available below.

Note: Data presented for the month of March was collected between February 12, 2021 and March 18, 2021.

March 2021 Paychex | IHS Markit Small Business Employment Watch

National Jobs Index

- The national index gained 0.30 percent in March, its first significant positive increase in a year.

- The national index remains 4.03 percent below a year ago.

- The 0.30 percent increase in March represents the largest one-month gain in nearly eight years.

National Wage Report

- Hourly earnings growth (2.98 percent) and weekly earnings growth (3.58 percent) accelerated for the fourth consecutive month.

- One-month and three-month weekly earnings growth are both above five percent, stemming from recent minimum wage increases and gains in weekly hours worked.

Regional Jobs Index

- All four regions improved in March, with the largest gains in the Northeast, up 0.36 percent.

- The South continues as the leading region for small business job growth.

- The Midwest ranks second and is more than a point lower than the South at 94.50.

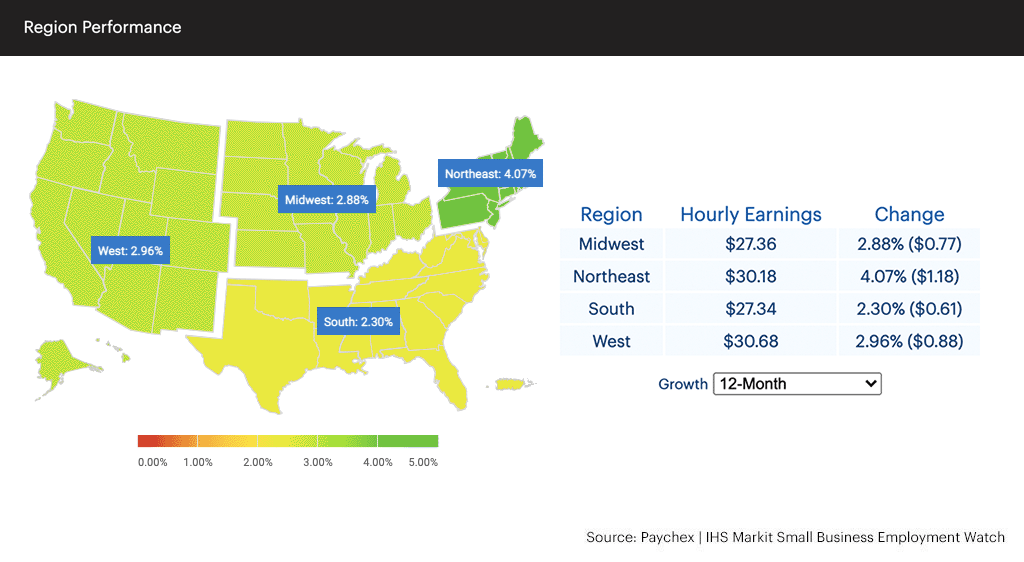

Regional Wage Report

- The Northeast leads regions in hourly earnings growth at 4.07 percent. All other regions are below three percent.

- The South is the only region with negative weekly hours worked growth, which pulled weekly earnings growth down to 2.02 percent.

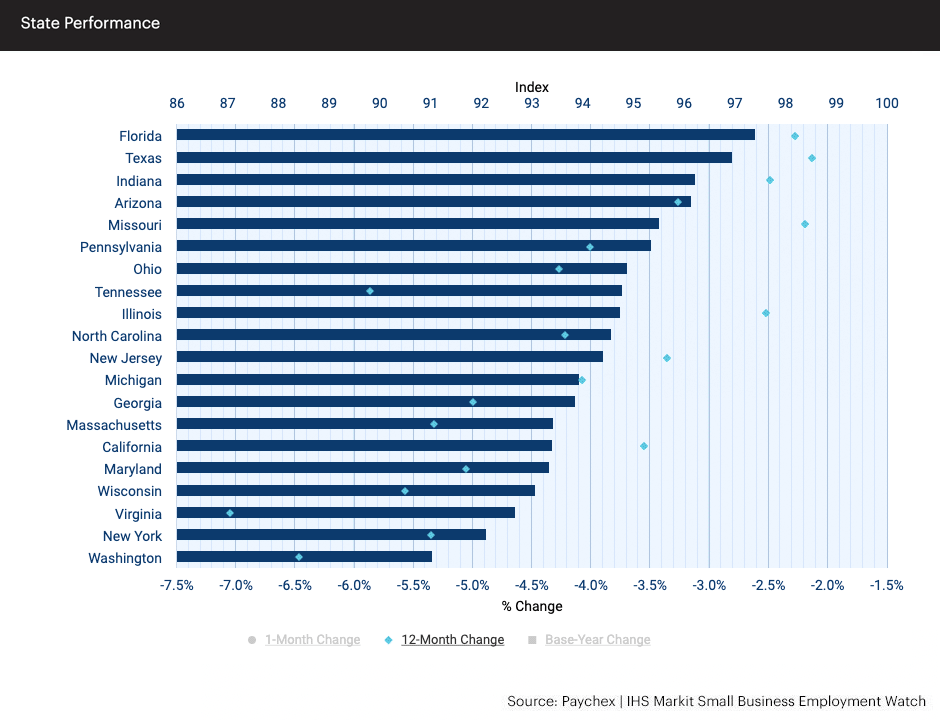

State Jobs Index

- 18 of the 20 states analyzed increased in March. Tennessee and Maryland were the only states to decrease.

- Florida leads all states in small business employment growth, with an index of 97.42 and up 0.47 percent in March.

- Washington lags all states in small business employment growth. At 91.04, it’s more than one point below the next lowest state index, New York at 92.12.

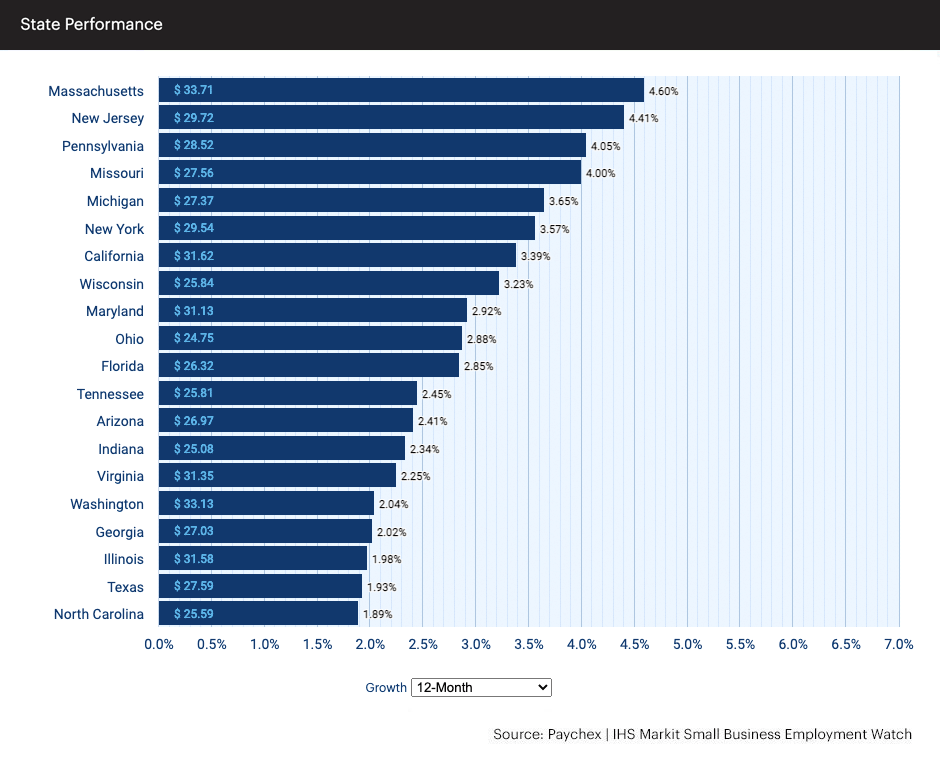

State Wage Report

- Hourly earnings growth continues to be led by Northeastern states, including Massachusetts, New Jersey, and Pennsylvania, all above four percent.

- North Carolina, Texas, and Illinois are the only states with hourly earnings growth below two percent.

- Washington and Massachusetts both have weekly hours worked growth above one percent.

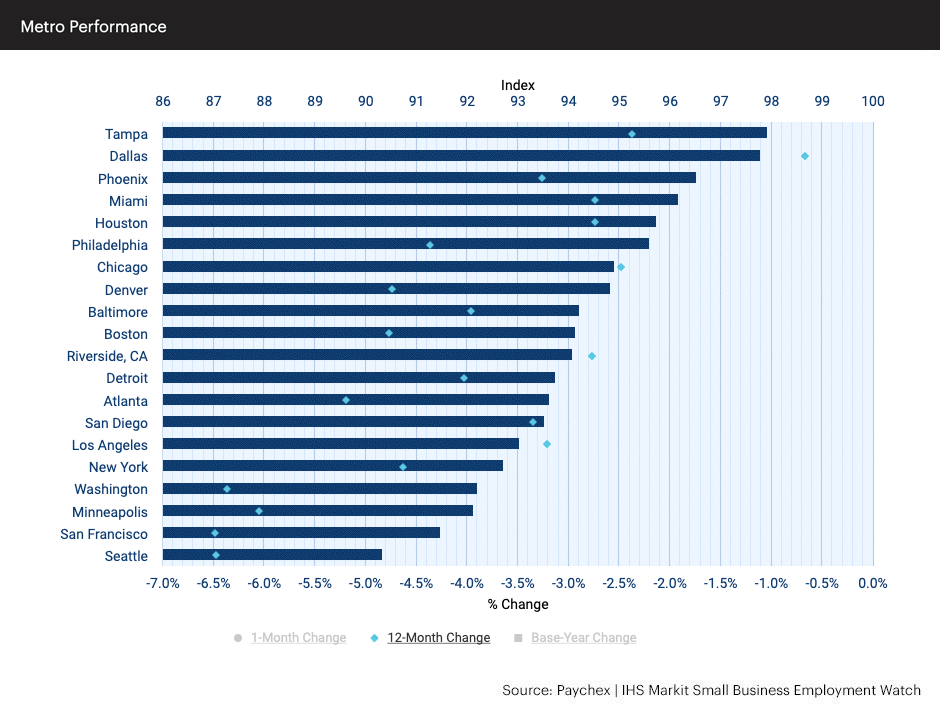

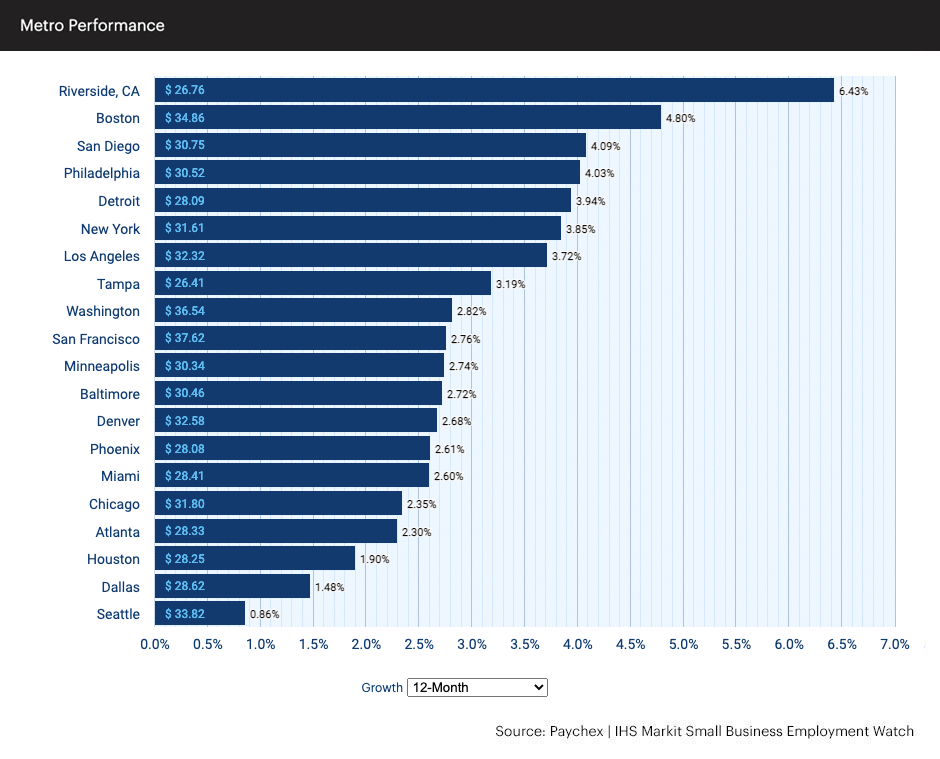

Metropolitan Jobs Index

- Tampa remains the leading metro at 97.92. Dallas jumped to a close second, 97.79.

- Seattle and San Francisco have the weakest metro indexes. Both are down the most year-over-year among metros.

Metropolitan Wage Report

- Riverside, CA ranks first among metros in hourly earnings growth (6.43 percent) and weekly earnings growth (8.07 percent). It ranks fifth in weekly hours worked growth (0.85 percent).

- In Houston, weekly hours worked are down 2.00 percent, a potential result of the historic winter storm. One-month and three-month growth rates are down more than four percent.

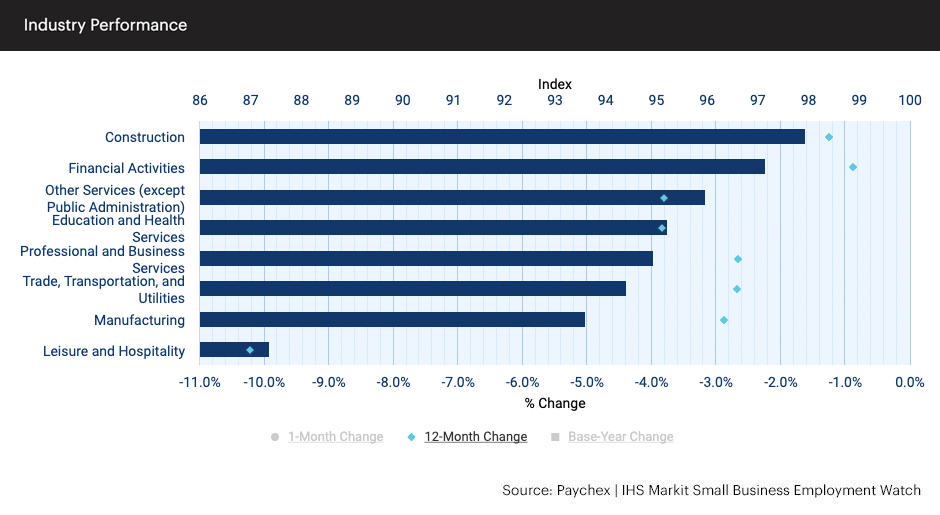

Industry Jobs Index

- Leisure and hospitality saw the greatest improvement among sectors, up 1.00 percent. However, it remains well below other sectors at 87.38.

- Construction continues to lead all industry sectors in small business job growth. At 97.95, it is down just 1.25 percent from last year.

- Financial activities was the only industry sector to decrease in March, though it remains second among sectors with an index above 97.

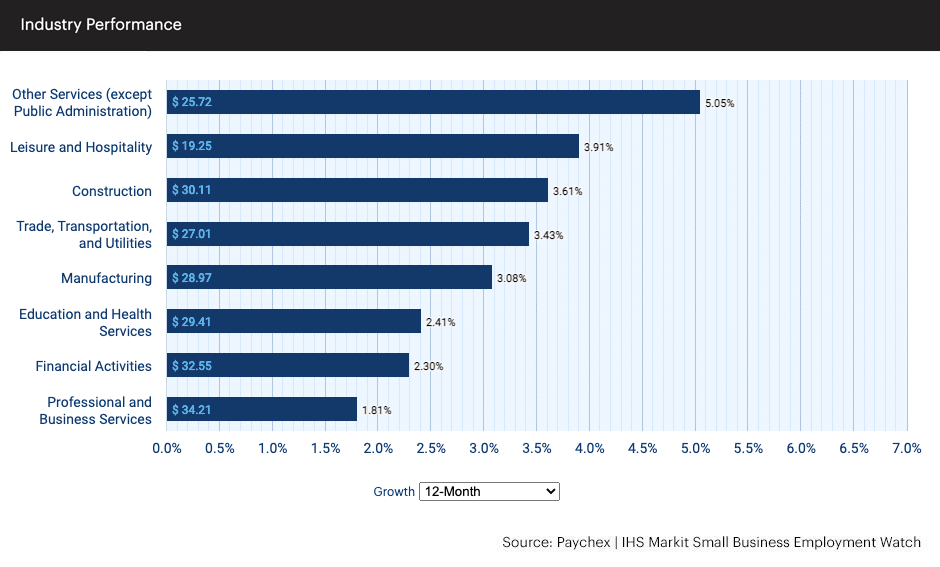

Industry Wage Report

- Leisure and hospitality saw a near a full percentage point gain in hourly earnings growth in March, increasing to 3.91 percent. One-month annualized growth spiked to 13.79 percent.

- Professional and business services has the highest earnings, yet its growth rate is lowest among sectors.

Note: Analysis is provided for seven major industry sectors.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs