At the end of July 2021, the accounting profession took a big step towards post-COVID normalcy with the return of the AICPA ENGAGE conference to Las Vegas. The program allowed for face-to-face mingling of 1,700 on-premise attendees along with close to 150 exhibitors, which had been sorely lacking in the past year and a half of self-isolation (virtual online attendance added another 2,300 participants according to the AICPA).

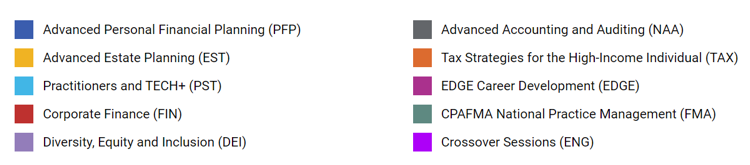

The annual ENGAGE event is a conglomeration of multiple AICPA disciplines and areas of emphasis (graphic below) and this year also incorporated the CPA Firm Management Association’s National Practice Management conference which emphasized internal CPA firm management and productivity.

While there were close to 200 sessions to choose from, as a consultant focused on internal CPA firm process optimization and information technology, my area of emphasis targeted the Practitioners, TECH+, and Firm Management Association tracks. Below I share key insights and information gleaned from the various sessions I attended:

Technology Update: While technological complexity continued to increase for accountants, the adoption of collaboration tools and cloud services were amongst the most significant IT trends along with of course-security. “Home users were the security vector attack point” according to Randy Johnson of NMGI who presented the annual TECH+ Update session. Firms need to make security a priority and begin with ensuring their remote users are as protected at home as in the firm. Session recommendations and specific takeaways:

- Expect consolidation of application vendors into fewer suites creating more information “silos” that will be connected by cloud vendors such as Right Networks specializing in digital plumbing.

- Firms need to become aware of digital plumbing tools to connect silos of data with products such as Zapier, MS Power Automate, CData and the QuickBooks Marketplace.

- Windows 11 will change the user experience starting at the end of this year, including providing native support for Android applications, extending MS365 usage to smartphones even more effectively.

- AMD Ryzen chips are significantly outperforming Intel chips at a lower cost, so Randy suggests accountants consider them for new computer purchases.

- Minimum RAM for new computers should be 32GB, particularly if on CCH Axcess platform and having regularly having 4-5 tabs open.

- Firms can expect to easily pay $100/month per user for individual productivity applications in the future including Microsoft 365 (E5 licensing) and Adobe DC, so firms should begin budgeting for that.

Gadgets/Tools: David Cieslak, aka Inspector Gadget, presented business hardware and applications that firms should consider with an emphasis on firms building for the future in the cloud versus on-premise. Some of the Gadget highlights from his session and the TECH+ Update that are worth perusing:

- ViewSonic TD1655 mobile monitor is new entry into marketplace and may be competing with the ever-popular ASUS MB19B+ and Zen mobile displays.

- Meeting Owl 360 speaker/video phone as an alternative collaboration tool for hybrid team meetings.

- Fujitsu scanners including the ScanSnap iX 1600 which is 33% than their previous iX 1500 and the ultracompact fi-800R for mobile use (which includes TWAIN linking capability) for remote work.

- Fujitsu also release the fi-7300nx which is networkable/WiFi 60ppm scanner and which Randy stated “may be an alternative device to your duplicator.”

- David stated that the rollout of the three flavors of 5G has been “really lumpy, bumpy” in actual delivery and new WiFi solutions are actually faster within US market.

- WiFi 6 is the next version (802.11ax) and worth upgrade for new WP3 security, but then of course they announce WiFi 6E to make us wait for the next version!

Professional Retrospective: The CPA profession had an incredible impact on the rebound of businesses post COVID, particularly on small business. “It has been an awesome time to be an accountant” according to Bill Pirolli-Chairman AICPA: “the unusual environment caused us to say: “I don’t know” to our clients more than ever, which pushed us towards being more advisory in our practices.”

This points to the opportunity to continue providing advisory services and formally launching advisory focused services if you have not already done so, which was another very strong theme amongst the sessions selected. Bill also touted the positive impacts of remote work which they seamlessly transitioned to by having the right technology in place.

“COVID moved us from a two-office firm to a 100-office firm overnight!” – Bill Pirolli, Partner DiSanto Priest & Company.

Audit Evolution: Acceptance of the remote audit seems inevitable as firms experienced the benefits of not having to travel (unless absolutely necessary- i.e. inventory observation) and peer reviewers became comfortable with alternate procedures. However, there was significant discussion on incorporating the next generation of AI (artificial intelligence) tools in that auditors needed to understand what the applications were “actually doing “and to validate they were working.

It was also important that firms proactively eliminate “redundant” processes that are being superseded by the AI tools and to address client confidentiality issues around using third-party cloud applications. One resounding recommendation from all the assurance-focused sessions attended and vendors I spoke with was that the KEY to AI tool success was getting good data, meaning the entire data set/GL, and that it warranted specific training of our clients.

Another corresponding theme in audit success and CAAS (client accounting and advisory services) success that came up in multiple sessions was that data visualization tools would be necessary to help us explain complex business information to clients and that Microsoft Power BI was viewed as the most likely firm solution.

Data Visualization: Throughout multiple sessions, the importance of data visual was often repeated and one specific session was devoted to explaining why Microsoft Power BI was the next evolution beyond Excel. Key reasons mentioned were that Power BI had superior graphing and reporting capabilities, was better integrated as a collaborative solution (Professional version), more secure, and could handle HUGE files, well beyond the limitations of Excel.

One speaker also referred to Gartner’s Magic Quadrant stating that Power BI has jumped ahead of industry leaders Tableau and Qlik because of Microsoft’s ongoing innovation and integration with the Microsoft 365 platform in the cloud.

CAAS (Client Accounting and Advisory) Explodes: One of the strongest recurring themes throughout the conference was how COVID pushed firms into advisory services and the importance of taking advantage of building an information platform or “Tech Stack” in the cloud. CAAS was being touted as the future of the profession since information technology was already disintermediating traditional accounting services.

In addition to becoming fluent in using the data visualization tools mentioned above, firms will need to connect multiple “silos” of business information utilizing tools such as Zapier mentioned previously. Accountants will need to understand how to use these tools along with APIs (application program interfaces), ML (machine learning) and eventually RPA (robotic process automation) as an integral component of learning to be more advisory in nature.

“If you are not part of the innovation discussion with your clients today, you are NOT part of the discussion” – Shawn Kanungo, Partner Queen & Rook.

Tax Tech Whispers: While tax was not my primary focus this year, products that were recommended for evaluation by the tax participants were Corvee Tax Planning compared to traditional vendor products. Another product called Ledgible Crypto Tax is helping firms automate gains calculations and reporting for clients selling their digital currencies. It was also suggested that firms make a priority of explaining the IRS backlog to clients and they will all have to deal with an ongoing stream of overlapping tax notices in the year ahead.

Overall, while COVID continued to cast a cautionary shadow, it was great to get back into the saddle and into an in-person collaborative environment. Without a doubt, the AICPA ENGAGE conference provided an abundance of different tracks, sessions and networking opportunities to tailor towards any attendee’s desire to learn and improve their practice.

========

Roman H. Kepczyk, CPA.CITP, CGMA is Director of Firm Technology Strategy for Right Networks and partners exclusively with accounting firms on production automation, application optimization and practice transformation. He has been consistently listed as one of INSIDE Public Accounting’s Most Recommended Consultants, Accounting Today’s Top 100 Most Influential People, and CPA Practice Advisor’s Top Thought Leaders.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs