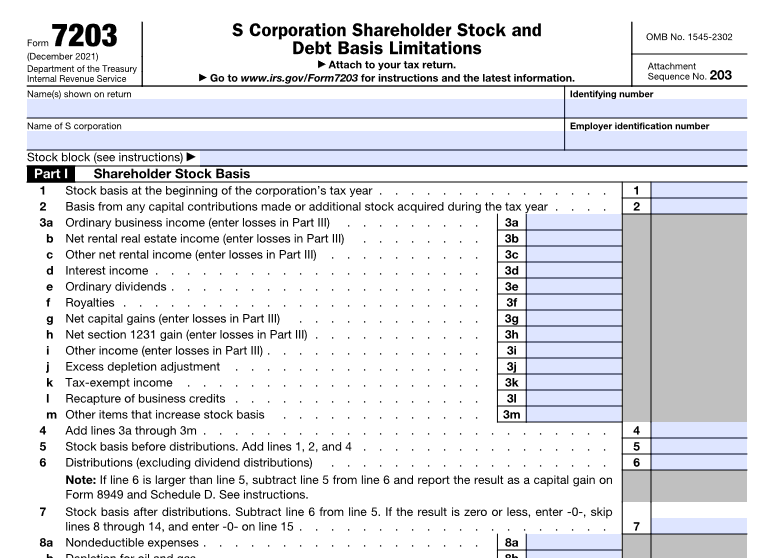

S corporation shareholders use Form 7203 to figure the potential limitations of their share of the S corporation’s deductions, credits, and other items that can be deducted on their individual returns.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs