The IRS has begun mailing out CP14 notices to millions of taxpayers who have a balance of $5 or more in unpaid taxes, kindly reminding them that the federal government would like its money.

“The IRS in not too active collecting immediately after tax season. After all, they have a lot to do. But come the end of June, into July, expect the IRS to start contacting you about any unpaid tax, or any questions they might have about matching information returns with tax returns,” Steven Leahy, a Chicago-area tax attorney, wrote last week on LinkedIn. “IRS Form CP14 is the first in a series of letters the IRS will send you if there is an unpaid balance for the last tax year. When asked, ‘What is the notice about?’ the IRS answers, ‘We sent you this notice because you owe money on unpaid taxes.’ If you receive IRS Notice CP14—read it carefully. The notice will tell you how much the IRS says you owe, when the IRS expects you to pay, and what to do if you disagree.”

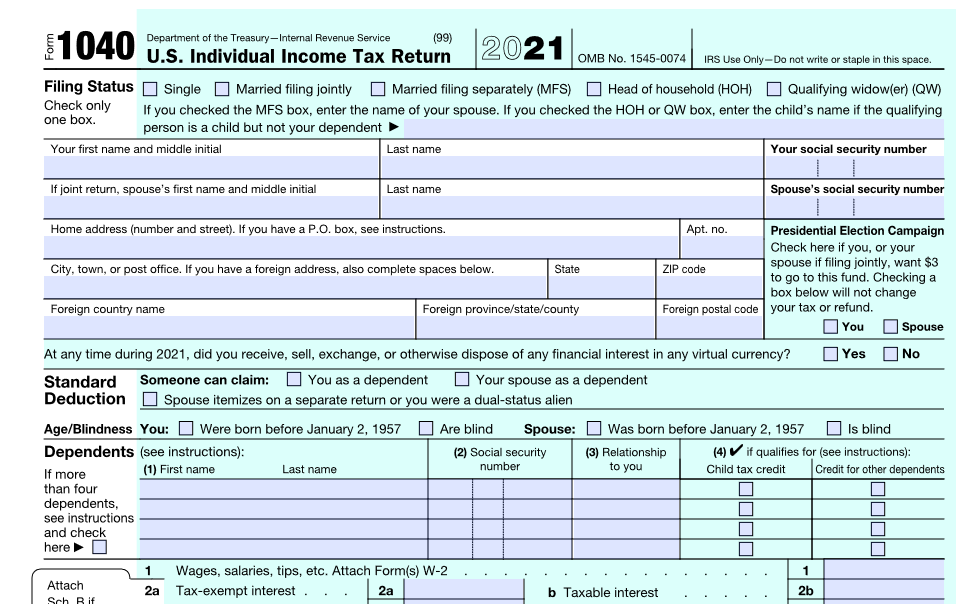

The CP14, which is required by law to be issued within 60 days after the IRS assesses a tax liability, is the most common IRS notice sent to taxpayers, according to the Taxpayer Advocate Service, and requests payment within 21 days. The reason why taxpayers have a balance due can be related to a number of issues, such as failing to report some income or failing to pay a balance in full, Tiffany Gonzalez, CPA, CEO of Miami-based accounting firm Accounting to Scale, stated last week on LinkedIn.

“It’s always a scary feeling receiving a letter or notice from the IRS in the mail, but these shouldn’t go unnoticed and ignored,” said Mark Steber, chief tax information officer at Jackson Hewitt, in a press release. He added that if a taxpayer does not pay what is owed by the due date in the CP14 notice, interest will accrue and penalties will be assessed back to the due date of the tax return.

The IRS’s failure-to-pay penalty is 0.5 percent for each month or part of a month that the tax balance goes unpaid, up to a maximum of 25 percent of the remaining amount due. If the taxpayer does not pay the amount due within 60 days, the IRS will not be so kind—it can proceed with collection activity, including by levy or via the filing of a Notice of Federal Tax Lean.

The IRS could send taxpayers a series of reminder notices, known as the collection notice stream, to ask for payment before enforced collection starts.

“Just because you get a notice does not mean that you necessarily owe the additional amounts due shown by the IRS. A CP14 means that the IRS shows a balance due on a tax return,” Steven Weil, EA, president of Fort Lauderdale, Fla.-based firm RMS Accounting, wrote this past weekend on LinkedIn. “This could be due to a number of things, including missing payments or credits. Check the notice to see if it accounts for all the payment shown on your return. If for some reason a payment is missing, or was mis-posted by the IRS, you will need to provide proof of payment and a timely response to the IRS.”

Taxpayers who disagree with the notice should call the IRS at the toll-free number on the top right corner of their CP14 notice, the Taxpayer Advocate Service said. Those who object should have their paperwork—such as canceled checks and amended return—ready when they call.

Taxpayers who do not object to the balance due on their CP14 but cannot pay the amount have some options, according to Steber and Jackson Hewitt:

Get an extension to pay in full: For taxpayers who need a little more time than what is included on their CP14 notice, they can work with the IRS to get an extension-to-pay agreement. The IRS allows a free extension to pay balance due up to 180 days. The IRS calls this a short-term payment agreement.

Enter into a payment plan with the IRS: This is the No. 1 option for most taxpayers and is the most common option for those who receive a CP14 notice. There is a fee to enter into a payment plan that varies based on financial status and monthly payment method.

Other options for those in financial hardship: For taxpayers who cannot afford to pay in full immediately, with an extension, or from a payment plan, there are other options to consider, including temporary not collectible status or a tax settlement called an Offer in Compromise.

The CP14 notice was not among the dozen or so IRS notices the agency said in February that it would stop sending to taxpayers.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs