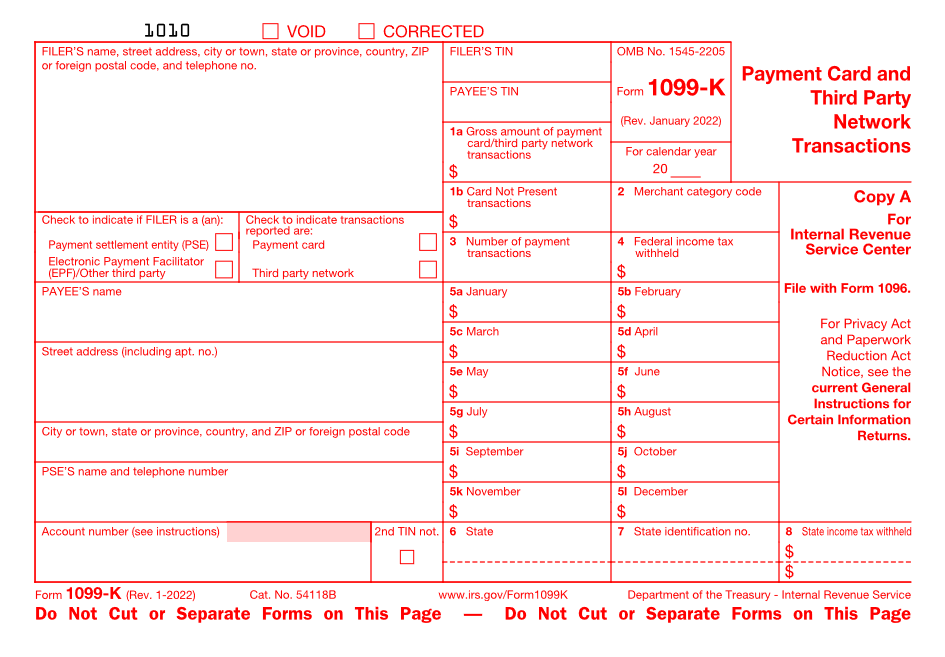

It used to be that receiving a Form 1099-K was relatively rare. The form, technically known as Form 1099-K Payment Card and Third-Party Network Transactions was used to report payments received from various third-party resources. Prior to 2022, the monetary threshold to receive a 1099-K was $20,000, with 200 sales-related transactions required. Both requirements had to be fulfilled in order to receive a 1099-K.

But thanks to a bill tucked inside the American Rescue Plan Act that was passed in 2021, anyone who sells more than $600 in merchandise with any number of transactions, even a single one, will be receiving the newly revised Form 1099-K.

If you’re a small business owner and receive the majority of customer payments from credit cards, cash, or checks, you’ll likely be unaffected. But if you use third party settlement organizations to get paid, the rules have changed. In 2022, companies such as Zelle, PayPal, Square, Stripe, Venmo, and others will be sending you a 1099-K if you receive more than $600 in payments during the year. Both Uber and Lyft are also considered third-party settlement organizations or use an organization to pay their workers, so if you had a few gigs with either, you’ll be receiving a 1099-K as well.

The American Rescue Plan Act does specify that reporting requirements are limited to goods and services only, so if will not affect any funds you may receive from friends and family, so you can transfer money to your kids without them having to pay taxes on it. Unfortunately, there is no really good way to differentiate between the two at this time, which may result in transactions being erroneously reported on Form 1099-K (and to the IRS) that should not be.

The end result of this change is that individuals who have sold small amounts of merchandise on eBay, Etsy, and other selling platforms to make ends meet may suddenly find themselves on the hook for increased taxes. From an accountant’s standpoint, this means that more small business clients will be including a 1099-K with their year-end documentation. Another downside to this new reporting is that Form 1099-K does not include credits, discounts, fees, or returns in its total reported, leaving it up to the individual to expense those items separately. This also means that more individual tax filers may find themselves required to file a Schedule C to report additional income.

Not everyone is onboard with these changes. Organizations such as eBay are currently lobbying Congress to increase the threshold back to the original $20,000, though it’s unlikely to happen, since this change is part of the government’s way to pay for the American Rescue Plan Act. However, there is a bill in Congress right now that would raise the threshold from $600 to $5,000, but it’s unclear as to whether the bill, if passed, would impact the 2022 tax year.

Whatever the outcome, both small business merchants, new gig workers, and accountants alike should be prepared for an influx of Form 1099-K in 2023.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Taxes