The movement towards more technology investment for accountants is driven first and foremost by the need for efficiency, streamlined workflows and added value to their business, according to the latest Annual Accountants Survey: Top Challenges & Tech Wishlist from accounting technology provider, LeaseQuery.

LeaseQuery’s Annual Accountants Survey: Top Challenges & Tech Wishlist polled 237 accounting professionals across public, private, nonprofit and government organizations on their technology maturity, wishlist and areas for growth. When asked about top priorities, improved accuracy and compliance was the top choice of accountants surveyed, followed by lower costs and faster delivery. It’s no coincidence that technology is built to improve all of these pain points.

“Automation has become the accountant’s best friend,” says Sarah O’Sullivan, Director of Product Accounting at LeaseQuery. “Accountants are facing mounting pressure to deliver more accurate results in less time, and they are increasingly turning to technology to help scale their work. This, in turn, drives high expectations for ROI for this technology.”

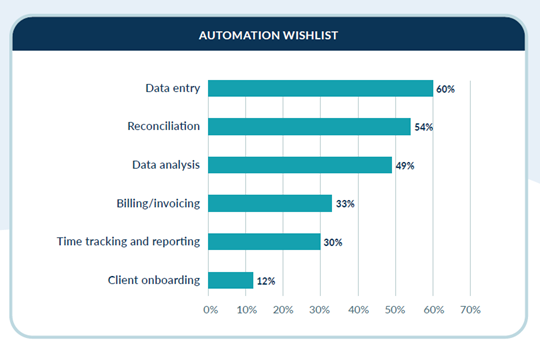

Job Functions in Need of Automation

Accountants have a long automation wishlist, with data entry, reconciliation and analysis at the top. Automation eliminates the need for manual tasks, from data entry to time tracking, enabling accountants to devote more time to higher-value work. As accountants’ roles become more analytical, automation is a critical strategy to meeting those needs. While fewer than a majority of the responding accountants included billing and time tracking on their automation wishlist, 80% indicated that they currently use technology to support expenses and accounts payable, and 77% noted they already use technology for billing and accounts receivable tasks.

While fewer than a majority of the responding accountants included billing and time tracking on their automation wishlist, 80% indicated that they currently use technology to support expenses and accounts payable, and 77% noted they already use technology for billing and accounts receivable tasks.

“The maturity of accounting technology is clearly progressing,” said Jennifer Booth, VP of Accounting, “however, massive opportunities to gain efficiencies remain. For instance, one of the first measures of technology maturity is cloud adoption, and only 38% are fully transferred to working in the cloud at this point.”

With Great Tech Power Comes Great Cybersecurity Responsibility

Cybersecurity risks are escalating as organizations have access to a plethora of data and cyber hackers become more sophisticated. Accountants are rightfully investing more resources and attention to battle emerging and persistent cybersecurity threats. LeaseQuery’s survey shows that the accounting industry continues to take security seriously, with 40% saying they plan to invest more in cybersecurity protections in the year ahead.

The cloud is generally regarded as the safest option for data storage, which ties back to the need for accountants – both from industry-specific organizations and accounting firms – to migrate their data, which is the first critical step in the digital transformation journey.

For more on today’s accounting technology investments and challenges, read the full report: Annual Accountants Survey: Top Challenges & Tech Wishlist.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management