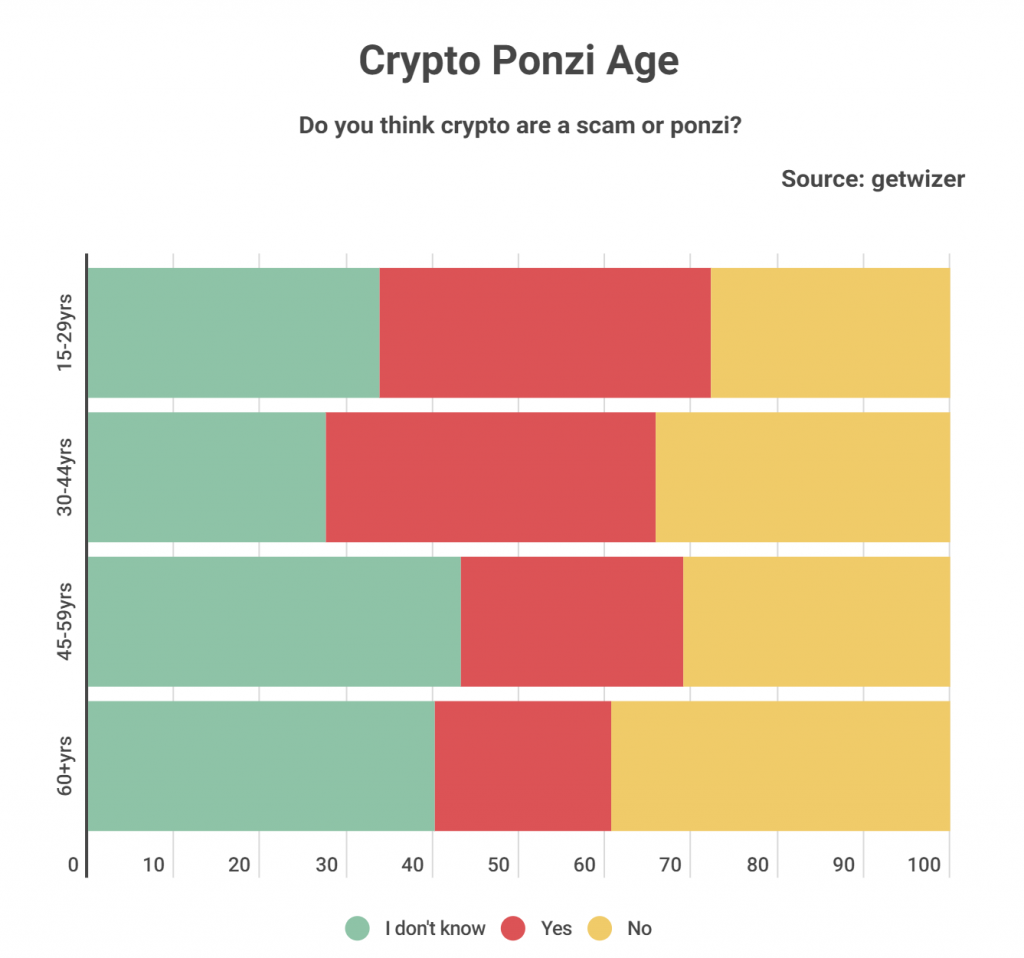

According to a survey from BanklessTimes.com, a third of the U.S. population believes digital assets are Ponzi schemes.

Ponzi schemes usually involve someone promising high returns on investment but using money from new investors to pay off old investors. Many people think cryptocurrencies are Ponzi schemes because they also promise high returns on investment.

“A Ponzi scheme is only sustainable as long as enough new investors are coming in to keep the scheme going,” BanklessTimes CEO Jonathan Merry said. “When that stops, the whole thing collapses. Bitcoin is not a Ponzi scheme because it does not rely on new investors to keep it going. Instead, Bitcoin relies on its own technology and network effects to maintain its value.”

BanklessTimes points out that while cryptocurrencies do have some similarities to Ponzi schemes, there are a couple key differences:

- Both promise high returns, but while a Ponzi scheme is not sustainable, cryptocurrencies are built to last.

- Cryptocurrencies are decentralized and not controlled by any person or organization. This makes them much more resistant to collapse than Ponzi schemes, which rely on new investors to keep them going.

And unlike Ponzi schemes, cryptocurrencies are transparent, and their code is open source. This allows anyone to audit their code and verify that they are not being manipulated, BanklessTimes noted. Cryptocurrencies also have a large and growing community of developers and users who can help keep them secure and improve their functionality over time.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Digital Currency