A combination of low minimum wages and a rapidly increasing cost of living have made passive income a more attractive proposition than ever before.

What is passive income?

Passive income is considered income that is not attached to a particular wage or salary. The IRS describes passive income as ‘income that requires minimal effort to obtain,’ and considers two types of income passive:

- Rental income

- Business activity where one does not materially participate.

Not included in the IRS list is side hustles. Side hustles can range from renting out storage space to publishing an eBook, with a lot of other options in between.

Unlike the IRS-defined passive income, side hustles typically require more effort. For example, selling goods online requires more effort than income generated from simply investing in a store and collecting a check each month.

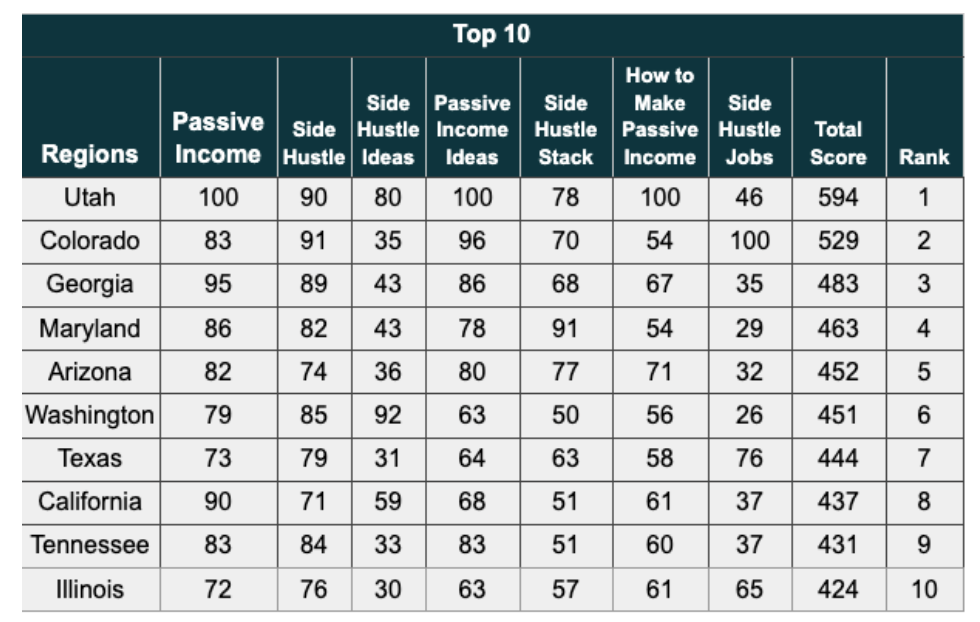

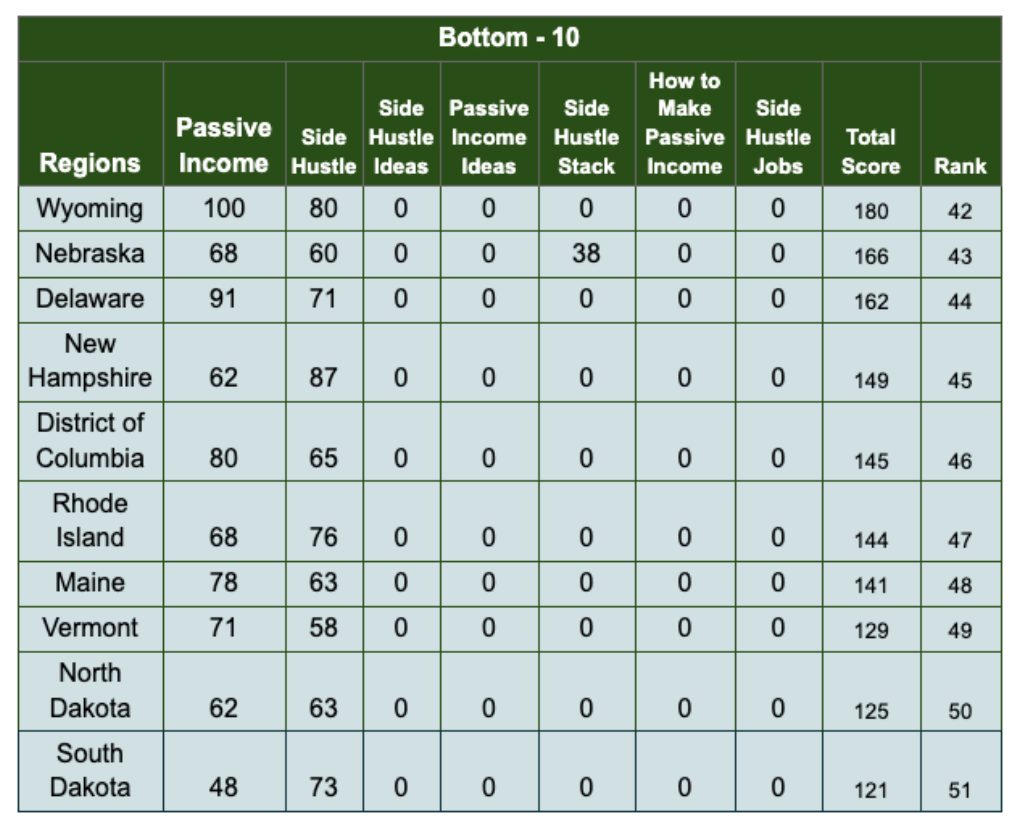

According to a study completed by https://nichesites.com/, some states are much more interested in side hustles than others. While in some cases, the results can be explained away by the prevailing minimum wage in that state, in other cases cost of living may play a more important role when determining the popularity of side hustles in that state.

The study used Google Trends to calculate state rankings for the year, with the report looking at the number of people searching for the following:

- Passive income

- Side hustles

- Side hustle ideas

- Side hustle stacks

- How to make passive income

- Side hustle jobs

For example, first place Utah has a minimum wage of $7.25 in 2023, which may explain their ranking for searching for passive income and side hustles. However, 5th ranked Washington State has a minimum wage of $15.74, while 7th ranked California’s minimum wage is just below Washington’s at $15.50. Clearly minimum wage has less to do with looking for passive income than the high cost of living in both of those states.

According to a spokesperson for NicheSites, “Gen Z and millennials are more focused on pursuing their passions and enjoying life, and they find the idea of a 9 to 5 job to be mundane and repulsive. That is why we notice that these generations always seek smarter earning sources. They find the idea of side hustles and passive incomes so attractive because it provides them with a stable cash flow and allows them to pursue their passions and focus on things that matter to them.”

What do the results mean?

Based on the survey results, it’s clear that Americans are interested in ways to up their income through passive income sources. It’s more difficult to determine exactly why. Much of this may be attributed to the COVID-19 pandemic when laid-off workers had to find alternative means to support themselves and their families.

But it may also be a shift in how Americans prefer to work. Having a side hustle or several side hustles provides workers with a sense of freedom, of controlling their destiny that a traditional 9 to 5 job may not. And with rising inflation, the cost of housing hitting record highs, and many employers, especially in the tech industry, laying off thousands of workers, having several passive income streams can mean the difference between continuing to pay your bills or filing for bankruptcy.

In other cases, people may be seeking a better work-life balance. It’s no coincidence that 60% of workers said that they would rather quit their job than return to the office five days a week. This isn’t due to laziness, but the fact that working from home has offered workers a better work-life balance, eliminating things like commute times, while offering flexibility and more time with their family, or to pursue other interests.

Why does this information matter?

According to Zippia, a popular employee recruitment site, 45% of Americans have a side hustle in 2023. But what should be alarming to businesses already struggling to find employees is that 73% of workers with a side hustle are actively thinking about quitting their job.

The way people work is changing. How far it will shift remains to be seen. But smart employers will understand this and adopt measures that keep employees happier.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, Payroll