By Andrew Antos, Co-founder and CEO of Klarity.

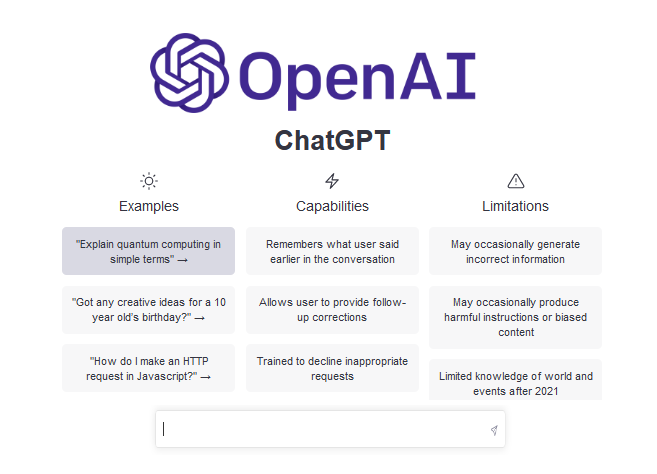

If you’ve been following recent news in even the most cursory fashion there’s a good chance you’ve heard about ChatGPT, the Large Language Model (LLM) technology that’s primed to revolutionize business operations. It’s an innovation that holds such disruptive promise that it has already begun to impact long-standing industries and left more than a few big incumbents spinning. But what is ChatGPT exactly? And most importantly for accountants, how can it help us do our jobs more efficiently and effectively?

What is ChatGPT?

ChatGPT and other LLM’s similar to it rely on a neural network that is trained on mass amounts of data to create probabilistic models. ChatGPT is able to leverage this neural network to create human-like responses to user queries. For an overview of LLMs, we asked ChatGPT itself:

Query: “Tell me how large language models work in four sentences or less.”

Response: “Large language models are based on deep learning neural networks trained on vast amounts of text data. They use this training data to learn patterns and relationships between words, allowing them to generate human-like text. When given a prompt, the model predicts the most likely continuation of the text based on the patterns it has learned. The quality of the generated text depends on the size and quality of the training data and the complexity of the neural network.”

So how can an LLM like ChatGPT help create functionality and automation within an accounting environment?

Using ChatGPT to automate accounting processes

There are multiple areas in which ChatGPT can help automate your accounting processes and make your team more efficient.

ChatGPT provides users with the ability to write prompts within the interface that can generate custom technical accounting memos. For example, implementing a new standard or structure, like a different revenue model, requires accountants to draft and distribute technical accounting memos. Instead, ChatGPT can generate them for you, in your preferred format.

We asked ChatGPT to “Think like a CPA. Write a technical accounting memo for ASC 606 based on consumption based pricing. Memo should focus on treatment of variable consideration.”

It automatically produced the following text and format:

Query: “Think like a CPA. Write a technical accounting memo for ASC 606 based on consumption based pricing. Memo should focus on treatment of variable consideration.”

Response: “To: [Client]

From: [Your Name], CPA

Subject: Accounting Treatment for Consumption-Based Pricing under ASC 606

Date: [Date]

I am writing to provide guidance on the accounting treatment for consumption-based pricing under ASC 606, specifically related to variable consideration.

Background:

ASC 606, Revenue from Contracts with Customers, outlines the accounting principles for recognizing revenue from contracts with customers. The standard requires companies to recognize revenue when control of the promised goods or services is transferred to the customer in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. Variable consideration refers to any element of a contract that is subject to uncertainty, such as discounts, rebates, performance bonuses, and penalties. Companies must estimate variable consideration when determining the transaction price and recognize revenue accordingly.”

ChatGPT can also help provide guidance and training to record journal entries in compliance with GAAP standards. For example, we asked ChatGPT “Create a GAAP journal entry to record deferred revenue of $1M on the balance sheet with an example journal entry for recording the revenue monthly over a 2 year period.” and it generated this draft within seconds:

Query: “Create a GAAP journal entry to record deferred revenue of $1M on the balance sheet with an example journal entry for recording the revenue monthly over a 2 year period.”

Response: “GAAP (Generally Accepted Accounting Principles) requires companies to recognize revenue when it is earned, even if it is not yet received in cash. In the case of deferred revenue, a company receives payment for goods or services that it has not yet delivered. Therefore, the company must defer the revenue recognition until it delivers the goods or services.

To record deferred revenue of $1M on the balance sheet, the following journal entry would be made:

Debit: Cash $1,000,000

Credit: Deferred Revenue $1,000,000

This journal entry recognizes the cash received as a debit to cash and the corresponding liability as a credit to deferred revenue.

Assuming that the company will recognize the deferred revenue over a 2-year period, the company would make the following journal entry each month to recognize revenue as it is earned:

Debit: Deferred Revenue $41,667

Credit: Revenue $41,667”

ChatGPT can help create excel formulas that can be used in different accounting scenarios. In the example below we asked ChatGPT to “Create an excel formula to calculate the depreciation on year 1 for an asset placed into service on June 30th, 2023 with a 10 year useful life and a depreciable base of $100,000.” and it provided both the logic and answer to the question which can be copied into excel.

Query: “Create an excel formula to calculate the depreciation on year 1 for an asset placed into service on June 30th, 2023 with a 10 year useful life and a depreciable base of $100,000.”

Response: “To calculate the depreciation on year 1 for an asset placed into service on June 30th, 2023, with a 10-year useful life and a depreciable base of $100,000, you can use the following formula in Excel:

=ROUND(((Cost of Asset / Useful Life) * (Months in Service / 12)), 2)

Where:

Cost of Asset = $100,000 (the depreciable base)

Useful Life = 10 (the number of years the asset will be used)

Months in Service = 6 (the number of months the asset was in service during the first year)

Note that the ROUND function is used to round the result to two decimal places, as depreciation is typically reported in dollars and cents.

Using the above formula, the depreciation on year 1 for this asset would be:

=ROUND(((100000/10) * (6/12)), 2)

= $5,000.00

Therefore, the depreciation on year 1 for this asset would be $5,000.00.”

Driving better outcomes for your organization

ChatGPT holds tremendous potential value for accounting professionals open to change. Large language models can assist accounting teams by automating repetitive tasks, accurately predicting outcomes based on mass amounts of data and even identifying non-standard terms within their documents. Though we are just beginning to unlock the multitude of use cases for this technology, LLMs have the potential to be the most impactful technology ever created for accountants – even more than Excel.

For accountants, the promise technologies like ChatGPT offer should generate genuine excitement and immediate relief. For example, with specialized solutions, you can automatically extract data using GPT-4 from an Order Form and validate them against data in your CRM/ERP environment, including matching that would normally require human reasoning (e.g. IBM and International Business Machines are the same entity). Another feature enabled by GPT-4 is the ability to “chat” with your document and search across multiple documents for non-standard pieces of language or other key data points.

Automating the processes that should be and expanding the scope of what can be automated gives accounting teams more time to focus on strategic, higher order tasks that truly impact the business while improving the working lives of their employees.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs