Of the 46 initial public offerings (IPOs) that were completed in the U.S. during the first quarter of 2023, Marcum audited seven of them—the most of any audit firm, according to a new analysis from Audit Analytics.

Overall, there was an increase in both the number of IPOs and the proceeds raised in Q1 compared to Q4 2022. However, the 46 IPOs is lower than the 85 completed in Q1 2022 and significantly smaller than the 407 in the first quarter of 2021, the analysis revealed.

In addition, Q1 2023 saw a substantial decrease in the total amount raised compared to offerings completed in the first quarter in each of the last five years. Compared to Q1 2022, total proceeds dropped 72%, continuing the IPO malaise that has occurred since the surge of companies that went public in 2020 and 2021.

During the first quarter of this year, 35 traditional IPOs were completed, raising $2.3 billion, while 11 special purpose acquisition company (SPAC) IPOs raised total proceeds of $797 million, according to Audit Analytics, which noted that this is more activity than what was seen in Q4 2022.

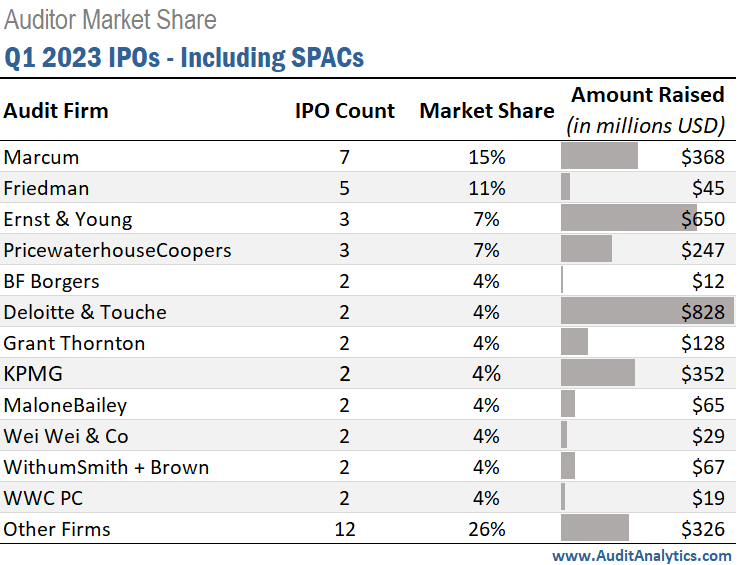

The 46 IPOs in Q1 were audited by 25 different audit firms, and 12 each audited more than one IPO client in the quarter. Marcum led the market with seven IPO clients, totaling $368 million in total proceeds. Deloitte’s two IPO clients raised the highest amount of proceeds, totaling $828 million, according to Audit Analytics.

For just traditional IPOs, the audit leader for Q1 was Friedman, which merged into Marcum last September. Five traditional IPO audit clients were attributed to Friedman, according to the analysis. PwC and EY followed with three each.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Firm Management