The number of CPA candidates who took the Uniform CPA Examination in 2022 was about 7% lower than the previous year, the Financial Times reported on May 28.

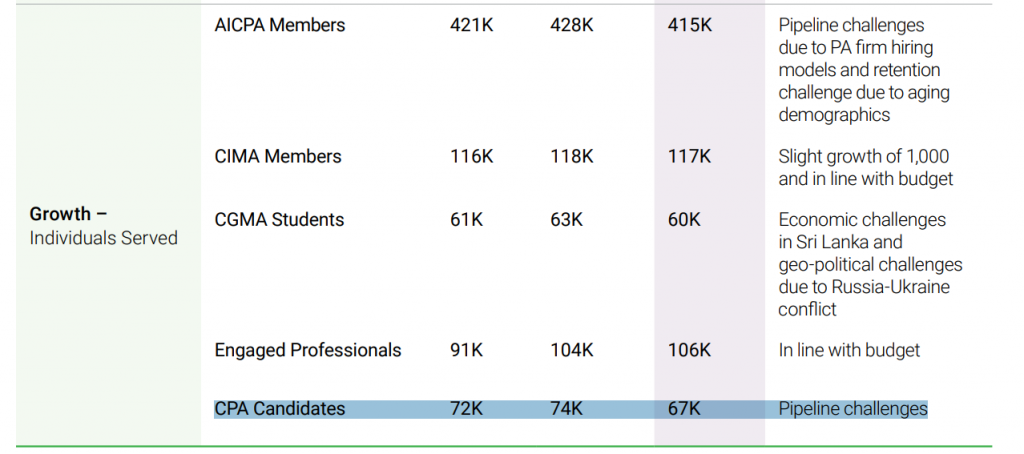

Citing the newly released AICPA and CIMA 2022 Integrated Report, the number of people who took the CPA exam in 2022 was about 67,000, down from 72,000 in 2021 and short of the AICPA’s 2022 forecast of 74,000. FT reported that was the lowest amount of CPA exam takers in at least 17 years.

In a chart in the annual report, the AICPA attributed the lack of CPA exams taken last year to “pipeline challenges.”

According to FT, the 67,000 CPA exam takers last year includes candidates who took the exam overseas. “The number of CPA exam modules being sat by U.S. candidates fell more than 10 percent year on year,” FT reported.

Only twice since 2006 have there been more than 100,000 CPA candidates who took the exam in a single year: 2010 and 2016. The number of CPA hopefuls who took the exam has decreased each year from 2017 to 2022.

Going Concern sounded the alarm back in 2019 about candidate numbers shrinking. It credited the surge of candidates in 2010 and 2016 in part to significant CPA exam changes that occurred the following year (2011 and 2017).

Candidates who may have been putting off the exam or otherwise wouldn’t have rushed put aside their procrastination to get the exam done before it changed. Additionally, and this is partly anecdotal, candidate numbers were likely higher than would have been usual from about 2007 to 2009-ish, as the economy circled the drain and accounting was one of the only professions in which one could find a job fairly easily.

If that trend were to continue, then more people should take the CPA exam in 2023, as another round of significant changes to the exam are slated to start on Jan. 1, 2024. It’s still early, but according to FT, the AICPA said it has seen an uptick in new candidates in the early months of 2023 and was predicting a 10% increase overall this year, in part spurred by the upcoming changes to the exam.

The AICPA and the National Association of State Boards of Accountancy (NASBA) are in the process of transforming the CPA licensure model—an initiative called CPA Evolution—to recognize the rapidly changing skills and competencies the practice of accounting requires today and will require in the future.

Starting in 2024, the redesigned CPA exam places a greater emphasis on technology and analytical skills, as well as on tax, accounting, and audit. Under the CPA Evolution licensure model, all candidates will be required to take three core sections:

- Financial Accounting and Reporting (FAR);

- Auditing and Attestation (AUD); and

- Taxation and Regulation (REG).

Then each candidate will choose a discipline in which to demonstrate additional knowledge:

- Business Analysis and Reporting (BAR);

- Information Systems and Controls (ISC); or

- Tax Compliance and Planning (TCP).

Regardless of a candidate’s chosen discipline, this model leads to full CPA licensure, according to the AICPA.

But a huge problem the accounting profession is facing is how to get accounting students interested in becoming CPAs and taking the exam, as there has been declining interest in an accounting degree at universities—thus creating a CPA talent shortage.

One thing NASBA did recently to pique interest is to give those who passed one section of the exam a rolling 30-month period to complete the other three sections of the exam, up from 18 months. However, this rule change has no immediate effect on the individual state boards of accountancy—meaning that each one would have to adopt the extra 12-month period before it takes effect in their state. So, current CPA candidates remain under the existing rules until the state board of accountancy to which they applied approves the test-taking extension.

And earlier this month, the AICPA released an overview of its Pipeline Acceleration Plan, the intent of which is to “identify ways to integrate the changing needs of new recruits and young professionals; increase flexibility and accessibility in the licensure pathway; and drive awareness of the wide range of career pathways within the profession in ways that result in a more robust supply of new CPAs.”

There are 12 initiatives—some considered near-term, some mid-term, and others long-term—the AICPA said it’s focusing on to fix the accountant shortage. Some of those initiatives include addressing accounting firm culture and business model challenges, using positive messaging that can help the profession resonate with today’s high school and college students, and affiliating with colleges and universities to offer internships, scholarships, and other programs to attract students to the profession, help defray costs, and assist them in developing the skills needed to succeed as a CPA.

The AICPA Governing Council last week passed a resolution supporting the Pipeline Acceleration Plan.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, AICPA