The IRS on Wednesday released an updated applicable percentage table used to determine a person’s premium tax credit for 2024.

The Affordable Care Act’s premium tax credit was created to help lower- and middle-income Americans pay for health insurance purchased through the healthcare marketplace (HealthCare.gov). Health insurance can also be purchased through some state exchanges.

Eligibility for the ACA premium tax credit program was temporarily expanded during the COVID-19 pandemic to allow more individuals and families to claim the refundable tax credit for 2021 and 2022. As a result, the ACA premium tax credit is extended for three more years, which means that more people will likely qualify for the premium tax credit, and some of those people will receive a larger credit.

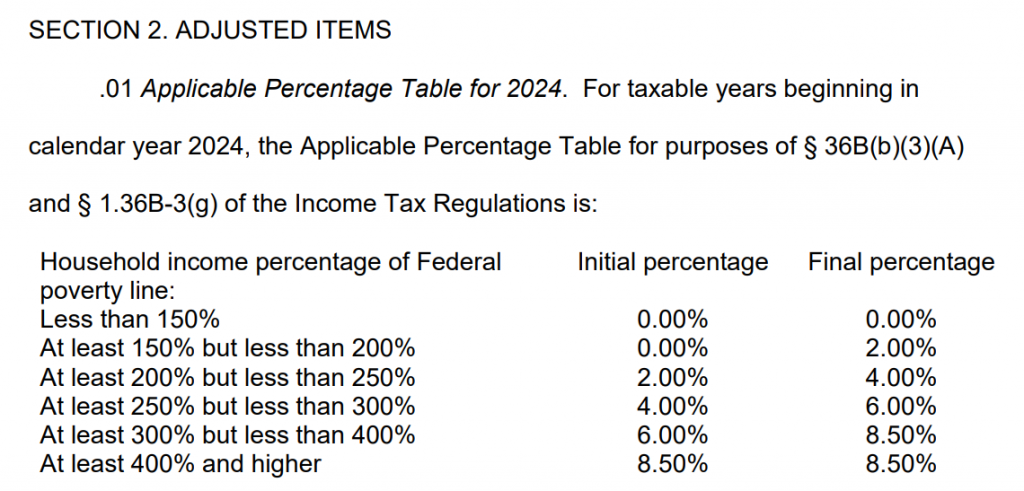

Rev. Proc. 2023-29 includes the following table used to calculate an individual’s premium tax credit under section 36 of the tax code:

Rev. Proc. 2023-29 also provides the indexing adjustment for the required contribution percentage used to determine whether an individual is eligible for affordable employer-sponsored minimum essential coverage under section 36B for plan years beginning in calendar year 2024. According to the IRS, the required contribution percentage is 8.39%, down from 9.12% for 2023 and 9.61% for 2022.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, IRS, Legislation