The federal government will partially shut down at 12:01 a.m. on Sunday, barring a last-minute deal between Republicans and Democrats in Congress to keep the government funded. If no agreement is reached by lawmakers this weekend, a contingency plan for the IRS will go into effect.

The plan, released by the Treasury Department on Thursday, calls for the IRS to furlough two-thirds of its workforce and press pause on most core tax administration functions. And remember, this would occur two weeks before roughly 10.5 million Americans file their 2022 income tax returns before the Oct. 16 tax extension deadline. The IRS and the Treasury Department have not said anything yet about extending that deadline in the event of a government shutdown.

“The IRS Lapse in Appropriations Contingency Plan describes actions and activities for the first five (5) business days following a lapse in appropriations. The plan is updated annually in accordance with guidance from the Office of Management and Budget (OMB) and the Department of Treasury,” the plan states. “In the event the lapse extends beyond five (5) business days, the Deputy Commissioner for Operations Support will direct the Business Continuity Officer to reassess ongoing activities and identify necessary adjustments of excepted positions and personnel.”

Nearly 60,000 employees will be furloughed

The IRS was expecting to remain open and fully staffed during a government shutdown by using money the agency received from the Inflation Reduction Act. However, the Washington Post reported on Thursday that the Office of Management and Budget told the IRS this week that the Inflation Reduction Act money cannot substitute for the agency’s regular budget, which pays the salaries of most of its employees.

According to the IRS shutdown contingency plan, 30,063 of the agency’s 89,944 employees are considered “excepted/exempt” and would be retained during the shutdown. That means 59,881 IRS employees would be furloughed until the shutdown ends.

“In fiscal year 2024, the IRS does have available multi-year funding under the Inflation Reduction Act and will use that funding for the activities outlined in this plan. Employees working on excepted and exempt activities during a lapse in appropriations will be paid using Inflation Reduction Act resources,” the plan states.

Among the non-furloughed employees is IRS Commissioner Danny Werfel, who will keep working because he is a presidential appointee and not subject to furlough, and the 3,117 employees who work in the IRS Criminal Investigation unit.

“Criminal Investigation works directly on investigations and associated law enforcement duties as the criminal law enforcement arm of the IRS,” the plan states. “There are approximately 2,621 active criminal investigations and 3,727 investigations in the adjudication phase (pre-indictment, indictment, trial and post–trial) in 93 judicial districts. As part of these 5,874 investigations, special agents are actively gathering evidence, conducting critical interviews, testifying in court proceedings, executing search warrants and conducting arrests. All these activities require our investigative support staff be available to acquire, analyze and preserve existing and emerging evidence and failure to timely act could jeopardize an investigation. In addition, special agents are assigned to respond to imminent threats of violence against IRS employees and provide executive protection to the IRS senior leadership. The CI senior leadership has direct oversight of criminal investigations and protection details are essential to continue these law enforcement functions.”

Another group of “excepted/exempt” employees are the more than 4,800 folks who work in information technology at the IRS, who are needed to protect the agency from cyberattacks and to maintain its computer systems.

IRS activities that will continue, stop

If a government shutdown does occur, the contingency plan says “the IRS will continue return processing activities to the extent necessary to protect government property, to include tax revenue, maintain the integrity of the federal tax collection process.” The plan also states that the IRS will continue activities to implement the green energy credit provisions of the Inflation Reduction Act, activities that implement the IRS Inflation Reduction Act Strategic Operating Plan, and the direct file pilot program.

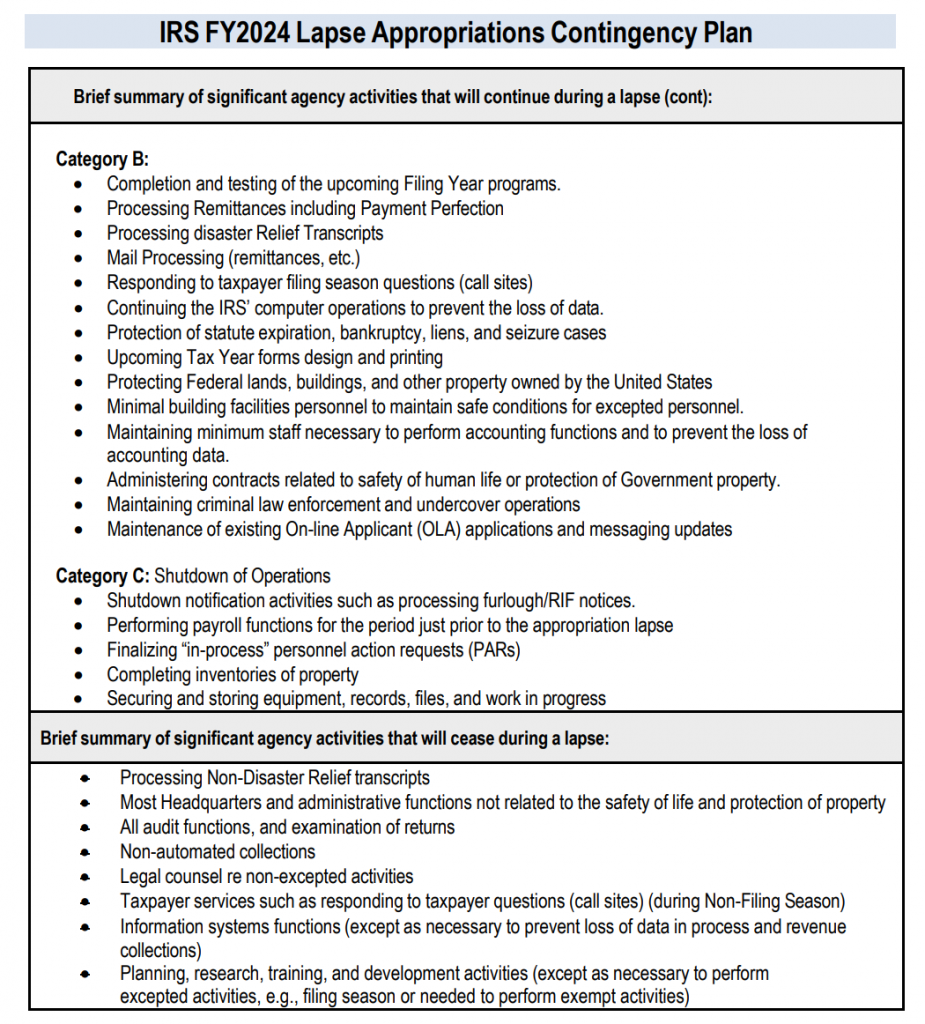

Here is a list of agency activities that will continue and a list of activities that will be halted if the government shuts down, according to the contingency plan:

Treasury said the IRS will not process tax refunds during a shutdown except in cases where electronically filed, error-free refunds can be direct deposited automatically. In addition, taxpayer phone calls to the IRS will go unanswered. The IRS usually answers about 46,000 phone calls from taxpayers every day in October. Also, the 363 Taxpayer Assistance Centers across the country would close during a shutdown. Taxpayer Assistance Centers typically provide in-person service to approximately 5,000 taxpayers each day in October.

Treasury also warned that once a government shutdown ends, it will take longer for people who mail in correspondence to get responses from the IRS because of the backlog.

In a statement on Thursday, Doreen Greenwald, national president of the National Treasury Employees Union, said it will be “incredibly difficult” for taxpayers to conduct business with the IRS if the government shuts down.

“According to the agency’s shutdown plan released today, 60,000 employees will be locked out of doing their jobs. These frontline employees—including those who open the mail and process tax returns—are now preparing for the financial hardship that comes with missed paychecks, which is possible if the shutdown extends well into October,” she said. “We are grateful that the 30,000 IRS employees who will remain on the job will be paid for their work, on time, through funds made available by the Inflation Reduction Act. NTEU remains concerned about the stress that thousands of IRS workers in every state are dealing with right now knowing their income is in jeopardy. An additional worry is the impact the shutdown will have on IRS efforts to hire to prevent further backlogs and delays that American taxpayers are likely to experience. Once again, we call on Congress to do what needs to be done to allow all federal agencies to remain open, employees to stay on the job, and government services to be delivered to the public.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Income Taxes, IRS, Taxes