Base pay for 11 positions in public accounting is projected to rise 4.9% next year, according to a CPA Practice Advisor analysis of salary data provided by LHH Recruitment Solutions.

The global talent solutions provider recently released its 2024 Salary Guide, which includes pay expectations for numerous positions in accounting and finance. According to LHH, there is more optimism heading into 2024 than there was this time last year as 2023 approached.

“Heading into 2023, many were bracing for an almost certain recession. However, despite these concerns, the labor market simply maintained a slow, but steady pace of growth. This resilience has led to a more cautiously optimistic outlook: hope for a possible ‘soft landing’ of reduced inflation without a recession and massive unemployment,” LHH said in the salary guide.

In its 2024 salary guide, LHH Recruiting Solutions provides salary data for employees in three tiers based on experience:

- Low: Zero to two years of experience in that position or one similar.

- Medium: Three to nine years of experience in that position or one similar.

- High: Ten or more years of experience in that position or one similar.

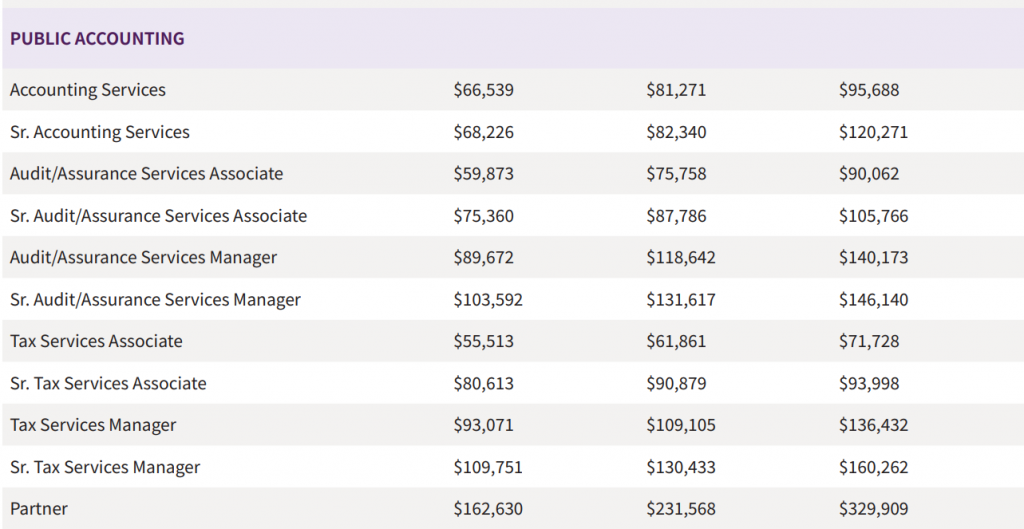

Here are its salary expectations in public accounting for next year (low/medium/high):

CPA Practice Advisor reviewed LHH’s salary projections for 2024 and compared them with the staffing firm’s salary projections for these 11 public accounting positions in its 2023 Salary Guide to see how much base pay is expected to increase next year. The analysis revealed that base pay is expected to increase 4.9% in 2024 for all 11 positions and across all experience levels.

Below are the projected 2024 average base salaries for each of the 11 public accounting jobs, listed by experience, with a comparison of 2023’s projected salaries (2023 -> 2024) for those same roles:

Accounting services associate

- Low experience: $63,443 -> $66,539 (4.9%)

- Medium experience: $77,489 -> $81,271 (4.9%)

- High experience: $91,235 -> $95,688 (4.9%)

Accounting services senior associate

- Low experience: $65,051 -> $68,226 (4.9%)

- Medium experience: $78,508 -> $82,340 (4.9%)

- High experience: $114,675 -> $120,271 (4.9%)

Audit/assurance services associate

- Low experience: $57,087 -> $59,873 (4.9%)

- Medium experience: $72,233 -> $75,758 (4.9%)

- High experience: $85,871 -> $90,062 (4.9%)

Audit/assurance services senior associate

- Low experience: $71,853 -> $75,360 (4.9%)

- Medium experience: $83,701 -> $87,786 (4.9%)

- High experience: $100,844 -> $105,766 (4.9%)

Audit/assurance services manager

- Low experience: $85,499 -> $89,672 (4.9%)

- Medium experience: $113,121 -> $118,642 (4.9%)

- High experience: $133,650 -> $140,173 (4.9%)

Audit/assurance services senior manager

- Low experience: $98,771 -> $103,592 (4.9%)

- Medium experience: $125,492 -> $131,617 (4.9%)

- High experience: $139,339 -> $146,140 (4.9%)

Tax services associate

- Low experience: $52,930 -> $55,513 (4.9%)

- Medium experience: $58,982 -> $61,861 (4.9%)

- High experience: $68,390 -> $71,728 (4.9%)

Tax services senior associate

- Low experience: $76,862 -> $80,613 (4.9%)

- Medium experience: $86,650 -> $90,879 (4.9%)

- High experience: $89,624 -> $93,998 (4.9%)

Tax services manager

- Low experience: $89,405 -> $93,071 (4.9%)

- Medium experience: $104,808 -> $109,105 (4.9%)

- High experience: $131,059 -> $136,432 (4.9%)

Tax services senior manager

- Low experience: $105,428 -> $109,751 (4.9%)

- Medium experience: $125,296 -> $130,433 (4.9%)

- High experience: $153,950 -> $160,262 (4.9%)

Partner

- Low experience: $155,063 -> $162,630 (4.9%)

- Medium experience: $220,793 -> $231,568 (4.9%)

- High experience: $314,557 -> $329,909 (4.9%)

“With automation streamlining processes, increasing productivity, and ensuring greater data integrity, today’s top accounting and finance professionals must be more than number crunchers,” LHH said in the salary guide. “Skills like critical thinking, problem-solving, and relationship-building are in higher demand as firms and in-house departments look to build teams of strategic analysts and consultants.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting