As part of its continuing effort to improve taxpayer services and make the agency more technology-friendly, the IRS said on Oct. 20 that it has launched new business tax accounts, with the initial version geared toward sole proprietors.

Over time, companies will be able to check their tax payment history, make payments, view notices, authorize powers of attorney, and conduct other business with the IRS.

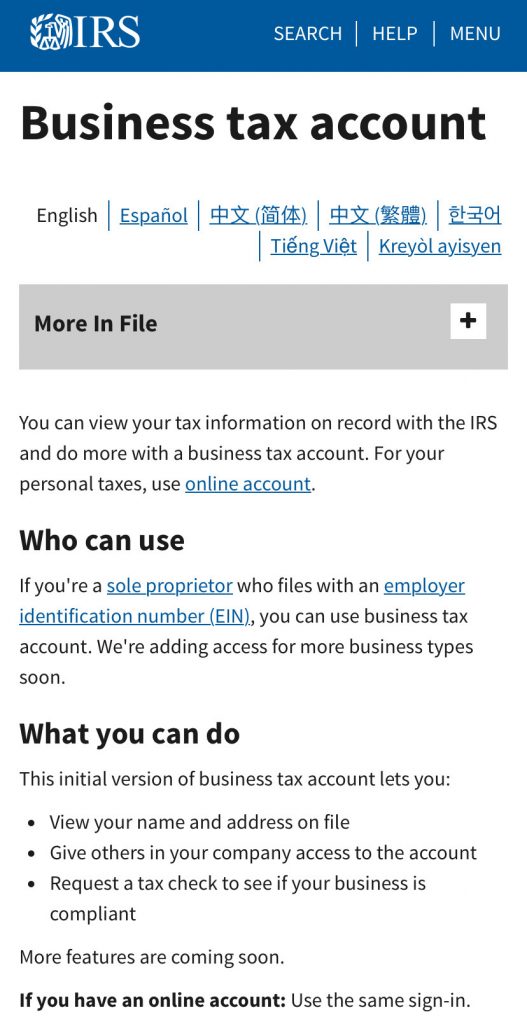

“This initial phase allows unincorporated sole proprietors who have an active employer identification number to set up a business tax account, where they can view their business profile and manage authorized users,” the IRS said in a press release.

Future improvements will allow taxpayers to use their business tax accounts to view letters or notices, request tax transcripts, add third parties for power of attorney or tax information authorizations, schedule or cancel tax payments, and store bank account information.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs