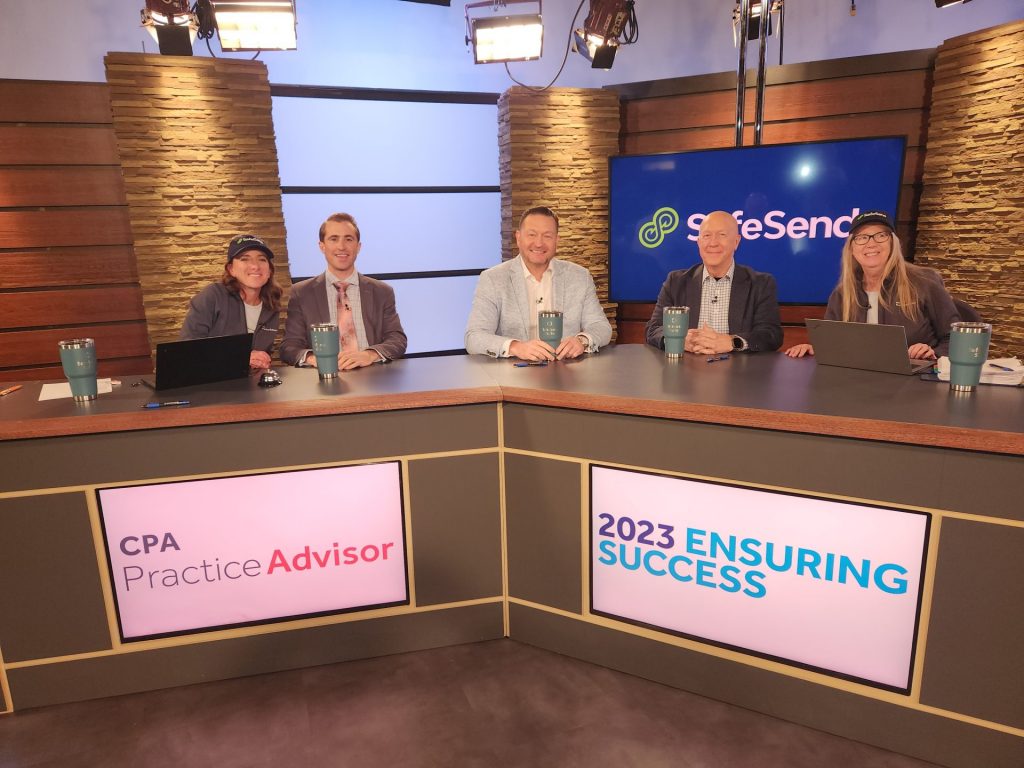

Ensuring Success, the largest live-streamed CPE conference for accounting and tax professionals, was held December 6-7, providing these financial and tax advisors the opportunity to complete their credential requirements, and also offering strategies for developing firm growth opportunities and strategies to better serve their clients.

More than 3,300 registered for this year’s event, which was the 10th anniversary of Ensuring Success. Over a period of two days and 14, one-hour sessions, an ensemble of thought leader panelists discussed a variety of subject areas related to tax, accounting, practice management and ethics.

On the first day of the event (Dec. 6, 2023), the CPE sessions included tax-related ethics, firm management, small firm strategies for tax credits, 2023-24 tax season issues, digital assets, firm branding/marketing, and practical AI uses for accountants.

On day two (Dec. 7, 2023), session topics included data security risks for firms, ecommerce accounting, spend management advisory services, big data, firm growth strategies, tax audit resolution issues, and firm transformation.

Attendees of the free, live streaming sessions were able to earn CPE credit. Recorded versions of all 14 CPE sessions will be available online soon, however, only attendees of the live event had the opportunity to receive the CPE. Visit www.ensuringsuccess.com for more information.

Day One Topics and Studio Images:

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs