By Matt Durr, mlive.com (TNS)

IRS Commissioner Daniel Werfel says millions of parents in America don’t need to wait to file their 2024 tax return due to a possible increase in refundable value of the Child Tax Credit. Earlier this month, the House passed the Tax Relief for American Families and Workers Act and sent the bill to the Senate for possible approval.

If passed by the Senate and signed into law by President Joe Biden, the amount of partially refundable credit per child would increase from $1,600 to $1,800 for 2024 tax returns and would again increase in 2025 and 2026 by $100 each year. Currently, the child tax credit—which is worth $2,000 per qualifying child—allows for taxpayers to receive up to $1,600 per child as part of their refund check.

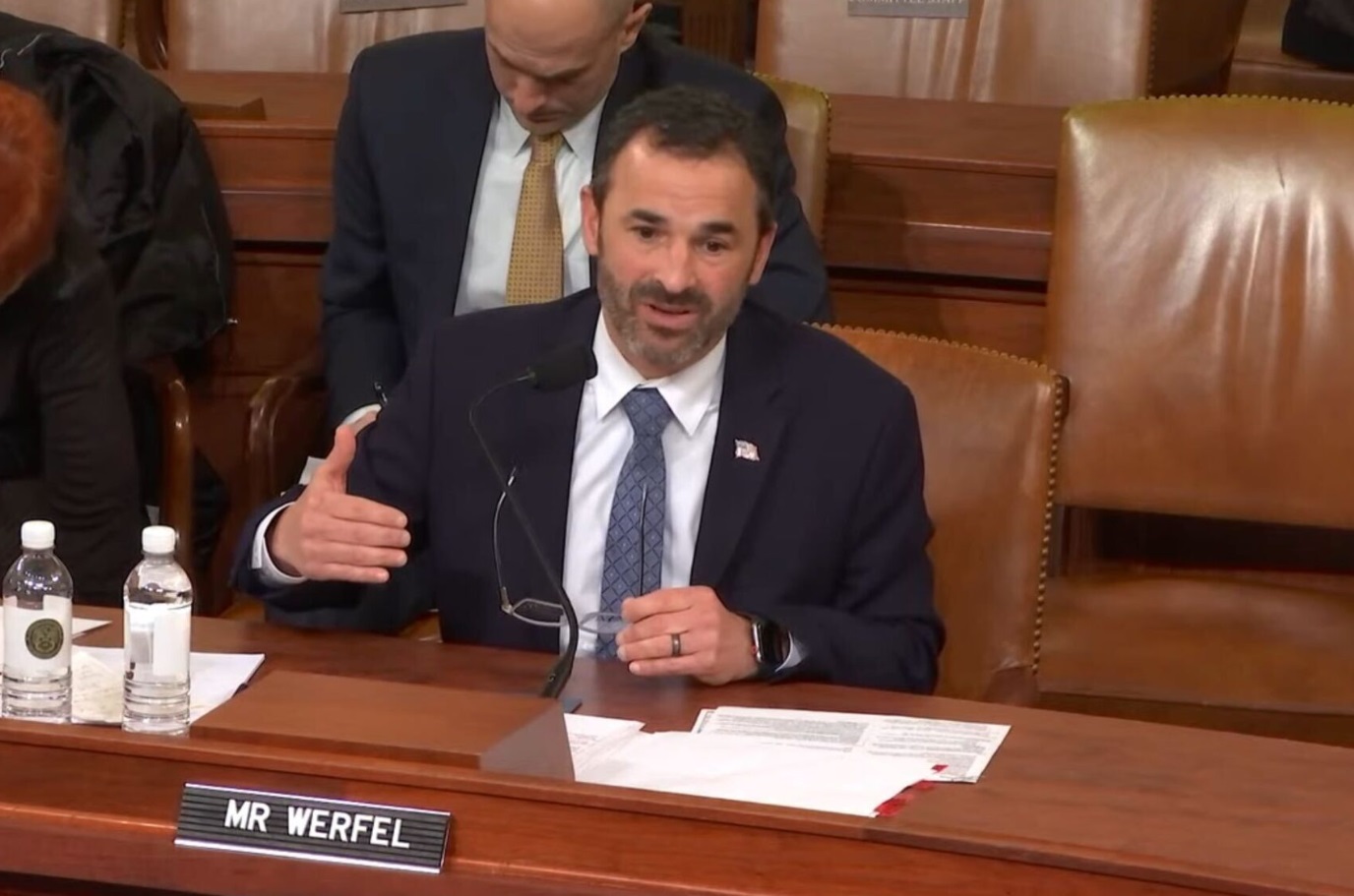

However, some taxpayers are concerned about possibly losing the additional $200 per child if the bill is passed in the middle of tax season. Luckily for those filers, Werfel testified before the House Ways and Means Committee last week and said his agency will ensure that if the bill is passed, those taxpayers will not lose out on that money.

“Taxpayers should not wait for this legislation to file their returns. We will take care of getting any additional refunds to taxpayers who have already filed. They won’t need to take additional steps,” Werfel said.

How do I qualify for the Child Tax Credit?

According to the IRS website, the credit is available for each qualifying child who has a Social Security number that is valid for employment in the U.S. In order to be a qualified child, the person must:

- Be under age 17 at the end of the year

- Be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (for example, a grandchild, niece or nephew)

- Provide no more than half of their own financial support during the year

- Have lived with you for more than half the year

- Be properly claimed as your dependent on your tax return

- Not file a joint return with their spouse for the tax year or file it only to claim a refund of withheld income tax or estimated tax paid

- Have been a U.S. citizen, U.S. national or U.S. resident alien

If you have children in the home that meet those requirements, then you qualify for the child tax credit. However, depending on your income, you may not receive the full value of the credit. To receive the full value per child, your adjusted gross income may not exceed $200,000 as an individual and $400,000 if filing a joint return.

If your income is larger than those totals, you may still be able to receive a partial credit that is reduced depending on how much you make. For every $1,000 over the thresholds, you lose $50 in credit, meaning an individual who earns $220,000 would only be eligible to receive a $1,000 credit per child.

To claim the credit, you must file a 1040 form and attach a completed Schedule 8812, Credits for Qualifying Children and Other Dependents, form.

______

©2024 Advance Local Media LLC. Visit mlive.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs