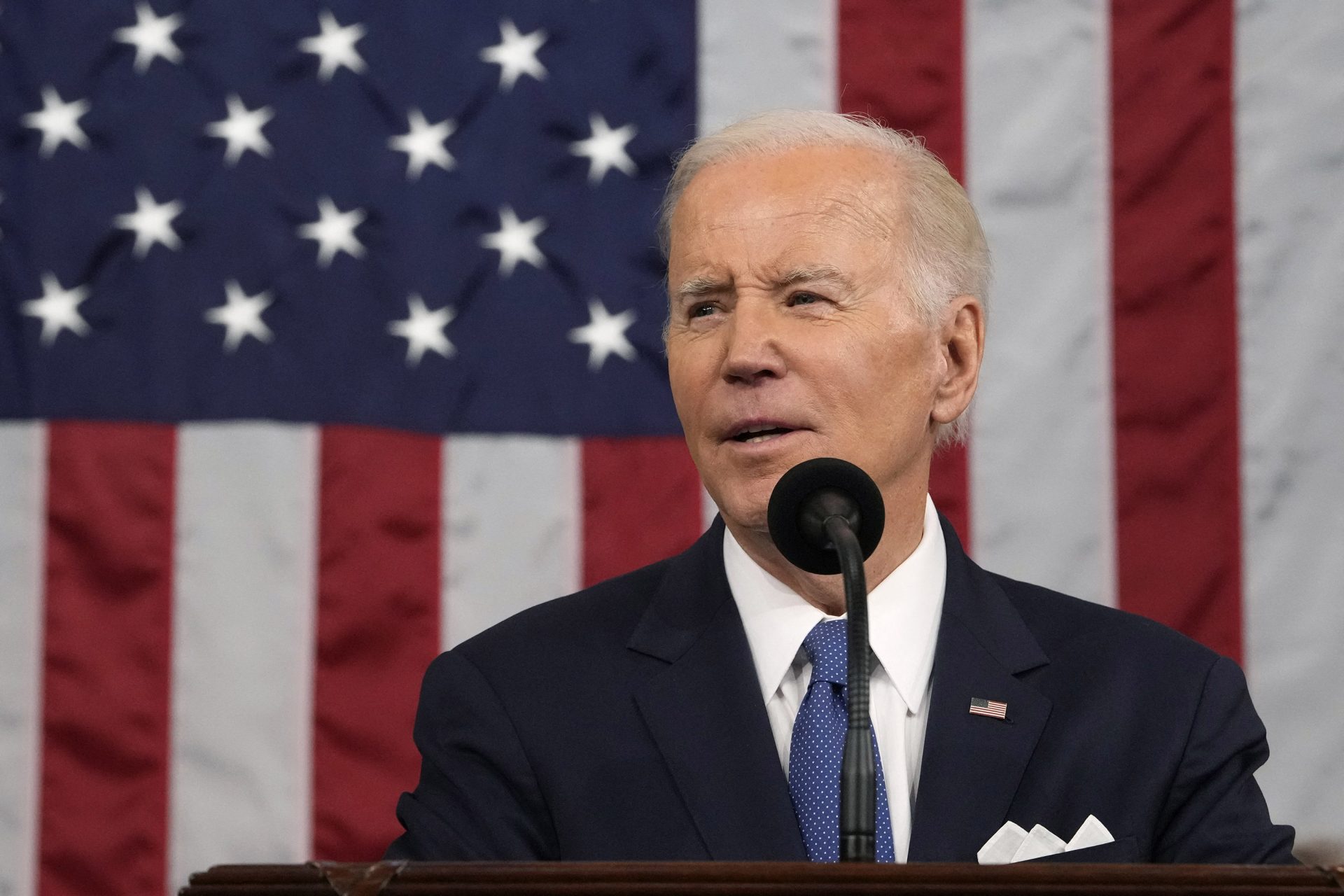

On Thursday night, President Joe Biden gave his 2024 State of the Union Address to a joint session of Congress. Mark Friedlich, ESQ., CPA, Vice President of Government Affairs at Wolters Kluwer Tax & Accounting, offered his take on the speech:

“President Biden in his State of the Union, highlighted plans to make the tax code fairer and reduce the growing federal deficit by reducing tax breaks for the wealthiest Americans, raising corporate tax rates, creating a minimum tax on billionaires and restoring the expanded child tax credit to include 18 million more children.

The President set out his plan to reduce the deficit by $3 trillion over 10 years by increasing taxes for the wealthiest individuals and corporations.

In his State of the Union speech, President Biden announced a proposal to deny corporations a tax deduction when they pay more than $1 million to any employee. He also described his plans to bump the corporate tax rate up to 28 percent from the level set by former President Trump’s 2017 tax cuts, which put it at 21 percent. His plan includes ensuring that billion-dollar corporations pay at minimum 21 percent of their income in taxes and imposes a 21 percent rate on multinational corporations.

Biden’s speech also highlighted his proposal of a 25 percent minimum tax on the wealthiest 0.01 percent of Americans with a wealth of more than $100 million. He laid out his vision to make the tax code fairer and to lower the deficit by making big corporations and the wealthy pay their fair share. He said he wants to rework the tax code so that ‘billionaires do not pay less than schoolteachers or firefighters and to ensure the wealthy cannot get away with cheating on their taxes.’

Biden also repeated his position throughout his administration that taxes won’t be raised for any Americans making less than $400,000 a year.

President Trump’s tax cuts are set to expire in 2025, with Democrats opposing a blanket extension of the law but Republicans hoping to extend it if they win Congress and the White House.

Surprisingly, Biden didn’t mention the Tax Relief for American Families and Workers Act of 2024, a bi-partisan tax bill that overwhelmingly passed the House of Representatives and remains stuck in the Senate. That bill is the president’s best chance to get at least a portion of his objectives, such as the expansion of the child tax credit into law. Most of his tax-related goals are not likely to see the light of day given the divisive environment in Washington, DC.”

===

Mark Friedlich, a renowned tax expert, is the Vice President of Government Affairs at Wolters Kluwer Tax & Accounting. Mark has been a consistent thought leader in the tax community and advisor to government taxing authorities and businesses. Mark is a retired PwC Managing Tax Partner.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs