The Internal Revenue Service continues to increase the amount of information available in multiple languages.

Although the primary language of the agency is usually expressed in dollar signs followed by numbers and commas, the agency offers a variety of support tools to help people across multiple languages. The agency’s multilingual efforts are a part of its Strategic Operating Plan, which has received additional funding since the enactment of the Inflation Reduction Act.

“The IRS is committed to making further improvements for taxpayers in a wide range of areas, including expanding options available to taxpayers in multiple languages,” said IRS Commissioner Danny Werfel. “Understanding taxes can be challenging enough, so it’s important for the IRS to put a variety of information on IRS.gov and other materials into the language a taxpayer knows best. This is part of the larger effort by the IRS to make taxes easier for all taxpayers.”

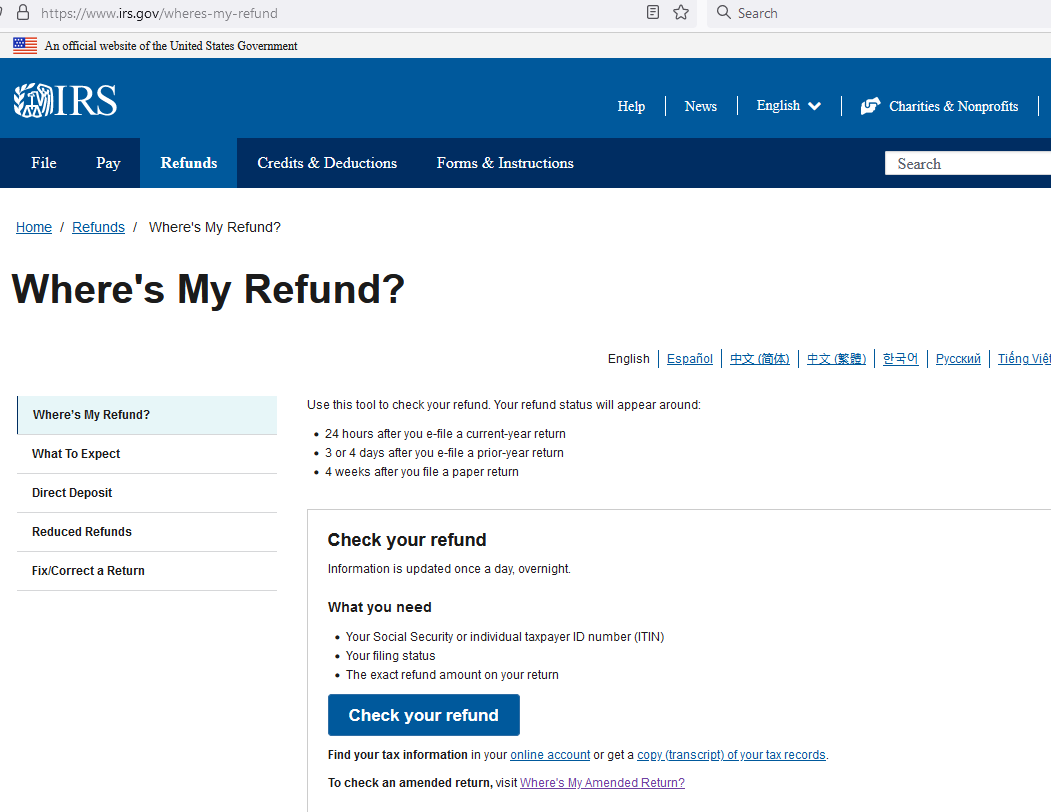

On the IRS website, much of the information has now been translated into seven languages other than English. Taxpayers can simply select their preferred language from the dropdown menu at the top of the page, including Spanish, Vietnamese, Russian, Korean, Haitian Creole, Traditional Chinese and Simplified Chinese.

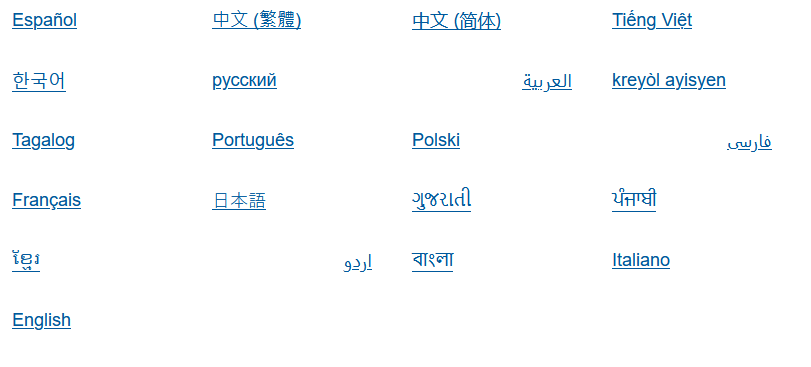

In addition, a special resource page on IRS.gov is offered in even more languages. The Languages page gives taxpayers an overview of key topics related to information about federal taxes in 21 languages. Topics include:

- Your rights as a taxpayer

- Who needs to file

- Filing for your business

- Get help preparing your tax return

- Refunds

Designate a preferred language

As the IRS continues translating more information into multiple languages, taxpayers have the option to tell the IRS what language they’d like to use now.

The Schedule LEP, with instructionsPDF available in multiple languages, can be filed with a tax return by those taxpayers who prefer to communicate with the IRS in another language. If available, the IRS will then send letters, notices and other information to that taxpayer in their preferred language.

The IRS’s commitment to taxpayers who speak various languages is part of a multiyear effort that began several years ago, expanding during the pandemic period and intensifying under the current IRS transformation work. The IRS strives to serve all taxpayers, no matter where they live, their background or what language they speak.

Interpretation services

If taxpayers can’t find the answers to their tax questions on IRS.gov, taxpayers can call the IRS or get help in-person at an IRS Taxpayer Assistance Center.

Over the phone, the IRS offers help in more than 350 languages with the support of professional interpreters. For assistance in English and Spanish, taxpayers should call 800-829-1040. For all other languages, taxpayers should call 833-553-9895.

IRS phone help:

- Can provide an interpreter over the phone.

- Can schedule an appointment for the taxpayer at one of IRS’s local Taxpayer Assistance Centers so they can get help face-to-face. Local offices provide assistance only on specific topics.

In addition, hundreds of IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs across the country have access to Over the Phone Interpreter (OPI) services. VITA and TCE offer free basic tax return preparation to qualified individuals.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs