The Treasury Department and the IRS on April 12 corrected Appendix A and Appendix B of Notice 2024-20 to add additional eligible census tracts for the qualified alternative fuel vehicle refueling property (i.e., electric vehicle charging stations and equipment) tax credit.

These additional census tracts were determined to meet the description of eligible census tracts in Notice 2024-20, the IRS said.

Notice 2024-20 was issued in January, providing guidance to taxpayers on determining whether their qualified alternative fuel vehicle refueling property is located in an eligible census tract for purposes of the credit under section 30C of the Internal Revenue Code.

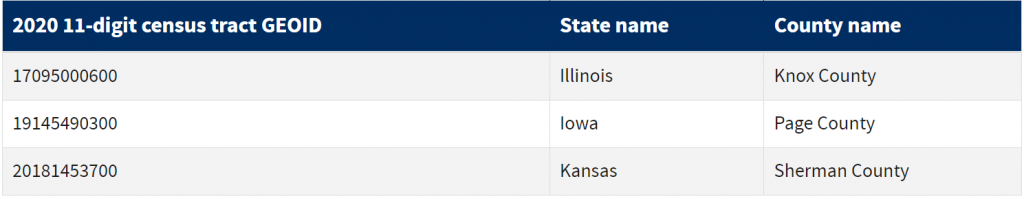

Appendix A was corrected to include:

Appendix B was corrected to include:

After expiring more than two years ago, the Inflation Reduction Act of 2022 brought back the federal EV charger tax credit. The changes in the Biden administration’s signature law apply to EV charging stations and equipment placed in service after Dec. 31, 2022, and before Jan. 1, 2033.

The credit amount for property not subject to depreciation is 30% of the cost of the qualified property placed in service during the tax year. The credit amount for depreciable property is 6% of the cost of the qualified property placed in service during the tax year but may be increased to 30% of the cost of the qualified property if the prevailing wage and apprenticeship requirements are met. The credit is limited to $100,000 for depreciable property and $1,000 for non-depreciable property, according to the IRS.

Property must be placed in service in an eligible census tract to qualify for the credit. An eligible census tract is any population census tract that is a low-income community or any population census tract that is not an urban area, the IRS said.

More information about the tax credit can be found here.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs