By Jennifer A. Dlouhy, Bloomberg News (TNS)

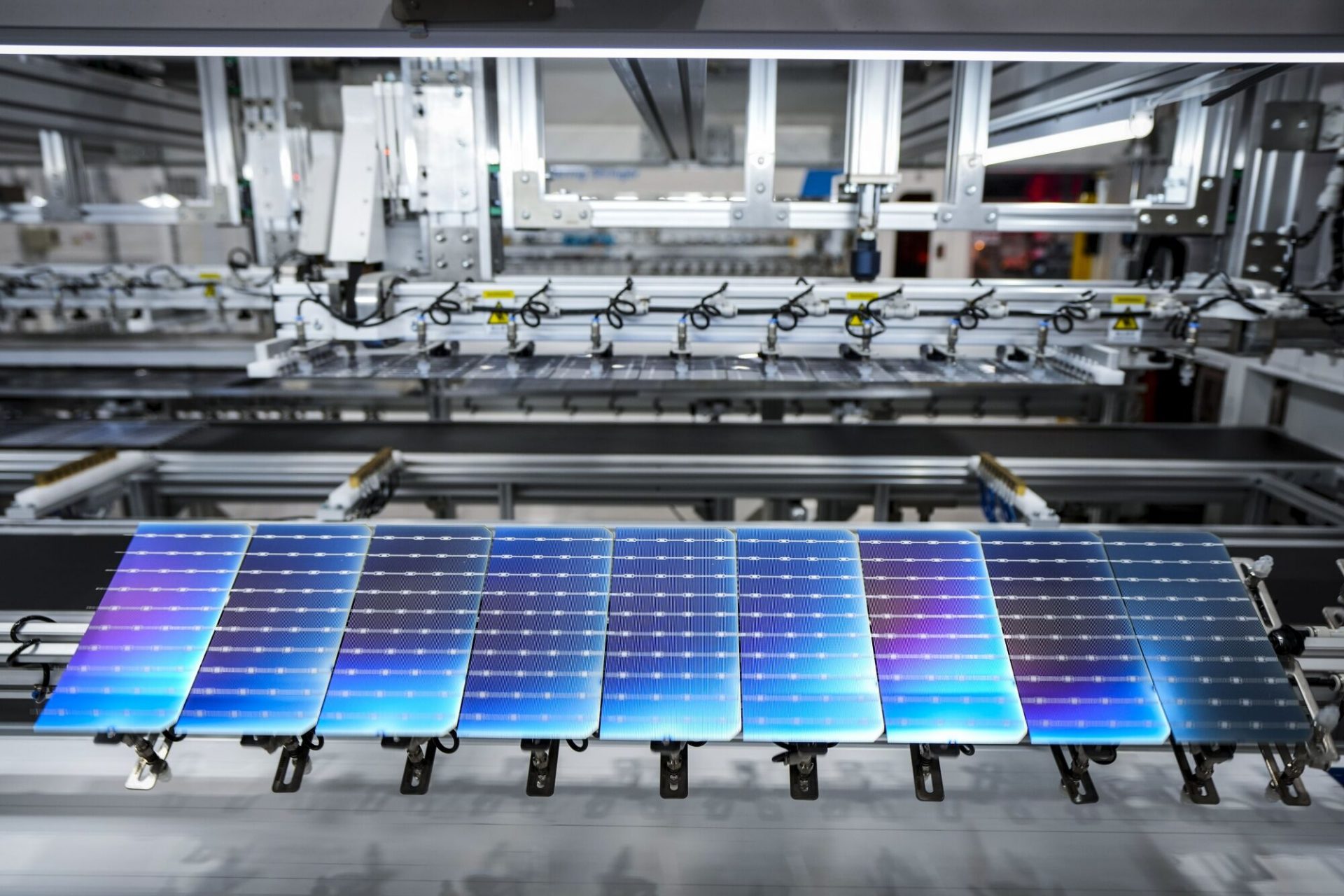

The Biden administration is initiating a suite of policies that it says will help foster a deeper domestic supply chain for solar panels, following pleas from U.S. manufacturers confronting a surge of tariff-free imports.

The measures, announced on Thursday, include expanded tariffs, tax policy guidance that could heighten demand for some U.S.-made solar equipment and promises of heightened vigilance for signs of unfair trade.

“We’re taking these new actions this week to support U.S. clean energy industries to both make sure we’re doing our part to reduce emissions and to make sure our competition with China is actually fair,” said John Podesta, senior adviser to the president for international climate policy.

The effort presents a response to more than a year of appeals from solar companies that said tariff exemptions, an uptick in cheap foreign panel imports and federal tax policy decisions were undermining incentives in the Inflation Reduction Act meant to support domestic manufacturing and erode China’s green technology dominance.

Although the law triggered a wave of promised investments in American manufacturing of solar panels and their components, several marquee projects have since been quietly shelved or slowed. It’s not clear the policies will be enough to rapidly recalibrate the market in the U.S., where importers and developers now have amassed a high inventory of panels.

The announcement came as President Joe Biden projects a tough-on-China election-year stance with a range of sweeping tariff increases on imports from the country that has come to dominate production of solar panels and their components—even though the technology was invented in the U.S. Three weeks ago some manufacturers moved on their own by formally petitioning the U.S. government to impose new duties on solar cells and modules from four Southeast Asian nations, arguing that they are unfairly priced below cost and benefit from illegal subsidies.

The Biden administration will swiftly end an exemption that allows two-sided, or bifacial, solar panels to avoid so-called Sec. 201 safeguard tariffs currently set at 14.25%. The exclusion was first created under President Donald Trump—then extended under Biden. Initially cast as a modest but essential safety valve to ensure large, utility-scale solar projects could procure the gear, it’s now become a widely used exception. Although Trump later sought to reverse the exemption, a federal court blocked the move.

At the same time, however, the administration is also raising the prospect of allowing more solar cells to enter the U.S. without being hit by Section 201 tariffs. Some manufacturers argued there isn’t a sufficient domestic supply of those components to support U.S. panel-making today.

They had urged the president to quadruple the existing 5-gigawatt tariff-free quota for those components to support US panel-making while U.S. cell production capacity climbs.

The administration is stopping short of that but said in a White House fact sheet that it is committing to pursuing an increase if the number of imported cells reaches the tariff-free threshold.

“This move provides an important bridge for module producers to access the supply they need while the United States continues to advance solar cell manufacturing,” said Abigail Ross Hopper, president of the Solar Energy Industries Association. “Today’s decision will help create a strong, stable module manufacturing sector that can sustain robust cell production in the long run.”

The administration also is promising to be more vigilant in watching for signs of unfair trade—and scrutinizing panels imported into the U.S. under a tariff moratorium Biden announced nearly two years ago.

The government already concluded that Chinese manufacturers were circumventing long-standing tariffs by assembling solar modules in the four Southeast Asia countries—Cambodia, Malaysia, Thailand and Vietnam. Now, the White House says, the Energy and Commerce departments “will closely monitor import patterns to ensure the U.S. market does not become oversaturated and will explore all available measures to take action against unfair practices.”

Biden also won’t extend a two-year holiday that waives anti-circumvention duties for many of the solar cells and modules imported from the four nations. And it is vowing that U.S. Customs and Border Protection “will vigorously enforce” a requirement that any equipment imported under the moratorium will have to be put in use by early December—or else duties must be paid. That includes calling for importers to provide certifications and “detailed information” proving the solar modules have been deployed on time, the White House said.

_______

©2024 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs