While more strategic tax leaders are most concerned that the 2024 election will result in changes to certain Inflation Reduction Act renewable energy credits, tax tacticians are most concerned about changes to federal corporate tax rates, according to a new survey from top six accounting firm BDO USA.

BDO’s 2024 Tax Strategist Survey, which was released on June 10, shows that fewer tax leaders are operating at a highly strategic level, compared to last year’s study. As a result, fewer respondents were classified as “tax strategists”—tax leaders who have substantial influence over key business decisions. Instead, more survey participants fell into the “tax tactician” category—tax leaders who contribute strategically to the business but are more often consulted after business decisions are made.

The year-over-year decline in tax strategists suggests that in an increasingly complex tax environment, many leaders are likely becoming entrenched in the day-to-day reporting and compliance demands of the job, according to BDO. With duties ranging from navigating intricate global tax requirements to leading new technology initiatives, tax leaders may be overburdened and underresourced, preventing them from taking on a larger role in shaping overall business strategy.

“To transition from tactician to strategist, tax teams need a shift in approach,” Matthew Becker, national managing principal of tax at BDO USA, said in a statement. “First, they should evaluate their team, processes, and technology to identify areas for improvement. Then they should consider how to bolster communication with key organizational leaders to build trust and advocate for the resources needed to execute effectively. Finally, they should involve the entire tax team in strategic efforts. This will foster a culture of collaboration, innovation, and growth.”

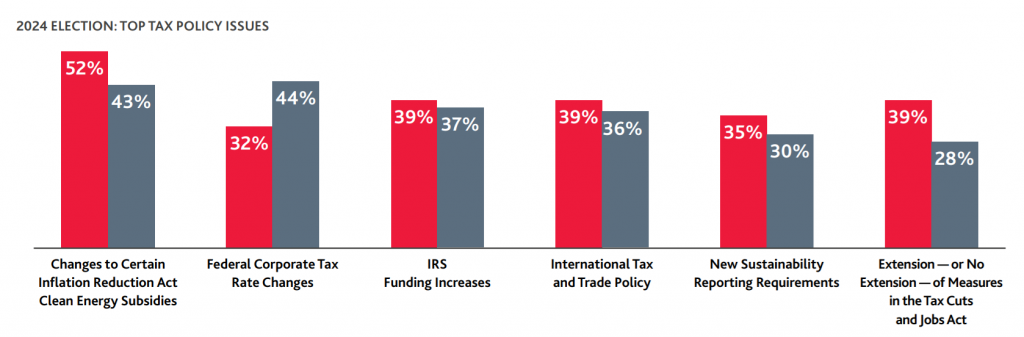

Tax leaders of all levels say the uncertainties of the 2024 election present challenges for tax planning. While tax strategists are most concerned about changes to the Inflation Reduction Act renewable energy subsidies (52%), tax tacticians are most concerned about changes to federal corporate income tax rates (44%).

“The 2024 elections will have a considerable impact on tax policy. Proposed changes include the extension of certain tax credits and extension of provisions included in the Tax Cuts and Jobs Act of 2017, as well as possible changes to the corporate alternative minimum tax rate. Staying informed about possible tax policy changes allows tax leaders to take a proactive approach to navigating impending challenges before they are enacted into law,” said Todd Simmens, tax policy and legislation technical practice leader at BDO USA.

BDO recommends that tax leaders lean on outside tax advisors to navigate uncertainty.

“Advisors can offer specialized skills, proprietary technology, and intelligence from their professional networks to help guide tax strategy,” BDO says in the survey report. “They can also help tax leaders cut through the noise to understand the implications of White House budgets and the U.S. Treasury’s Green Book, which outline the administration’s tax proposals.”

Another top concern shared by both tax strategists and tax tacticians is international tax and trade policy. Pillar Two of the Organisation for Economic Co-Operation and Development’s (OECD) framework to address base erosion and profit shifting places substantial compliance and financial reporting burdens on in-scope companies. And the fact that it remains unclear if the U.S. will adapt its laws to the OECD Pillar Two agreement only complicates the matter, BDO says.

Other key results of the survey include:

- Nearly half (44%) of all organizations plan to increase investment in tax risk management in 2024 in response to changing regulations, rapid growth, and outdated technology.

- More than half of tax leaders (51%) said their teams will deploy artificial intelligence and machine learning in the next 12 months, but many lack the proper data foundation.

- Fewer tax leaders in the 2024 survey (28%) say they have a strong understanding of how tax and environmental, social and governance (ESG) strategy intersect at their organization compared to the 2023 survey (45%). In addition, the majority (56% of tax leaders) say that although they have a formal mandate to advance ESG strategy, they aren’t executing against that mandate effectively.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs