Three people who blew the whistle on a longstanding tax evasion scheme will share a $74 million payout from the IRS, one of the largest awards in the history of the agency’s whistleblower program.

The individuals, whose identities remain protected, disclosed an offshore tax evasion scheme that spanned 15 years, enabling the IRS to collect $263 million from an unidentified individual, Bloomberg reported.

Under the IRS whistleblower program, which began in 2007, about 2,500 tax tipsters have gotten $1 billion for providing information that led to collections of $6 billion. The biggest payout was to former UBS Group AG banker Bradley Birkenfeld, who got $104 million in 2012 for telling U.S. investigators how his employer helped thousands of Americans evade taxes.

The $74 million award rivals the $88.8 million that was awarded to 121 whistleblowers, which led to the collection of $338 million in tax revenue, for the entirety of fiscal year 2023. The government’s $263.7 million recovery exceeds all amounts collected based on whistleblower information in 2021 or 2022.

Although it took years to resolve the case, recent policy changes significantly shortened the time it took to pay the whistleblowers, lawyers said.

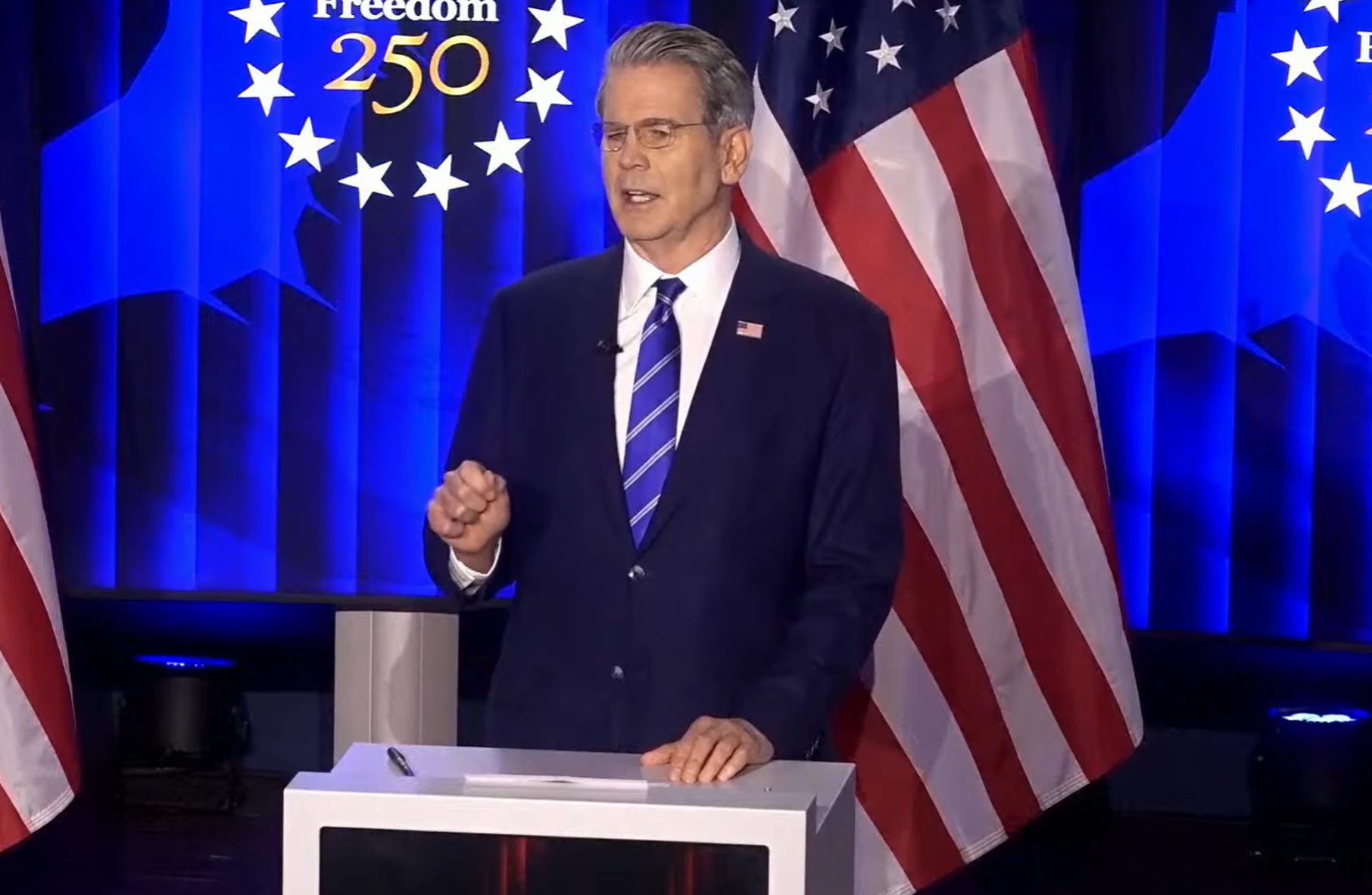

“We think that this victory that we have achieved together with the IRS Whistleblower Office is a harbinger for the future,” said Neil Getnick, managing partner at Getnick Law, in an interview with Bloomberg.

Getnick Law, SEC Whistleblower Advocate, and Outten & Golden represented the primary whistleblower in the case, while Whistleblower Partners represented another. The other whistleblower didn’t have legal representation.

The whistleblower award process, which typically takes a decade or longer, has been criticized by whistleblower advocates, who say the IRS has been far less responsive on paying tipsters than the Justice Department, Securities and Exchange Commission, and Commodity Futures Trading Commission, Bloomberg reported. In its first five years of existence, the IRS program made no payment, after more than 1,300 tipsters came forward. Since then, the program has made progress, especially since John Hinman took over as director of the whistleblower office in 2022.

“After languishing for years, the IRS whistleblower program has never shown more promise. We foresee more large awards in the years to come,” Whistleblower Partners attorney Chris McLamb said in a statement.

Hinman told Bloomberg that he has expanded the office to 84 employees from 48, with a goal of reaching 130. They’re improving evaluation of tips and working more closely with lawyers who represent whistleblowers, he said.

IRS investigations of tax claims can take years to resolve as taxpayers pursue possible appeals, delaying any rewards for tipsters. To address that, the agency has sought to make earlier partial payments in cases initiated by whistleblowers, a process known as “disaggregation,” Hinman said.

Lawyers have complained the agency has long battled whistleblowers over their awards. Under the law, tipsters can reap 15% to 30% of any taxes collected. Those awards are now increasing.

In this case, the three whistleblowers got the maximum 30%, minus several million dollars under U.S. legislation cutting all government payments, according to Bloomberg.

The IRS let the whistleblowers negotiate among themselves on how to divide the award, which helped avoid possible challenges to an agency decision on how to split the bounty, McLamb told Bloomberg. That alone may have shortened the timeframe for collecting the money by years.

“Together we have demonstrated that when the IRS whistleblower program functions as a public-private partnership embracing mutually supportive cooperation, it can produce a win-win-win resolution for the whistleblower office, whistleblowers and their counsel, and most importantly, the public,” Getnick said in a statement.

Jennifer Schwartz, a partner at Outten & Golden, added, “Our client may be anonymous, but whistleblowers everywhere can easily identify with their bravery and their willingness to do what’s right. We hope their actions inspire others to speak out and pursue justice.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs